New Anglia LEP Investment Appraisal Committee

Wednesday 23rd May 2018

9am to 9:45am

Co-op Education Centre, 11 Fore St, Ipswich IP4 1JW

Agenda

Committee Members

Lindsey Rix

Aviva

Cllr David Ellesmere

Ipswich Borough Council

John Griffiths

St Edmundsbury Borough Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norfolk County Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Exec Members

Iain Dunnett

New Anglia LEP

Chris Dashper

New Anglia LEP

Tracie Ashford

New Anglia LEP

No.

Item

1.

Welcome

2.

Apologies

3.

Declarations of Interest

4.

Minutes from last Meeting

5.

Horizon Paper - Confidential

Items for discussion

6.

Capital Growth Programme - Confidential

7.

Speculative Development Paper

8.

Atex Developments - Confidential

Other

9.

Any Other Business

Date and time of next meeting: Wednesday 20th June, 2018. 9am-9:45am

Venue: The Council House, University of East Anglia, Norwich, Norfolk, NR4 7TJ

1

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

18TH April 2018

Present:

Committee Members

Lindsey Rix (LR)

Aviva

Cllr David Ellesmere (DE)

Ipswich Borough Council

Tim Whitley

BT

Dominic Keen (DK)

High Growth Robotics

In Attendance

Iain Dunnett (ID)

New Anglia LEP

Keith Spanton (KS)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Tracie Ashford (TA)

New Anglia LEP

Actions from meeting 18.04.18

Horizon Projects Table

New headings detailing funding, drawdown, forecast and a RAG rating to be included and

ID

for the table to be transferred to excel.

Speculative Investment Paper

CD to make the amendments as discussed and re circulate to the Investment Appraisal

CD

Committee before the next meeting.

1

Welcome from the Chair

Lindsey Rix (LR) welcomed everyone to the meeting.

2

Apologies

Apologies were received from Sandy Ruddock, Alan Waters and John Griffiths.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board/.

Declarations relevant to this meeting: NONE

4

Minutes of the last meeting

The committee agreed the minutes were a true account from the last meeting on 21.03.18.

Actions from last meeting updated as follows:

Capital Growth Programme Verbal Update

CD/ID to review Cultural Projects - to be completed as part of the Growth Deal appraisal of

deferred projects - Ongoing.

CD to oversee review of Growth Deal projects in May - Ongoing.

Minutes from last meeting

All attendees to be listed on the agenda - Completed.

Minutes from last meeting

Horizon information to be visible at the beginning of the meeting papers in future -

Completed.

Stowmarket Atex Confidential

ID to send the committee further information on land value, draw down and cash flow for

committee consideration and recommendation to board - Completed.

5

Horizon Projects Table - Confidential

Iain Dunnett (ID) took the majority of the paper as read and reviewed the key points of the

paper.

Lindsey Rix (LR) stated this was a good start to the development of the table.

Page 1 of 3

3

Tim Whitley (TW) noted the absence of some data and ID explained this was only for the

current financial year.

LR would like the table to be converted into Excel with running totals and further headings of

Approved Funding, Current drawdown, drawdown forecast with these spread across the

years to 2021, RAG status to be included.

The Committee agreed

To note the content of the paper.

That new headings detailing funding, drawdown, forecast and a RAG rating to be

ID

included and for the table to be transferred to Excel for the next meeting.

6

Speculative Investment Paper

Chris Dashper (CD) took the majority of the paper as read and highlighted the key areas.

TW asked what sum of money this would relate to and CD explained £500,000 - £1,000,000

and that all the other factors would need to be considered.

TW said that previous awards of funding had enabled removal of a barrier for example some

additional infrastructure or enabling and he would like to see that captured in the paper.

LR agreed and also mentioned the link to the Economic Strategy and that the explicit

rationale would need to be detailed.

David Ellesmere (DE) explained the paper highlighted we were treating residential and

commercial applications the same and there should be a different criteria, DE also

highlighted the need for the match funding to be clear as would build confidence in lending.

LR said a set of return on investment guidelines were required.

LR was concerned about the capacity within the team for these types of projects with limited

resources available.

DE questioned how much it costs for the LEP to set up a speculative loan and noted that

loans would have to be priced accordingly.

LR asked for CD to amend the paper in line with the discussions and re-circulate before the

next meeting of the IAC.

The committee agreed

To note the content of the paper.

For CD to make the amendments as discussed and re circulate to the Investment

CD

Appraisal Committee before the next meeting.

7

West Suffolk College Engineering and Technology Centre

CD took the majority of the paper as read and reviewed the keys points of the paper

LR asked if anything had dramatically changed from the original paper and CD said there

could be some over-run costs which the LEP would not be covering- these costs were

unknown until full access to the building had been secured.

Dominic Keen (DK) asked when they would start educating students CD confirmed next

academic year.

DE asked if the LEP had ever considered owning the building and CD said that they had not

at the time but that was a potential for other non-grant aided projects.

The committee agreed

To note the content of the paper

For CD to present the committee recommendation at the LEP board meeting on the

CD

23rd May 2018 for the release of the remaining £3m to West Suffolk College

Engineering and Technology Centre

8

Draft Capital Growth Programme Call - Confidential Appendices

CD took the majority of the paper as read and highlighted this was an introductory paper

and reviewed the key points.

TW asked what proportion of the remaining funding was left to allocate, CD explained it

would use up the majority of the £9m 2017 call fund and some projects may qualify for a

Growing Places Fund grant, CD also explained there would still be an Autumn call for the

Page 2 of 3

4

remainder of the Growth Deal funding and all projects not funded now could be considered

again as part of that round.

The Committee Agreed

To note the content of the paper.

That the paper would come back to the Committee in May for approval and

recommendation to the May LEP board meeting

Other

14

Any Other Business

Cash Deposits - Confidential Paper circulated at meeting

Keith Spanton provided an update on the receipt from government of the Growth Deal funds

for 18/19 and where the funding would be deposited until drawn down by the approved

projects

The Committee Agreed

To note the content of the paper

That the funds be deposited as recommended in the paper

Next Meeting

Wednesday 23rd May 2018, 9am - 9.45am.

Co-op Education Centre, 11 Fore St, Ipswich IP4 1JW

Page 3 of 3

5

New Anglia Local Enterprise Partnership

Investment Appraisal Committee

Wednesday 23rd May 2018

Agenda Item 7

New Anglia LEP: Speculative Investment

Author and presenter: Chris Dashper

Summary

Since 2012, when the Growing Places Fund was first launched, New Anglia LEP has had the

opportunity to support commercial projects with repayable loans.

Due to the requirement to ensure that best value is secured through the use of public funds at

minimal risk, the majority of loans made by New Anglia LEP to date have been non-speculative,

with either a confirmed end user or occupant or a defined and manageable repayment method

in place from the outset.

New Anglia LEP continues to receive regular requests for funding through the Growing Places

Fund, many of which could be considered as speculative projects.

In lower risk circumstances, a loan for a speculative project may be appropriate for LEP

support. This paper proposes a framework through which the LEP can determine whether it

should or should not invest in speculative developments.

The paper also includes a table to calculate the appropriateness of investments in terms of the

return received.

Recommendation

The Board is recommended to consider using Growing Places Fund and other funds if available

to support speculative investments in certain lower risk circumstances.

Background

The term ‘speculative construction’ or ‘speculative development’ describes a process in which

unused land is purchased or a building project is undertaken with no formal commitment from

any end users.

Despite the end user being unknown, the developer is confident not only that they will be able

to find one but also that the type of development being undertaken is suitable. This contrasts

with custom building when a builder is contracted for a specific development by a client who is

able to provide a brief of their requirements.

Speculative development does have a degree of notoriety attached to it, from the 1980s in

particular where in cities and major growth areas de-regulation of the financial sector and the

1

33

availability of international financing led to significant commercial developments and property

booms.

Examples of speculative construction include:

Constructing retail space to lease space from or to sell

Constructing a business park or office space to sell or lease

Building houses to sell

Conversion of existing buildings into other uses to lease or sell

Speculative developers typically profit from carefully timing the buying and selling of land or

property for development.

Land for office or housing developments can often be purchased at a cheaper rate during a

market depression and then sold once developed when the market has recovered. However

there is risk in this as the costs are often high, the timescales are long and the consequences of

misjudging the market and not finding a buyer can be serious.

Public funding is not traditionally used to support the purchase of land and the LEP would not

consider requests to solely support the purchase of land through any of the programmes. The

growing issue of land banking is also a reason not to support land purchases.

For any other type of development the LEP already operates a policy of supporting ‘shovel

ready’ projects to ensure that funding is not tied into projects that have no chance of an

immediate start.

It can be common for speculative developments to remain empty or partially empty for a long

time after construction and for developers to suffer financially as a result, which can then have

a corresponding impact on the ability to repay any debt finance.

It is rare that large scale speculative developments such as large offices will be undertaken by

anyone other than the largest developers as the amount of investment and duration can be

prohibitive.

Building companies speculating on small scale industrial developments are more common and

of the type that New Anglia LEP has often been approached to support, for example the

Malthouse in Ipswich and Atex in Stowmarket.

It is also common with owner-occupied housing, where there is a relatively short build time,

limited capital is tied up in the building and there may be greater willingness from commercial

banks to extend credit on the security of land holdings. The LEP has had few approaches for

such investments because there is a less obvious failure in the traditional funding available in

the market.

New Anglia LEP has funded a number of commercial and public projects through repayable

loans since the launch of the Growing Places Fund in 2012.

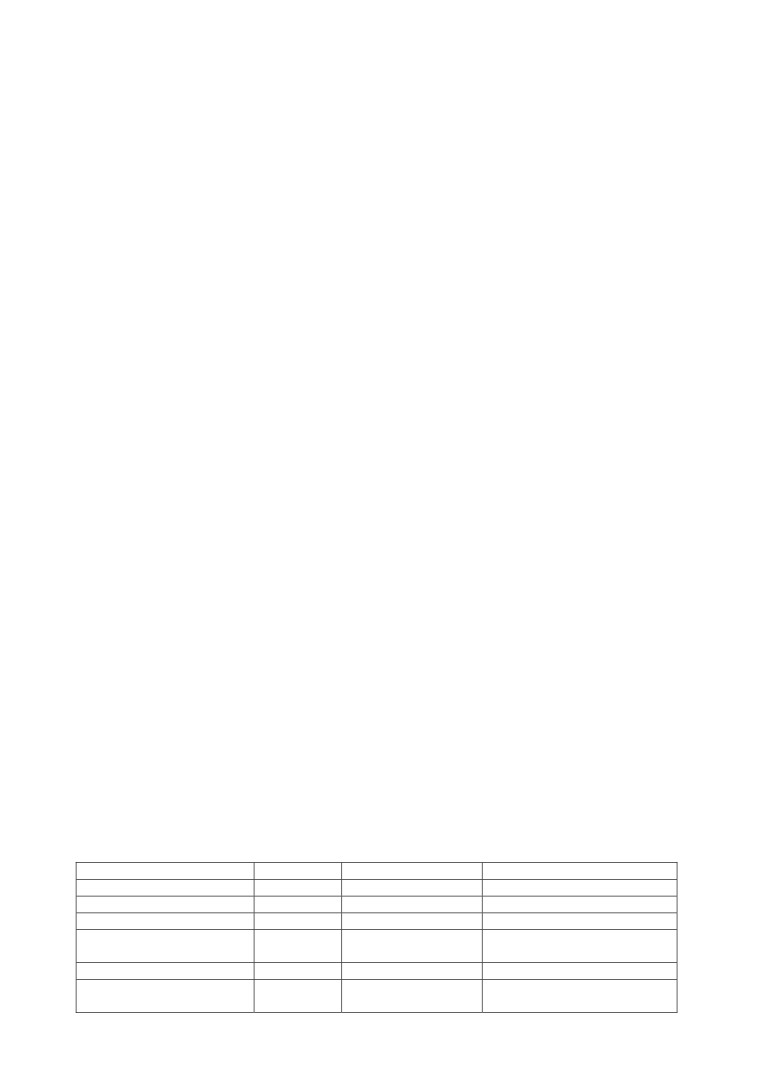

Table of LEP loans to date

Project

Loan £

Public/Commercial

Loan type

Haverhill Research Park

£2m

Commercial

Road infrastructure

Barton Mills Roundabout

£500k

Commercial

Road infrastructure

Kesgrave Hall

£300k

Commercial

Commercial business

Kings Lynn Innovation

£2.5m

Public

Innovation Centre

Centre

Pasta Foods

£2.4m

Commercial

Commercial business

Peel Estates, North

£2.3m

Commercial

Housing infrastructure

Walsham

2

34

Ipswich Flood Defence

£6.6m

Public

Flood defence infrastructure

Scheme

Ipswich Winerack

£5m

Commercial

Housing infrastructure

Malthouse Ipswich

£600k

Commercial

Commercial business space

Loans have been awarded for a variety of purposes, from unlocking stalled sites with

infrastructure, which was the original purpose of the Growing Places Fund, through to the

purchase of capital equipment and capital build and flood defences.

To ensure appropriate use of public funding, all loans to date aside from Ipswich Malthouse

have been awarded on a non-speculative basis, with either an existing owner or an identified

future occupier or a pre-arranged repayment arrangement in place.

Where housing projects have been supported through the Growing Places Fund, the loan has

been provided for the infrastructure to unlock the site, not to fund the houses themselves.

The exception to this is the Ipswich Winerack, where the fund has supported a mixture of

infrastructure and housing, but only because the Homes and Communities Agency was the

senior partner in the project, which reduces the overall risk for the LEP. The deal also included

a significant number of pre-sales of flats.

Ipswich Malthouse, which has received agreement for a GPF loan is considered to be a

speculative project, because the project had no confirmed future occupiers at the time of

approval, however, the project was considered to address a market failure in Ipswich, with a

significant level of un-serviced demand for small, easy terms business lets, particularly in a

prime location between the railway station and the Princes Street EZ in Ipswich

Key considerations

Evidence of demand

Recent discussions around commercial developments such as the Malthouse in Ipswich and

ATEX in Stowmarket suggest that demand for speculative type investment exists and that a

market failure remains concerning the ability to secure all necessary funding to commence such

developments.

Our Economic Strategy development work has highlighted a shortage of quality office and

commercial accommodation in our area.

Furthermore there remains a lack of appetite amongst commercial lenders to provide finance to

these schemes. There are a number of factors for this.

Commercial lenders have focused lending on larger projects, in London and the South East and

in centres such as Cambridge.

This means that SME developers in Norfolk and Suffolk are finding it harder to secure finance.

Our experience has shown that LEP support is an enabling factor in securing commercial

finance.

Consequently, on an appropriate scale and where other factors are met and a strategic benefit

exists, a degree of limited speculative commercial investment should be considered by the

LEP.

Residential vs Commercial investment

The criteria in this document applies to speculative commercial investments only, unlocking

residential developments should be considered a different scale of risk and a more common

3

35

use of LEP funds, with several residential developments already supported by the LEP in the

past.

Skills and capabilities

It is appreciated that appraising speculative developments will require additional skills and

capabilities given the increased risks attached.

The LEP’s newly appointed Chief Operating Officer Rosanne Wjinberg is leading a review of

LEP programme delivery.

This will look at performance of our programmes, reporting mechanisms and will also ensure

additional skills and capabilities are added to the existing team. This could be through

accessing additional skills on a retainer or as and when basis.

This will include the skills required to analyse and recommend to the LEP Appraisal Committee

and LEP Board Investment more complex investments including speculative developments.

Financial impact

A higher proportion of speculative loans completed would have an impact on the overall funding

available to the LEP for more traditional interventions. However, speculative loans are likely to

be an exceptional request, rather than the standard.

In addition, delivery of our economic strategy ambitions through our programmes is the priority.

Speculative investments will be used to supplement programmes only to the extent that they do

not prevent them from delivering the promised targets

Assessment of applications

The following list defines the factors recommended to be reviewed each time a speculative

investment is being considered:

Projects should follow the original principles of the Growing Places Fund, with a focus

on unlocking stalled sites and addressing market failures

A suitable site should have been identified and any ownership issues resolved

Necessary approvals such as planning permission should be in place

Projects should be of appropriate size and complexity to be considered

Residual valuation exceeding loan request by appropriate ratio, to be determined by the

IAC

Amount of request should be within LEP preferential limits- the range of investment

would be between £300k and £1m.

Match funding or financing arrangements in place, LEP investment should not be the

only source of funding

Delivery and repayment within a 3-5 year time period

The market conditions and evidence of need at the time and in the future

The potential return on investment is commensurate with risk and value

Comparison with other potential projects to ensure best value

LEP delivery costs should be recovered from the applicant and the overall benefit to the

LEP as a result of investing should at least match the rate of inflation

4

36

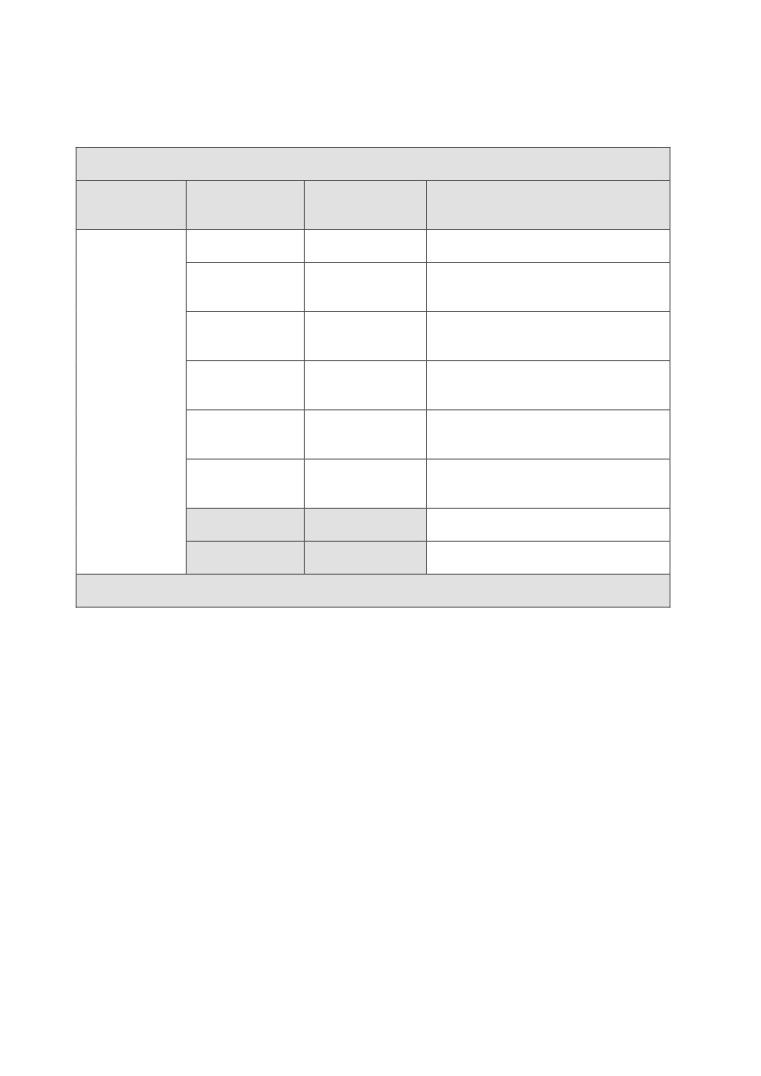

Acceptable Return on Investment scoring table

The table below can be used to score applications to provide an initial acceptability assessment

of applications for speculative developments.

Acceptable Return on Investment framework

scoring values in brackets

Public

or

LTV % (b)

Period of loan

Interest Rate % (d)

Commercial

(years) (c)

applicant (a)

Less than or

1 Year (1)

2%-3% (8)

equal to 10 (1)

Greater than 10

2 Years (2)

3%-4% (7)

or less than 20

(2)

Greater than 20

3 Years (3)

4%-5% (6)

or less than 30

Public: (5)

(3)

Greater than 30

4 Years (4)

5%-6% (5)

Commercial:

or less than 40

(10)

(4)

Greater than 40

5 Years (5)

6%-7% (4)

or less than 50

(5)

Greater than 50

6 Years (6)

7%-8% (3)

or less than 60

(6)

8%-9% (2)

9%-10% (1)

Scoring (a+b+c+d)

Acceptable scoring range 15-24

Should the above factors be satisfied and the project is considered to be of appropriate type

and scale for LEP investment (or the investment requested from the LEP can be scaled in a

way that still allows the project to proceed) then a legally binding, secured loan should be

considered by the IAC and subsequently by the LEP Board .

Link to the Economic Strategy

Support to developments of all types through LEP programmes links to the creation of jobs,

new homes, support to new and existing businesses and the promotion of growth locations and

Enterprise Zones.

The Economic Strategy seeks to influence the creation of high quality commercial space and

housing in the right places, along with appropriate infrastructure to support the growth of

communities and the places for them to live. Not all such developments are supportable by the

traditional finance marketplace, giving the LEP the opportunity to consider investing in certain

speculative opportunities.

Recommendation

The Board is recommended to consider using Growing Places Fund and other funds if available

to support speculative investments in certain lower risk circumstances.

5

37