New Anglia LEP Investment Appraisal Committee

Wednesday 29th January 2020

9.00am - 9.45am

Liftshare Office, 4 Duke St, Norwich NR3 3AJ, Norfolk

Agenda

No.

Item

1

Welcome

2

Apologies

3

Declarations of Interest

4

Minutes of previous meeting held on 27th November 2019 - Confidential

5

Horizon Paper - Confidential

Reporting - Growing Business Fund

6

Growing Business Fund Performance Report

6.1

Growing Business Fund approvals

6.2

Small Grant Scheme approvals

7

Innovative Projects Fund Performance Report

Items for discussion

8

Growing Places Fund Grant Application: L’Arche Confidential

9

Growing Places Fund Loan: Hempnall Housing - Confidential

10.

Growing Places Fund: Introductory Paper, One Farm- Confidential

Other

11

Any Other Business

1

Committee Members

Lindsey Rix

Aviva

Cllr David Ellesmere

Ipswich Borough Council

Andrew Proctor

Norfolk County Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norwich City Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Martin Williams

Exec Members

Rosanne Wijnberg

New Anglia LEP

Chris Dashper

New Anglia LEP

Iain Dunnett

New Anglia LEP

Tanya Nelson

New Anglia LEP

Date and time of next IAC meeting: Wednesday, 26 February 9-9:45am

Venue: Gallery Three, Ipswich Town Hall, Cornhill, Ipswich, IP1 1DH;

2

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

27 November 2019

Present:

Committee Members

Alan Waters (AW)

Norwich City Council

Sandy Ruddock (SR)

Scarlett and Mustard

David Ellesmere (DE)

Ipswich Borough Council

Andrew Proctor (AP)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Tim Whitley (TW)

BT

In Attendance

Rosanne Wijnberg (RW)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP

ACTIONS

Circulate date for additional IAC meeting in December to accommodate at least 2 further projects for

review by the committee: CD

1

Welcome from the Chair

David Ellesmere welcomed everyone to the meeting.

2

Apologies

Apologies were received from Lindsey Rix and Martin Williams

3

Declarations of Interest

None

4

Minutes of previous meeting (30 October 2019)

The minutes of the previous meeting were approved by the committee.

5

Growing Places Fund Horizon Paper (Confidential)

Iain Dunnett (ID) took the Horizon paper as read.

The Committee had no questions on the content.

An additional telephone meeting would be scheduled in December to accommodate at least 2 further

projects on the pipeline.

Action: Circulate date for additional IAC meeting in December to accommodate at least 2 further projects

for review by the committee: CD

6

Growing Business Fund Programme Performance Report

6.1

Growing Business Fund Project approvals

6.2

Small Grant Scheme project approvals

The monthly GBF report and accompanying appendices were reviewed by the Committee with no

questions.

Page 1 of 2

7

Growing Places Fund Loan: Confidential

Iain Dunnett presented an updated paper on the project.

Subject to confirmation of affordable housing/social rent figure and efforts to achieve parity of charge with

the bank then a repayable, interest bearing loan offer of £750k was confirmed by the committee.

8

Growing Places Fund Grant Request- Confidential

Iain Dunnett presented a paper on a request for funding towards capital costs.

The Committee agreed to support the request for a grant of £250k, subject to match funding. Grant to be

paid in arrears on evidence of expenditure.

9

Growing Places Fund Grant Request: Confidential

Chris Dashper presented a paper on a request for funding from GPF.

The Committee agreed to support the request for a grant of £100k, subject to the applicant securing the

match funding required to deliver the development phase of the project.

10

Growing Places Fund Grant Request: Confidential

Iain Dunnett presented a paper on a request for funding towards capital costs.

The IAC agreed to support the request for a grant of £50k, to be paid in arrears on evidence of

expenditure.

11

Lessons Learned discussion: Confidential

Chris Dashper provided a lesson’s learned paper on an investment project.

The Committee noted the contents of the report.

12

Any Other Business

None

Page 2 of 2

Growing Business Fund Performance Report - December 2019

Programme Overview - What is the Growing Business Fund?

Launched in April 2013, the Growing Business Fund provides grants for businesses to enable growth, an increase productivity and job creation.

Capital grants between £25,000 and £500,000 are provided at up to 20% of project costs for SMEs, with an enhanced rate for small businesses located in an Assisted Area (until 2021).

Funding for the Growing Business Fund is provided on an annual basis by the LEP's Growth Deal.

The fund is accessed through the New Anglia Growth Hub with Due Diligence undertaken by Finance East and agreed by the monthly GBF panel meetings as required .

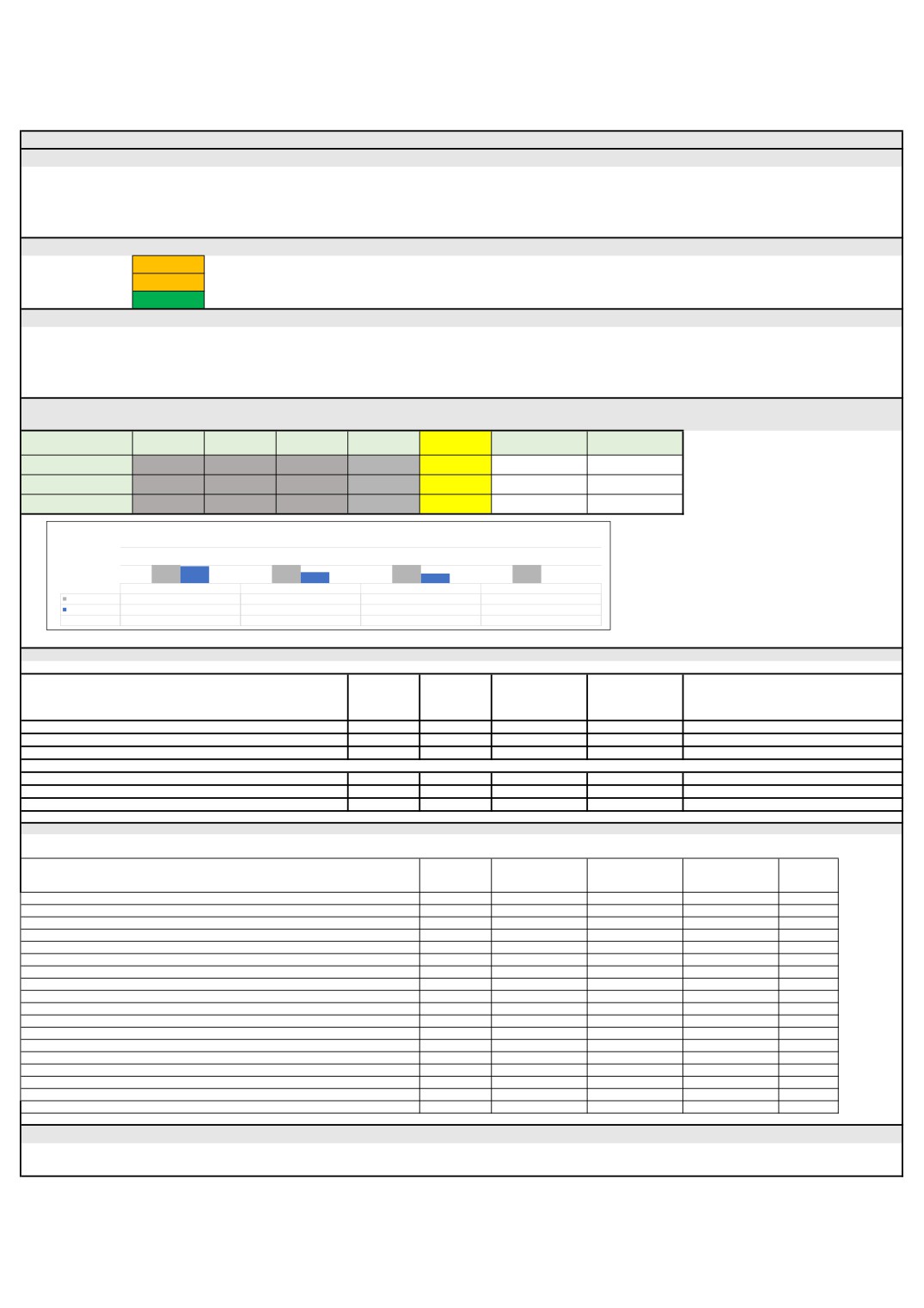

What is the overall Programme Status?

Finance

Amber

Over the summer we have seen reduced interest, and applications are taking longer to develop and bring to panel.

Outputs

Amber

Based on recent grant applications, reduced spend and pipeline, the scheme will possibly underperform against the current targets for the year 2019/20.

Delivery

Green

We now have a healthy pipeline of applications, current projects and historic approvals which will help to ensure that the fund performs well.

What are our key updates?

Participant SMEs of the Scale Up New Anglia programme are being offered a range of support including applications to GBF (where appropriate).

This is still the LEP flagship grant scheme with many enquiries, however, perhaps due to Brexit we are seeing requests for funding for smaller less ambitious projects actually submitted.

Due to a slowing down the number and value of applications to panel is reducing, three in October totalling £250,000 and two November £127,000.

Of our 2019/20

£4.121m budget, 16 applications, £1.686m is existing commitment from 2018/19; of which £128,000 (2 applications) are still to be claimed and 2 applications have withdrawn.

What is our financial position?

Financials (£ million)

Year

2013 to 2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

Total

Profile Spend (£m)

£12.000

£3.536

£3.050

£5.096

£4.121

£2.790

£30.593

Actual Spend (£m)

£11.999

£3.001

£3.049

£4.764

£2.148

£24.961

Remaining Spend (£m)

£0.001

£0.535

£0.001

£0.331

£1.973

£2.790

£5.631

2019/2020 Expenditure Profile

2

1

0

Q1-18/19

Q2-18/19

Q3-18/19

Q4-18/19

Quarterly Forecast

£1.030

£1.030

£1.030

£1.030

Quarterly Spend

£0.963

£0.631

£0.554

£0.000

Variance

£0.067

£0.399

£0.476

£1.030

What is our contribution to the Economic Strategy?

Actual to end of

Outputs April 2019 to March 2020

Target

Monthly Change

Shortfall

Notes

November 2019

Value of grants approved

£4,121,000

£1,113,953

£0

£3,007,047

Value of private sector match approved

£16,484,000

£5,171,160

£0

£11,312,840

Number of New Jobs to be Created

206

72

0

135

Value of grants claimed

£4,121,000

£2,147,829

£304,866

£1,973,171

Private sector match funding drawn down

£16,484,000

£9,239,081

£1,503,861

£7,244,919

Number of New Jobs Created

206

165

5

41

What is the project status?

The following table shows grants approved by sector since the start of the programme in 2013/14

Number of

Projects

Grants

Private

Total Project

Jobs to be

Sector

Approved

Approved

Match

Costs

Created

A - Agriculture, Forestry and Fishing

3

£

235,899

£

1,018,543

£

1,254,442

58.0

B - Mining and Quarrying

1

£

100,000

£

1,654,600

£

1,754,600

10.0

C - Manufacturing

129

£

14,300,026

£

92,094,168

£

106,394,194

1556.5

E - Water supply, sewerage, waste management and remediation activities

4

£

274,000

£

1,174,000

£

1,448,000

26.0

F - Construction

16

£

1,136,486

£

5,514,740

£

6,651,226

144.5

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

26

£

2,829,816

£

52,382,892

£

55,212,708

386.0

H - Transportation and Storage

8

£

666,992

£

3,275,957

£

3,942,949

90.0

I - Accommodation and Food Service Activities

5

£

372,000

£

2,342,138

£

2,714,138

45.5

J - Information and Communication

10

£

717,700

£

3,537,616

£

4,255,316

74.0

K - Financial and Insurance Activities

1

£

30,000

£

79,425

£

109,425

3.0

L - Real Estate Activities

1

£

100,000

£

232,500

£

345,000

10.0

M - Professional, Scientific and Technical Activities

22

£

2,459,931

£

15,317,782

£

17,777,713

264.6

N - Administrative and Support Service Activities

22

£

2,145,771

£

11,440,136

£

13,585,907

251.0

P - Education

1

£

20,000

£

102,191

£

122,191

4.0

Q - Human Health and Social Work Activities

1

£

31,580

£

126,320

£

157,900

3.5

R - Arts, Entertainment and Recreation

8

£

502,921

£

3,159,776

£

3,662,697

55.5

S - Other Service Activities

2

£

320,000

£

4,737,413

£

5,057,413

32.0

Total

260

£

26,243,122

£

198,190,197

£

224,445,819

3014.1

What are the next steps?

The LEP is working with delivery partners, to ensure that the scheme has a greater focus on business growth and productivity.

As part of the marketing Action Plan a number of case studies have been commissioned and the growth hub website revamped, plus new literature and banners for launching in January 2020.

11

New Anglia LEP

Growing Business Fund

Grant Approvals 1st April 2019 to 31st March 2020

Date

Total Project Jobs to be

Business Name

Grant Awarded Private Match

Approved

Cost

CreatedDescription of Support Given

Apr-19

Anglian Plant Ltd

£170,000

£681,915

£851,915

8 Capital grant to support business growth

May-19

Portable Space Ltd (2)

£78,378

£313,513

£391,891

5 Capital grant to support business growth

May-19

Goldwell Manufacturing Services Ltd

£40,000

£96,200

£136,200

2 Capital grant to support business growth

May-19

Belle Coachworks Ltd (4)

£36,000

£85,151

£121,151

5 Capital grant to support business growth

May-19

HBD Europe Ltd (2)

£52,388

£341,133

£393,521

6 Capital grant to support business growth

Jul-19

Bendart Limited

£42,500

£99,495

£141,995

4 Capital grant to support business growth

Jul-19

Fathom

£40,000

£162,821

£202,821

4 Capital grant to support business growth

Jul-19

Hugh Crane Cleaning Equioment Ltd

£56,369

£507,327

£563,696

5 Capital grant to support business growth

Jul-19

Anglia Indoor Karting (Ipswich) Ltd

£40,000

£126,060

£166,060

2 Capital grant to support business growth

Aug-19

William Moorfoot Ltd

£50,000

£283,067

£333,067

2.5 Capital grant to support business growth

Aug-19

Timber Frame Management Ltd

£35,662

£142,649

£178,311

2 Capital grant to support business growth

Sep-19

Musks Limited

£71,469

£285,876

£357,345

4 Capital grant to support business growth

Sep-19

Edmondson Hall (Moved from SGS approvals)

£25,000

£371,148

£396,148

0 Capital grant to support business growth

Oct-19

Hollinger Print Ltd

£57,000

£228,000

£285,000

3 Capital grant to support business growth

Oct-19

Equipmake Ltd

£121,997

£487,988

£609,985

7 Capital grant to support business growth

Oct-19

Richmond Defence Systems Ltd

£70,000

£282,500

£352,500

4 Capital grant to support business growth

Nov-19

Plastech Industries Ltd

£56,500

£226,046

£282,546

3 Capital grant to support business growth

Nov-19

LiMAR Oil Tools (UK) Ltd

£70,690

£450,271

£520,961

5 Capital grant to support business growth

£1,113,953

£5,171,160

£6,285,113

71.5

12

Small Grant Scheme Approvals (April 2019 - March 2020)

Total

Jobs to

Date

Grant

Private

Business Name

Project

be

Description of Support Given

Approved

Awarded

Match

Cost

Created

Apr-19

DXB Pumps & Power Ltd.

£16,845

£67,385

£84,230

1.0

Capital investment to support business growth

Apr-19

Bradleys (Stowmarket) Ltd. (2)

£17,919

£71,679

£89,598

0.0

Capital investment to support business growth

Apr-19

Praxis42 Ltd.

£6,362

£25,449

£31,811

4.0

Capital investment to support business growth

Apr-19

Edmondson Hall

£25,000

£371,148

£396,148

0.0

Capital investment to support business growth

Apr-19

The Penny Bun Bakehouse Ltd.

£7,203

£16,807

£24,010

0.0

Capital investment to support business growth

Apr-19

Criterion Ices Ltd.

£19,515

£78,064

£97,579

2.0

Capital investment to support business growth

Apr-19

Fruitful Media Ltd.

£8,805

£35,222

£44,027

7.0

Capital investment to support business growth

Apr-19

Tosier Chocolate Ltd.

£2,724

£10,900

£13,624

1.0

Capital investment to support business growth

May-19

Apex Print & Promotion Ltd.

£9,930

£39,720

£49,650

2.0

Capital investment to support business growth

May-19

Pastonacre Ltd

£4,305

£17,224

£21,529

1.0

Capital investment to support business growth

May-19

Donald Utting & Sons Ltd (2)

£24,973

£99,892

£124,865

0.0

Capital investment to support business growth

May-19

Safety Devices International Ltd

£5,600

£22,400

£28,000

0.0

Capital investment to support business growth

May-19

A J Laminated Beams Ltd

£5,500

£22,000

£27,500

0.0

Capital investment to support business growth

May-19

P J Lee Hire & Sales Ltd

£6,600

£26,400

£33,000

2.0

Capital investment to support business growth

May-19

Newton Automotive Ltd (2)

£16,160

£64,640

£80,800

1.0

Capital investment to support business growth

Jun-19

Timberwolf Ltd

£18,275

£73,100

£91,375

0.0

Capital investment to support business growth

Jun-19

CapTrac Ltd

£25,000

£101,844

£126,844

0.0

Capital investment to support business growth

Jun-19

Yum Yum Tree Fudge Ltd

£10,905

£43,620

£54,525

0.0

Capital investment to support business growth

Jun-19

N-Ergise Ltd

£25,000

£64,285

£89,285

1.0

Capital investment to support business growth

Jun-19

Emkay Plastics Ltd

£14,453

£57,814

£72,267

0.0

Capital investment to support business growth

Jun-19

Vinyl Installation Ltd

£7,200

£16,800

£24,000

0.0

Capital investment to support business growth

Jun-19

C.S. (Computer Services) Ltd.

£1,749

£6,996

£8,745

0.0

Capital investment to support business growth

Jul-19

The Space Burston

£9,313

£52,775

£62,088

2.0

Capital investment to support business growth

Jul-19

Clenshaw Minns Ltd

£21,740

£86,963

£108,703

1.0

Capital investment to support business growth

Jul-19

Able Cleaning & Hygiene Supplies

£1,113

£4,455

£5,568

0.0

Capital investment to support business growth

Jul-19

Sabrefix (UK) Limited

£4,260

£17,040

£21,300

3.0

Capital investment to support business growth

Jul-19

E Rand & Sons Limited

£4,247

£16,991

£21,238

0.0

Capital & Revenue investment to support business growth

Aug-19

EGM Products Ltd

£12,575

£50,304

£62,879

2.0

Capital investment to support business growth

Aug-19

Saw Media Limited

£1,611

£6,447

£8,058

1.0

Capital investment to support business growth

Aug-19

ASBT Holdings Ltd

£6,188

£24,754

£30,942

3.0

Capital investment to support business growth

Aug-19

Intelligent Resource Management Ltd

£3,000

£12,000

£15,000

0.0

Capital investment to support business growth

Aug-19

Suffolk Yacht Harbour Ltd

£2,919

£11,678

£14,597

0.0

Capital investment to support business growth

Aug-19

Twyfords To You Limited

£12,545

£50,182

£62,727

1.0

Capital investment to support business growth

Sep-19

Finn Geotherm UK Ltd

£4,550

£18,200

£22,750

0.0

Capital investment to support business growth

Sep-19

Lexhag Ltd

£9,972

£39,888

£49,860

0.0

Capital & Revenue investment to support business growth

Sep-19

Stephen Green & Associates Limited

£9,973

£39,892

£49,865

1.0

Capital investment to support business growth

Sep-19

Display Products Ltd

£22,500

£52,500

£75,000

6.0

Capital investment to support business growth

Sep-19

Mio Conferencing Limited

£9,105

£36,420

£45,525

1.0

Capital & Revenue investment to support business growth

Sep-19

Edmondson Hall

-£25,000

-£371,148

-£396,148

0.0

Moved from SGS to GBF

Oct-19

The Rainbird Partnership Ltd

3,668

14,673

18,341

1.0

Capital & Revenue investment to support business growth

Oct-19

WBC (Norfolk) Ltd

5,048

20,195

25,243

1.0

Capital investment to support business growth

Oct-19

Steele Media Ltd

25,000

155,000

180,000

1.0

Capital & Revenue investment to support business growth

Oct-19

SSAF Window Films Ltd

3,490

13,961

17,451

0.0

Capital investment to support business growth

Oct-19

Revolution Fitness Academy Ltd

8,007

32,029

40,036

2.0

Capital investment to support business growth

Oct-19

Tom Soper Photography

2,191

8,766

10,957

0.0

Capital investment to support business growth

Oct-19

Surftech Surfaces Ltd

12,210

48,840

61,050

2.0

Capital investment to support business growth

Nov-19

Re Form Sports Fitness Ltd

13,078

52,314

65,392

2.0

Capital investment to support business growth

Nov-19

David Holliday Limited

2,820

11,280

14,100

0.0

Capital investment to support business growth

Nov-19

Creative Image Management Ltd.

10,260

41,040

51,300

0.0

Capital investment to support business growth

Nov-19

Big House Holiday Rentals Ltd.

4,800

19,200

24,000

0.0

Capital investment to support business growth

Nov-19

H. Smith & Sons (Honingham) Limited

8,133

32,533

40,666

0.0

Capital investment to support business growth

£489,339

£1,932,561

£2,421,900

52.0

SGS Grants Approv3d Apr19-Mar201

Innovative Projects Fund - 2018 Projects Call

Programme Overview - What is the Innovative Projects Fund

The Innovative Projects Fund is a revenue grant programme that provides funding towards innovative projects to support the delivery of the themes and activities identified in the

Economic and Industrial Strategies. The first call of the Innovative Projects Fund was made in October 2018 with a remit to facilitate innovative projects supporting economic growth

and the delivery of the Economic Strategy utilising revenue from the Enterprise Zone Pot C.

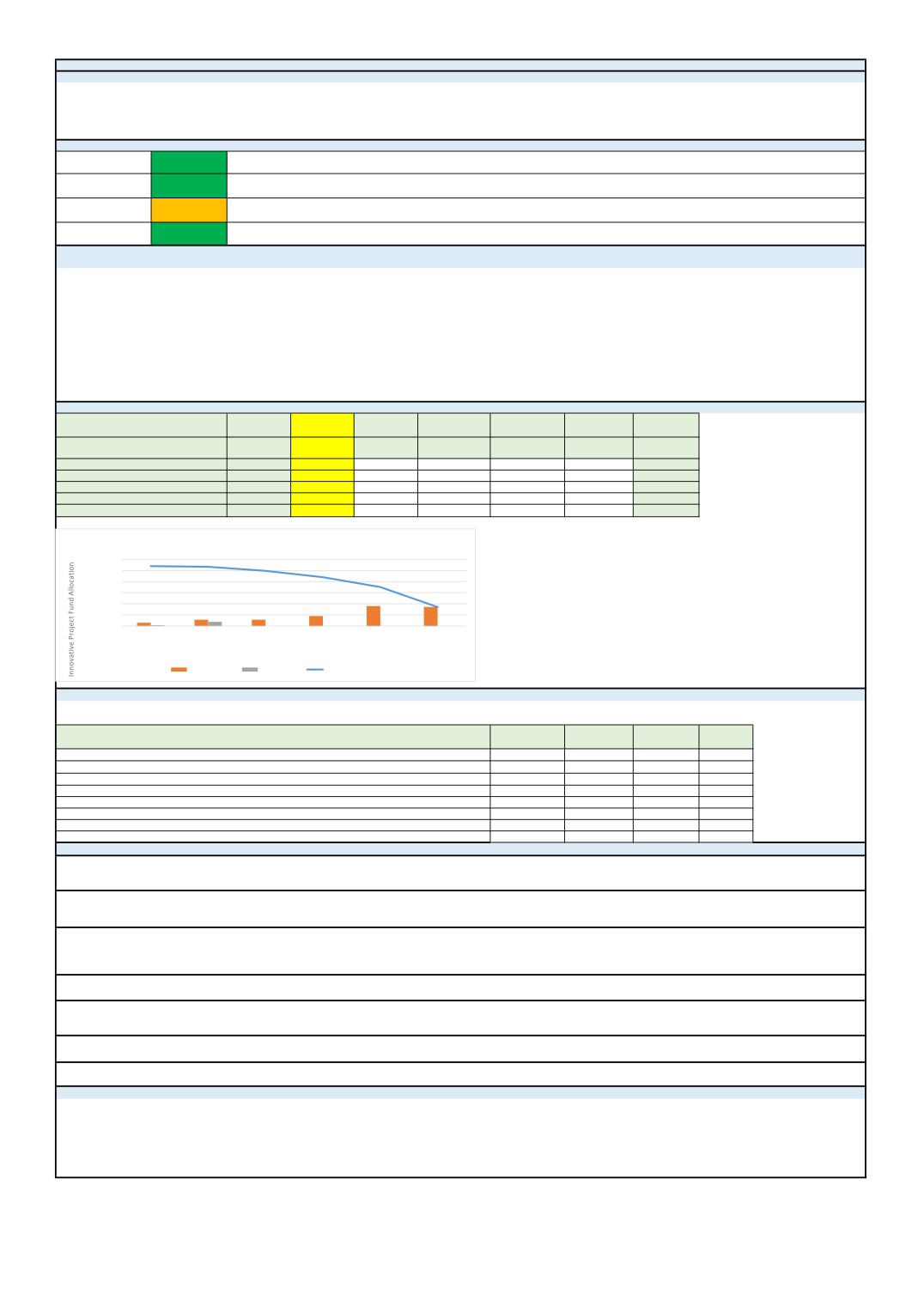

What is the Overall Programme Status?

6 out of the 7 projects have signed Offer Letters. All 6 projects with signed Offer Letters are now in the delivery phase and in the process of

Overall:

Green

claiming their allocations.

5 of the 7 projects have been delayed in starting their projects due to meeting Offer Letter conditions and delays in staff appointments. All

Delivery:

Green

projects are now delivering within approved re-profiled timeframes.

Spend:

Amber

Total forecast spend by the end of Quarter 2 was £85,682, Actual spend is £43,781.

Outputs:

Green

No accumulated outputs were forecast by the end of quarter 2.

What are our Key Updates?

•Since quarter one all projects except Building Supply Chain Skills Capacity and the Cornhill project re-profiled their expenditure.

•Norwich University of Arts’ Connecting Creative Capital was re-approved at the October 2019 IAC. £100,000 was approved.

•Suffolk County Council’s Fit for Nuclear project has now met the conditions of the IAC's offer of funding. £118,000 has been approved. The project will now be led by West Suffolk

College. The project will commence ASAP after receipt of a signed Offer Letter.

•There are now 7 projects under the 2018 call of the Innovative Projects Fund with a combined allocation and commitment of £539,531.

•The value of claims for Quarter 2 is: £37,200.62

•Accumulated claims /spend for the IPF to date is £43,781

•A claim of £32,499.45 is pending for Quarter 2.

•Local Authority match funding of £47,579.05 has been recorded.

•Private Match Funding of £28,287.89 has been recorded.

•1 part time job has been created, 10 jobs have been safeguarded and 6 businesses have been supported.

What is our Financial Position?

Financials (£ million)

Forecast

Actual

Forecast

Forecast

Financial Year

2019/20

2019/20

2020/21

2021/22

Brought Forward

0.000

0.308

0.129

LEP Allocation

0.540

0.000

0.000

Spend [Act/Fcst]

0.231

0.044

0.179

0.129

Committed

0.231

0.188

0.179

0.129

Carried forward

0.308

0.308

0.129

0.000

2019/20 Expenditure

600,000.00

500,000.00

400,000.00

300,000.00

200,000.00

100,000.00

-

Q1-19/20

Q2-19/20

Q3-19/20

Q4-19/20

20/21

21/22

Axis Title

Qtrly Forecast

Qtrly Claims

Available IPF

What is our contribution to the Economic Strategy?

Quarter/ year:

2 (Jul - Sept) 2019

Forecast to

Outputs - cumulative from April 1st to 30th September 2019 (Quarter 2)

Actual to date

Pending

2022

Number of Direct Full-Time Jobs Created

0

65

High Value Jobs created

0

59

Number of Jobs Safeguarded

10

60

Number of businesses created

0

12

Number of Businesses Supported (at least 12 hrs of support)

6

94

Number of Learners

0

49

Number of businesses created

0

41

Number of part time jobs created

1

3

0

What is the Project Delivery Status?

Building Supply Chains - NCC: This project made a combined claim for quarters 1 and 2 totalling £19,526. NCC in partnership with Vattenfall and the Chambers of Commerce have

held 3 Supply Chain workshops for local business. The project has provided 6 businesses with at least 10 hours of support each. Public match funding of £4,793 and private match

funding of £14,732 has been spent. Expenditure of £17,000 is expected within the next quarter.

The Ipswich Cornhill Action Plan- Ipswich Central: A claim of £17,675 was made for Quarter 2. A claim of £12,000 is forecast for Quarter 3. Twelve new events were approved

and delivered through collaboration between Ipswich Borough Council and Ipswich Central. The project created the equivalent of 1 part time job. Private match funding of £13,555 has

been spent.

Growing the Year-Round Economy - Visit East of England: This project made a combined claim for quarters 1 and 2 totalling £32,499.49. Payment from New Anglia LEP is

pending awaiting the receipt of defrayal evidence. Accommodation and event ticketing has been now built into the website, VEE is now linking with Greater Anglia, Stenna Line and

other transport providers. VEE will now start promoting the new website to the public, promoting the free listings to businesses and services, and building the business and consumer

mailing lists.

The Catapult - The Catapult Network: The project has been delayed pending the appointment of the Innovation Manager for the ORE Catapult. The new post holder, based at Orbis

Energy in Lowestoft will begin on 1st January 2020.

Norfolk & Suffolk Offshore Wind Competitiveness Positioning Programme - GYBC: The project has been delayed somewhat pending the appointment of SCC's Business

Development Manager and the Offshore Wind Marketing Manager. The project has incurred some expenditure via Offshore Wind / promotional events.

Fit for Nuclear - SCC: This project has now met the conditions of the IAC's Innovative Projects Fund Offer. £118,000 has been approved. The project will now be led by West Suffolk

College. The project will commence ASAP after receipt of a signed Offer Letter.

Creating Creative Capital - NUA: This project was re-approved by the IAC in October 2019. The project has submitted a signed offer letter and will start ASAP.

What are the Next Steps?

A 2019/20 Call of the IPF Programme, with a budget of £1.5million, closed on 20th December 2019. 37 applications were received with a total ask of £3,095,196. The applications

have a total projects value of £6,790,048. The applications are now with the externally appointed appraisal consultants. A report highlighting the recommendations for the approval

and rejection of projects will be made available for the IPF Panel on 11th March 2020.

The Programmes Case Worker for the IPF Programme is working with Project Leaders to ensure claims and associated monitoring reports are received for quarter 3.

15