Norfolk and Suffolk Agri-Food Industry Council Meeting

Date: 19 June 2020

Time: 1000 - 1130

Our vision: The future is a place where we make a telling contribution in growing the agri-food sector in Norfolk

and Suffolk

Our vision is to be a shining beacon of how an LEP industry council supports its sector and businesses. As a result

of our activities, the agri-food sector in Norfolk and Suffolk will become bigger, more prosperous and more

economically and environmentally resilient.

Our mission: We will get there by maximising opportunities to generate economic prosperity

The Norfolk and Suffolk Agri-Food Industry Council’s mission is to help our sector thrive and grow. Providing clear

and demonstrable value, the Council will drive the delivery of the Industrial Strategy and Sector Deals, which will

strengthen the agricultural and food sector in Norfolk and Suffolk, reinforce its economic prosperity, support its

environmental objectives, and make it even more attractive to those who want to work, and invest, in the sector.

In attendance

Doug Field (Chair)

New Anglia LEP

Madeleine Coupe

New Anglia LEP

Philip Ainsworth

Suffolk Agric Assocn.

Emma Taylor

New Anglia LEP

Charles Hesketh

NFU

Robert Gooch

The Wildmeat Co

Jonathan Clarke

JIC

Andrew Fearne

UEA

Rachel Brooks

CLA

Clarke Willis

Food Enterprise Park

Greg Smith

RNAA

Nigel Davies

Muntons

Viv Gillespie

Suffolk New College

Martin Collison

Collison and Associates

Corrienne Peasgood

City College Norwich

Andrew Francis

Elveden Estate

Ben Turner

Ben Burgess and Co Ltd

Allan Simpson

Anglian Water

Jasmine Joolia

Suffolk County Council

Alex Dinsdale

Agri-TechE (secretariat)

Kate De Vries

Norfolk County Council

Minutes

1

Welcome from the Chair; apologies and roundtable introductions (if

1000 - 1010

Chair / all /

needed), minutes of the last meeting; approval and matters arising

Following a welcome from the chair, he briefly introduced New Anglia LEP’s Restart report and the continued

focus of the LEP staff on the recovery.

Minutes from the last meeting were approved and there were no matters arising. Apologies were received

from Sarah Lucas, Belinda Clarke, Barry Chevalier Guild

2

State of the nation: Context and how information is used

1010 - 1015

Chair

The chair thanked the Council for their continued feedback and explained how previous ‘state of the nation’

input had been used to identify challenges and inform support and recovery, both locally by the LEP and

nationally through feeding it up to HMG. The chair explained that the LEP’s focus was on both stability and

growth.

3

State of the nation: Norfolk and Suffolk farming and food update

1015 - 1055

ALL

Members of the Agri-Food Industry gave feedback and updates on their experiences of the impacts of the

pandemic on the sector. For the purpose of the minutes, these have been grouped into themes.

Agricultural incl. rural crime, inputs and weather

•

Cut flower sector was hit very hard but has begun to rebuild and has now returned to near normal.

•

Garden centre trade has taken a lot longer to come back. Garden centres opening on 13 May has begun

to address problems but hasn't addressed impact for earlier losses around Easter, so there are major

cashflow problems for some.

•

NFU-led petition (to require food imports to have been produced at equivalent standards to British

food) has reached 1million signatures. MPs in East Anglia have received around 8,000 emails on this

subject, which is also gaining momentum with the Lords and backbenchers.

•

A Defra report published recently showed that East Anglian farmland receives the highest income on a

per hectare basis.

•

There is high levels of rural crime, from opportunist garden thefts to organised crime stealing

machinery. Additional patrols from police rural crime teams have helped. There are reports of

increased flytipping.

•

Many research institutes still closed, meaning that on-farm trials that farmers are running aren’t being

serviced. Farm businesses are having to take a lot of the wok on themselves and hoping not lose our

on effort and investment already made. However, the John Innes Centre is reopening, so it’s likely that

research input will be back on track shortly.

•

Raw materials supply is generating challenges, especially around building materials. For example, one

business reported challenges in obtaining shed panels needed to repair a grain store. Concern exists

about how businesses will adapt and trim back capacities while maintaining supply to businesses

working at normal full capacity.

•

Farm businesses are voicing concern at 2021 inflation for next year’s crops; some have reported that

they are already seeing 4% for pesticides which will add cost to new crops.

•

Weather resilience as always is a challenge, and impacts of the extremes of wet and dry we’ve

experienced over the past several months continue to be felt.

•

Low demand for potatoes (due to the earlier closure of the foodservice sector) is causing storage and

on-farm difficulties

•

Supply and demand in general (agricultural supplies and machinery) have continued at a trickle during

the crisis rather than shutting off completely.

•

Tractor sales have dropped but downtime has given the equipment sales industry time for training -

John Deere is providing free distance learning and training for it’s dealer staff, for example.

•

Council members believe the ongoing uncertainty around Brexit arrangements and slow progress with

the successor funding schemes for agriculture, are a considerable concern to the sector. Major sector

bodies are feeding in strongly to Government on this matter.

•

Public behaviour in the countryside, including issues around littering and fires/barbecues, is a concern,

which has increased since lockdown. The CLA has written to the Education Secretary requesting that

the Countryside Code is taught in schools.

Food processing, retail and supply

• The Food Enterprise Park about to launch new brochure and continues to generate interest. Plans for

the Food Innovation Centre workshop are also moving ahead.

• Businesses report that orders are running 200% for past few months but now beginning to stabilise and

return to normal.

• Only 50% above normal now, hoping demand levels continue at current higher level rather than

dropping to pre-Covid levels.

• One member reported that his egg business was still seeing strong demand in both retail and

wholesale.

• Food service and manufacturing beginning to recover; slow return to normal.

• Food and homebrew sectors are buoyant and recruitment is underway to keep up with these sectors.

• Breweries are returning to production sooner than expected. The likely re-opening of pubs and cafes

in some form was welcomed.

• Craft brewing sector has taken massive hit; not confident all businesses will come back.

• Flavours Connexions has done its job in re-focusing supply chains. Demand for shifting and distributing

food product has settled down as distribution networks re-emerge.

Business environment and staff / labour

•

Malting sector is extremely busy and expecting huge increase in demand when restrictions removed.

•

Malting business has robust work at home and on-site measures in place. Online events are easier to

attend and are achieving high numbers, which helps with training and CPD. Examples of how

businesses are adapting to changes include a clear desks policy making them much easier to sanitise

every day and only every other desk used. Personnel temperature checks on-site have built confidence

in the workforce.

•

One business reported that - capital projects have continued after initial blip but taking about 30%

longer than previously.

•

Businesses need to rebuild margins; many have seen costs increase and margins decline so big focus on

productivity, automation, labour, how supply chain works in order to rebuild margins.

•

Changes have come quickly in supply chain and distribution, businesses need to work hard to respond.

•

Many food businesses want to increase proportion of UK input and enthusiasm too for supply chains to

be simpler to help reduce risk.

•

Council believes that consumer demand over next few years will focus on downward pressure on prices

as people short of cash and unemployment increases, so premium end of market likely to struggle.

•

Interest in opportunities to capitalise on a new emphasis on diet and health, with the expertise at

Quadram Institute coming into play..

•

Political and consumer enthusiasm to rebuild in a ‘better way’ means activity around single use plastics

and other sustainability activity will shortly be back on the agenda. Businesses need to bring their

focus back.

•

Likely downward pressure on food prices in the coming months, due to increase in unemployment, and

power of multiples will put pressure on small local food brands. Recent successes seen in independent

food businesses will be undone without strong consumer action, and we’ll see further consolidation

and loss of diversity in the marketplace.

•

G's Growers and Place UK both positive about British workers, proportion of which has increased from

0 - 25%. Some East European staff returning but both businesses quite relaxed about staffing levels for

2020.

•

Retail and industry are now all preparing for Christmas and planning how to manage it with social

distancing.

•

A retail business reported an average number of applicants per vacancy has increased tenfold.

•

SME retailers are at capacity with packing and shipping - the danger exists that they don’t have time

for longer term strategy and development.

•

Investment in automation and digitisation is needed to support innovation and physical infrastructure

improvements, necessary to maintain competitiveness.

Water

•

Information circulated nationally by Water UK confirms that the UK is currently seeing the highest ever

demand for water. People are using on average 20% more water, due to personal hygiene (Covid) and

also watering gardens. Peak demand is 6pm - 10pm. Extra demand not generally an issue for reservoirs

but is a challenge for distribution around networks.

•

A national campaign is in development to put water on the agenda before summer demand peaks.

•

Anglian Water has launched the Positive Difference fund via Community Foundations -£1m across

whole region for community groups to bid into to help protect the vulnerable from Covid and impacts.

Brexit and Trade

• Members commented that the border issue is a real problem, only around 10% (border and customs)

staff are trained and time is short.

• It is also unclear where border points and posts will be, and which food products will require these

border checks.

• There are real concerns around these shortfalls in personnel and training in border controls and

customs post-Brexit. Tens of thousands of regional businesses (including many food and ag businesses)

rely on trade and border delays / problems will cause severe further difficulties down the line. It was

suggested that the LEP look closely at this area of career opportunity and recruitment for school

leavers.

• Concerns still exist about the impact of trade changes on UK agriculture.

Skills and education

• Questions remain over where long-term staff skills will come from in post-Covid food supply

businesses.

• None of the agriculture apprentices have been furloughed locally that we are aware of.

• New Anglia LEP will be rolling out a Morrisons apprentice levy share scheme in Norfolk and Suffolk.

• Generally apprenticeships are 75% down but not in the agricultural sector where numbers hold up. It

was warned that there will be a big impact if HMG doesn't fund apprenticeships next year.

• Suffolk New College is back up and open for certain activities; students are still to be assessed over

summer and the college has opened up in a very measured way, such as with very small group sizes.

• As unemployment rises, colleges are expecting to see increases in student numbers in the autumn, but

numbers will fluctuate according to availability of employment.

• Concerns exist around numbers of agriculture students for the coming year; marketing / exposure

opportunities such as Royal Norfolk and Suffolk Shows have not happened and colleges don’t expect to

see high numbers of agriculture students in the autumn.

• Suffolk New College has been undertaking community work such as donating PPE, selling plants for

NHS etc.

• School leavers haven’t got jobs to go into so UEA applications still high.

Public sector

• LEP, County and District Councils are all working on recovery planning, and maximising available

funding for businesses, including from pooled business rates. Issues for public sector include the need

to focus on innovation needed throughout supply chain, together with infrastructure; planning and

transport need to be fit for purpose, including energy and water, so that required growth is not

constrained by infrastructure.

• The sector is currently providing training grants, supporting recruitment. There is a considerable focus

on school, college and university leavers and their transition to employment challenges.

• IoT innovation network virtual will launch this summer; innovations from it will include measures to

help tackle rural crime.

• Looking at tech adoption and skills development in tourism and other sectors.

Shows and events

• RNAA Local Flavours event likely to happen over 2 days with timed appointments, social distancing,

potentially at the end of October. Royal Norfolk Show cancelled, and concerns about planning for

2021.

• Suffolk Show cancelled and Suffolk Skills and Careers Festival, planned for October has been

repurposed as a virtual event.

• On the 1st and 2nd of July there will be activities in lieu of the Royal Norfolk Show itself, including a

virtual Innovation Hub run by Agri-TechE.

• In July RNAA begin a series of drive in events including cinema, live music, comedy, and church.

• RNAA YIELD committee has organised some great evening Zoom meetings - helpful for those people

isolated in farming whose isolation has been exacerbated by CV-19.

4

New Anglia LEP: Approach to recovery. Response, Restart and

1055 - 1105

MC

Rebuild

NALEP focusing on support businesses, with three phases of dealing with the crisis:

1. Response: NALEP working closer than ever with businesses to support them. Programmes adapted to target

Covid support. Weekly intelligence reports sent to Government to inform and influence. The LEP website has

been expanded to include a Covid section, case studies on social distancing (including in food businesses) and

job vacancies. Have introduced new grant schemes as reported in the Council paper.

2. Restart - Initial restart plan being considered by LEP Board and County Councils this month, with input from

Council members and others from the sector. It covers actions in the next 12 months, and will evolve.

3. Rebuild - This has been a major economic shock and recovery will take time. A longer-term strategic

document will be published in due course with 3-5 year plans to rebuild the economy. This will build on the

Local Industrial Strategy and will be signed off by local partners and Government. The Council will have an

opportunity to help shape the plan and its interventions.

5

gri Food Sector ‘Voice’: Our approach to recovery and growth

1105 - 1130

ET

ALL

Emma Taylor, New Anglia LEP

Feedback and intelligence from Council members has been collated and sent to BEIS and Defra, and we have

feedback from Government that it has been very helpful.

As we move into recovery planning, Emma Taylor set out a proposal to develop a standalone regular report on

the agrifood sector specifically, to cover longer term intervention proposals and success stories. Council agreed

to input into these reports when drafts are circulated.

6

ANY OTHER BUSINESS; DATE OF NEXT MEETING

11.25

- 11.30

Chair

TUESDAY SEPTEMBER 15

TUESDAY DECEMBER 15

It was suggested that the Council meets again sooner than the proposed September date, and ET indicated that

a subgroup would be put together in the interim period to look more closely at developing the agrifood sector

response, as explained above.

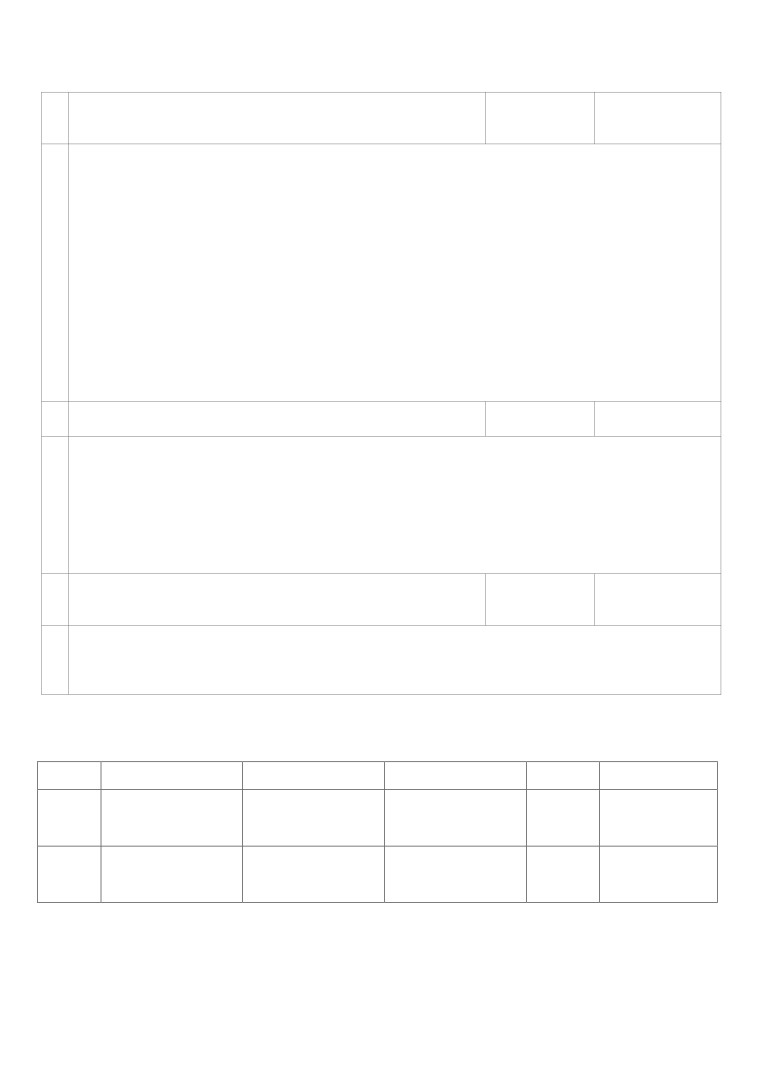

Actions from Norfolk & Suffolk Agri-Food Industry Council meetings

Date

Item

Action

Update

Actioned by

Target date

19/06/2020

Item 5: Agri Food Sector

Circulate draft report for

ET

By September meeting

‘Voice’͗ Our approach to

comment & input

recovery and growth

19/06/2020

AOB

Establish subgroup to develop

ET

By September meeting

agrifood sector response

further