DIGITAL TECH

A Skills Plan for New Anglia

November 2017

Page|1

Welcome to the Digital Tech Skills Plan for New Anglia. It sets

out our collective vision for how skills development can

support the growth of the Digital Tech sector, increasing local

competitiveness, supporting economic growth and building

high quality local careers in this high potential, globally-

influential dynamic sector. Consider this a ‘Green Paper’ for

further development by the sector into a roadmap or ‘White

Neil Miles

Paper’ over the coming months. Today I see this plan as the

TechEast Chair

first key step to enabling local collaboration to ensure

business growth and skills opportunities are maximised. We

look forward to businesses and education providers coming

even closer together to shape the future of a vibrant regional

tech economy in the East of England.

Contents

introduction ………………………………………………..…..……………… page 2

future priorities …………………………………………….……..…………… page 10

appendix A - Methodology ………………………………………….………. page 21

appendix B - Employment and Education Consultation ………….……… page 23

appendix C - Digital Tech Evidence Base …………………………………. page 27

The Digital Tech Skills Plan has been developed by the digital tech sector in Norfolk and Suffolk,

working alongside the New Anglia Local Enterprise Partnership, the New Anglia Skills Board and

supported by SkillsReach.

SkillsReach was contracted to facilitate and prepare eight sector skills plans for the New Anglia LEP

priority sectors. The project was commissioned by the Education and Skills Funding Agency, in

partnership with New Anglia LEP, and funded through the European Social Fund. Each Sector Skills

plan and supporting Data Pack has been developed in collaboration with local employers and other

stakeholders.

The Digital Tech Skills Plan has been developed in partnership with TechEast, the lead organisation

taking forward the further development and implementation of this plan in conjunction with New Anglia

LEP, local education institutions and other stakeholders and key sector champions.

The New Anglia Skills Board places employers at the centre of decision making on skills in Norfolk

and Suffolk to ensure the skills system becomes more responsive to the needs of employers, and the

future economy.

TechEast is the lead Digital Tech employer group for New Anglia, and aims to accelerate the growth

of the digital economy, creating a further 5,000 jobs across the East (including Cambridge),

generating an extra £650M GVA of economic growth, establishing the area as one of the UK’s top 5

Tech Clusters.

SkillsReach is an established East of England-based strategic skills consultancy with an associate

project team with extensive experience of developing skills plans.

Page|2

introduction

Overview

To ensure that the New Anglia Digital Tech sector maximises its

potential for business and the wider economy and community,

TechEast and our partners share the following ambition:

Ensuring that our local skills infrastructure enables sector growth,

supporting the take-up of 10,000 jobs, through an expanding, diverse

pipeline of talent and best in class in-career development.

The New Anglia Local Enterprise Partnership has prioritised the Digital Tech Sector as one of five

high impact sectors with the greatest opportunity for economic growth within its Strategic

Economic Plan (SEP) published in 20141. The SEP sets out major economic targets to be achieved

by 2026, including a net increase of 95,000 new jobs, 10,000 new businesses and an overall increase

in regional productivity from £36,000 to £40,000 by Gross Value Added (GVA). This plan identifies

the need for the Digital Tech sector to respond to replacement and expansion demands of

approximately 6,000 vacancies by 2024, principally at graduate and post graduate levels, plus

the TechEast sector growth aspiration to create an additional 4,000 jobs in New Anglia by

2024.

Nationally, the 2017 TechNation Report2 highlights that the Digital Economy is growing twice as fast

as the wider economy, with an economic output of approximately £100 billion per year. The Digital

Tech sector has been placed in the centre ground of driving UK competitiveness, with the emerging

Industrial Strategy and the emerging UK Digital Strategy. It is recognised as a sector that is a driver

for innovation and economic growth and an enabler for a digitally fluent, more resilient economy.

Pivotal to national developments for the sector is the role of business in guiding the planning and

delivery of the skills development that is critically important for a globally competitive market.

New Anglia’s Digital Tech sector is diverse and productive, with a total employment base of 16,600,

up nine per cent since 2010, and a GVA of around £1.3bn. Employment opportunities in the region

are increasingly requiring higher skills, creating even greater demand for qualifications at degree level

and above. As well as businesses that self-define as Digital Tech, this plan recognises Digital

Tech professionals employed across all sectors in the area. There is an expanding digital

economy across New Anglia, involving marketing, finance, public services and tourism, and

recruitment opportunities for digital workers with transferable digital skills are set to accelerate

1 New Anglia LEP Strategic Economic Plan (2014), New Anglia LEP

2 TechNation 2017, TechCity

Page|3

according to replacement demand forecasts. Also, there is significant demand for competencies

across marketing and sales within a Digital Tech environment and this is set to increase.

In compiling this Skills Plan, detailed consultation with employer groups, education and other

stakeholders, including rural economy groups, Local Authority economic development and current

European Social Fund skills providers, has focused on three key themes:

• Skills gaps and barriers

• Perception of skills supply

• Employer leadership

Based on feedback from these groups, six key needs for the Digital Tech sector have been

identified:

• Fill gaps in skills provision

• Meet growing demand for higher level qualifications

• Tackle graduate talent migration

• Build industrial partnerships

• Promote careers within schools

• Combine resources and grow investment

In addition, three priorities have been identified as having the most potential to support the ambitions

of the SEP and deliver the ambitions for growth in the regional digital economy:

• Local employer skills leadership, in partnership with education and skills stakeholders

• New and Broader Talent Pipelines

• In-career learning and development

The priorities are developed within the plan into an outline implementation schedule which

incorporates practical tactical objectives alongside more strategic longer term wins.

In identifying the relationship between skills and acceleration of the sector’s competitiveness, two key

impact categories have been defined, against which the plan’s priorities and action plan have been

indexed. These are:

• Increasing Digital Tech Competitiveness Nationally

• Growing Digital Tech Economy Jobs, Businesses, and Value

Embedding employer ownership in goal setting

The Digital Tech skills plan aims to address key goals to support the economic development

priorities of the New Anglia Local Enterprise Partnership.

First and foremost, the plan aims to represent the views of the Digital Tech industry and

build a series of priorities that enable the sector to lead and take ownership of skills

requirements. The plan summarises the importance of building a responsive skills market

that is adaptive to the demands of industry, as a way of driving competitiveness. Central to

this is the reform of skills policy and delivery itself, with employers at the centre, articulating

the standards they expect to see within their industries, which will define training and

qualification outcomes. Industrial partnerships between public agencies, educational

Page|4

institutes and employers is a further key element. The aspiration is to create a future-

proofed skills partnership, able to drive national and local investment, to act as a catalyst

in driving excellence in training and to deliver added value through a responsive and ‘skills in

demand’ approach.

The plan aims to support the overall strategic development of New Anglia’s skills system.

The area’s further and higher education institutions and training community are key assets

for all sectors in the region and the education sector already demonstrates a range of

cutting-edge activity. Through the Digital Tech skills plan, the aim is to demonstrate how

priorities developed in consultation can amplify such innovation, with the intention of

achieving greater access, greater coordination and value for employers across all

sectors.

The plan aims to complement existing strategic skills development activity locally. The

focus on employer leadership aligns with opportunities for public and private sector co-

investment and with the LEP’s strategic focus on enterprise across schools, colleges and

universities. The plan also recognises the role of the New Anglia Skills Board and its key

priorities for equipping young people for success, workforce development and increasing the

overall growth in employment for the area.

Sector Value, Employment and Skills

The Digital Tech sector is an important economic engine for the New Anglia area. It

demands a highly skilled and talented labour supply, with higher than average wage

earnings and significant GVA output, indicating a productive industry that can

stimulate the retention of economic value in the local area.

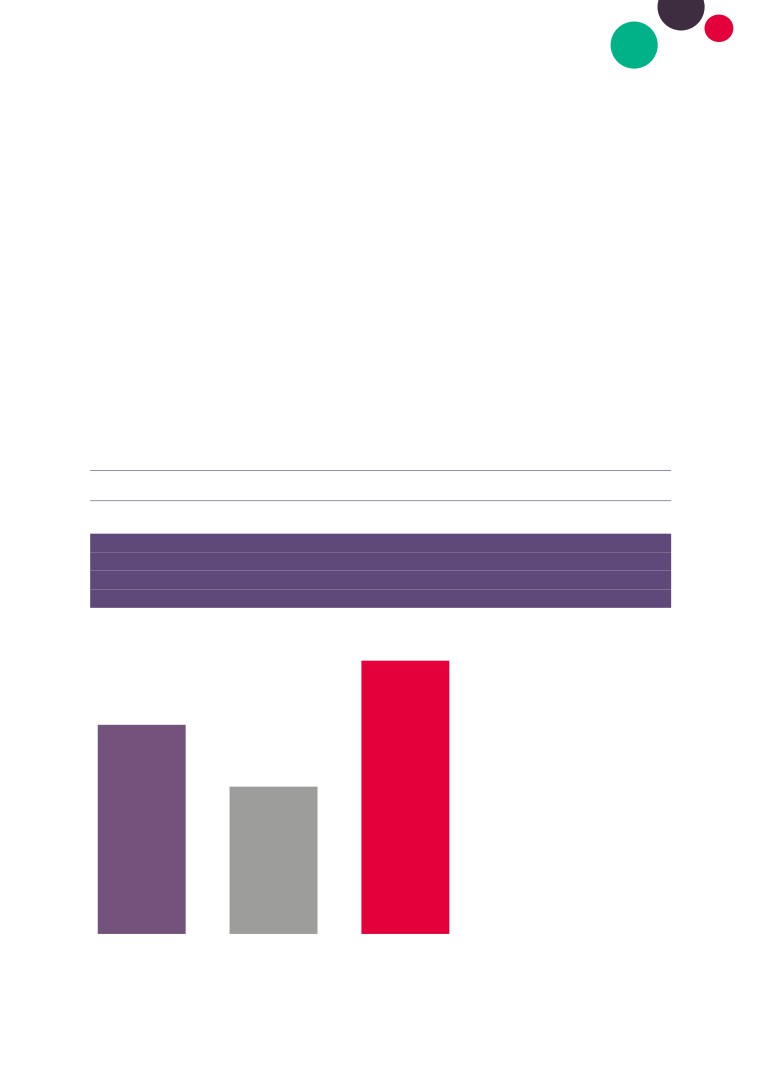

e Digital Tech sector contributes

The Digital Tech sector’s contribution to

arly 4 per cent of total economic

4.7%

the New Anglia economy

ue (Gross Value Added or

A) generated, which is around

3bn of the £35.5bn generated

the New Anglia economy in

3.6%

15.

arly 5 per cent of businesses,

er 3,400 of the 72,900

2.5%

sinesses in New Anglia, are

ital Tech businesses.

ployment in the sector (as

asured by the employment

vided by Digital Tech

sinesses) stands at just under

000, or 2.5 per cent of total

ployment in the area. This

GVA

Employment

Businesses

ns well with the job numbers in

Page|5

Ipswich and Norwich identified by the TechNation16 report (as per the

image left). If we take a slightly wider measure of the sector

(using Standard Occupational Classification codes identified in

the TechNation report), and estimate for Digital Tech jobs in

traditional industries as well, then this employment figure

rises further to an estimated 24,000.

Cambridge

Average wages across all employees (both full-

Norwich

time and part-time) in the sector nationally

18,532 jobs

stand at just over £39,000pa in 2016. This is

5,306 jobs

around a six per cent increase on 2014 wage

levels. Wages range from £69,000pa for IT &

telecoms directors to nearly £27,000pa for IT

engineers.

Ipswich

Total average wages across New Anglia are

9,981 jobs

around 10 per cent lower than nationally, and

given that consultation with sector stakeholders

revealed that the pull of higher wages elsewhere

was a barrier to attracting and retaining talent, then

there is little to suggest that the Digital Tech sector is

immune from this effect. This would put average wages for the Digital Tech sector in New Anglia at

around £35,000pa. However, this is still considerably higher (c66%) than the average wage across all

sectors in New Anglia of around £21,000pa.

Forecasts suggest that employment levels within the New Anglia Digital Tech sector are set to remain

steady between now and 2024. However, this does not take into account TechEast’s original target of

5,000 new jobs created and the associated activity taking place to achieve it. Further to and

supporting this endeavour will be the intervention of the New Anglia Local Enterprise Partnership and

its identification of the Digital Tech sector as ‘high-performing’ and therefore integral to its delivery of

95,000 new jobs across the New Anglia area.

The TechEast target of 5,000 jobs includes job creation in Cambridge. If we break this target down,

t

No Qual

17%

to

No Qual

17%

13%

QCF 1

QCF 2

44%

59%

QCF 3

16%

No Qual

No Qual

17%

13%

QCF 1

QCF 2

44%

59%

QCF 3

6%

b

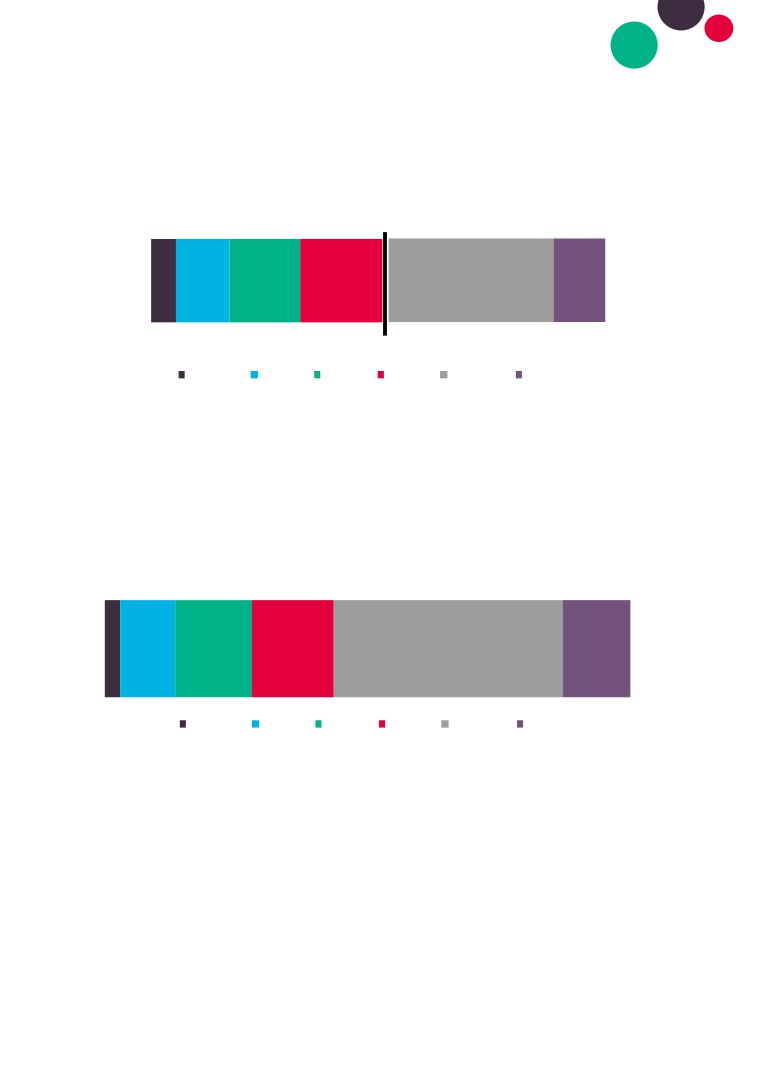

Job creation and loss by qualification level to 2024 (Expansion Demand)

000

10%

15%

16%

44%

13%

No Qual QCF 1

QCF 2

QCF 3

QCF 4-6

QCF 7-8

vast majority of new opportunities will be at a higher level. Again, people already working in the sector

will be able to fill some of these posts (e.g. through up-skilling), but this in itself creates the

requirement for further backfilling down the skills/job chain. Equally, not all the posts required will be

high level with some continuing demand for lower / intermediate positions.

Latest figures in New Anglia (2014/15) suggest approximately 280 Digital Tech sector apprenticeships

starts which constitute around 1.7 per cent of the total sector workforce. The large majority of these

apprenticeships are at lower qualification levels suggesting that these will make a significant

contribution to replacement demand at lower levels, but will not currently enable the sector to respond

to the higher skills challenges.

Page|7

Levels of student/graduate retention in New Anglia, and the relatively small numbers of higher level

apprenticeships in the area, mean that the challenge for the sector is concentrated in filling those

higher level roles that will come open or be created in the future, placing a significant emphasis on up-

skilling the current workforce. The Apprenticeship Levy and the emerging higher / degree

apprenticeships may create a new impetus for higher skilled recruitment and up-skilling, although

Digital Tech employers have articulated that they remain focussed on the challenge of recruiting and

retaining recent graduates.

Taking into account these factors of expansion and replacement demand, and the

TechEast target for job creation; in total the overall jobs challenge for the sector is to

fill 10,000 posts.

Sector Activity

In close proximity to two of the most

important tech clusters in the world

(London and Cambridge), the New

Anglia region of Norfolk and Suffolk

has a distinctive tech economy,

primarily B2B/enterprise-oriented but

with a significant number of B2C

businesses.

Source: TechEast

The data analysis shows that Digital

Tech businesses are widely spread

across New Anglia, with two main

spatial clusters, in Norwich and

Greater Ipswich. Furthermore

ICT/Digital is recognised in New

Anglia as a key enabler by other

high growth sectors including

Agritech, Cleantech, Life Sciences

and Advanced Manufacturing /

Engineering with exciting

developments such as the Internet

of Things (IoT) and Big Data. The

skills strategy will reflect the needs

for underpinning digital technology

in those priority markets and

industries.

Source: East of England Science and

Innovation Audit 2017

Page|8

Important Digital Tech spatial business clusters : Adastral Park, Suffolk

Adastral Park includes BT’s global research centre, employing approximately 3,500. This has been an

important catalyst in attracting telecommunication and hardware/software development enterprises,

with over 50 other companies located at Adastral Park.

Businesses play an important role as primary suppliers to BT (CISCO, ALCATEL) and benefit from

increased market opportunities due to proximity to BT and its related supply chain activity (KCOM,

Cisco, Huawei).

Alongside there is business incubation and support through Innovation Martlesham, which has

attracted SMEs and start ups and now houses home-grown Digital Tech businesses such as Silicon

Safe and InnStyle.

The University of Suffolk has been central to the Smart Anglia business partnership that has seen the

development of the Ipswich Waterfront Innovation Centre and works closely with Suffolk New College

for the delivery of STEM based qualifications and in the provision of apprenticeship training to BT.

Meanwhile West Suffolk College is increasingly engaged with globally recognised brands such as

ARM in apprenticeshp training.

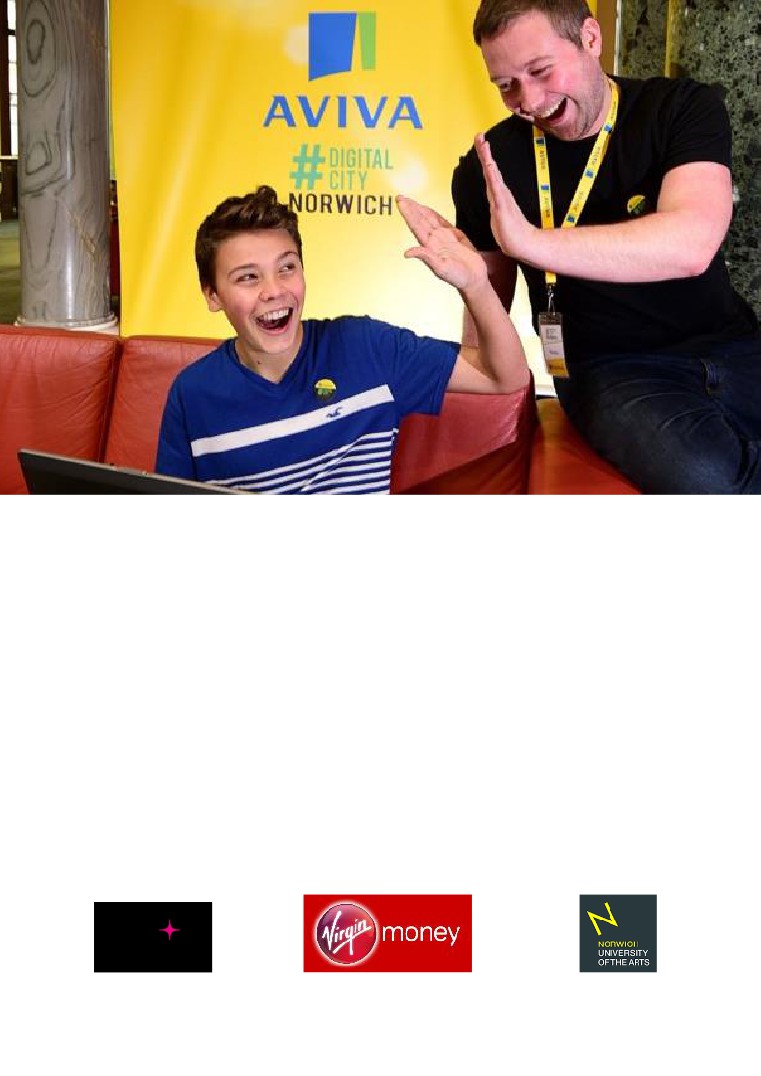

Important Digital Tech spatial business clusters : Norwich’s Digital and Creative

cluster

Norwich features a growing and nationally significant digital cluster, with specialisms in digital creative, gaming

and app development, digital advertising and marketing. Notable home-grown success stories include Epos

Now, Proxama, Brandbank and Rainbird.

University of East Anglia (UEA) and Norwich University of the Arts (NUA) are key to the output of talent for the

Norwich area. UEA ranked consistently in the Top 20 UK universities, has global pull with students drawn to

specialisms that include computing science; computer systems engineering; business information systems;

computer graphics, imaging and multimedia; data mining; engineering and environmental science. NUA is

gaining national recognition for its UX - user experience - digital design courses. There is major demand for UX

standard skills across both digital creative primary industries, such as web and software design, and in customer

experience in the broader digital economy. UEA and NUA have also developed partnerships with AVIVA and

Virgin Money to respond to the digital demands of the FinTech finance sector and support SMEs within the local

tech networking groups.

SyncNorwich, now in its fifth year has a membership of over 1,300 members and provides a vibrant networking

programme that supports business start-up, business development and ongoing good practice sharing for the

local technology community. Other networking groups include Norfolk Developers, SyncDevelopHer, Hotsource,

Norfolk Data Science, Norfolk Games Developers and Digital East Anglia.

Main picture: Digital City 2016. 15 year old Hellesdon High School student Andy Moncur with Aviva digital software engineer Jamie McLeod. Picture: ANTONY KELLY.

Reproduced from EDP

P a g e | 10

Snapshot

DEVELOPING THE SKILLS PLAN

THROUGH COOPERATION AND AN EMPLOYER-LED PARTNERSHIP

DIGITAL

L

TECH

TECH

Skills

E

SKILLS

Board

EAST

P

PLAN

NEW ANGLIA LOCAL

DIGITAL TECHNOLOGY

ENTERPRISE

BUSINESS-LED

SECTOR

PARTNERSHIP and NEW

PARTNERSHIP

ANGLIA SKILLS BOARD

REALISING

Sector Lead

COMPETITIVE

ADVANTAGE, LOCAL

As part of the East of England region, Norfolk and

OPPORTUNITIES AND

Suffolk have worked alongside Cambridge to launch

ECONOMIC GROWTH

the Cambridge Norwich Tech Corridor, which has a

THROUGH BEST

vision to be a destination of choice for global

SKILLS INVESTMENT

technology by 2031, that includes engineering, agri-

tech and digital companies.3

FOR DIGITAL TECH IN

NEW ANGLIA

Supporting the region

overall, TechEast, a

business-led partnership

that draws in key

stakeholders from local companies, business support organisations and the Universities, was formed

in 2016 to promote New Anglia and the broader East of England Digital Tech economy. TechEast is

a primary stakeholder in the development of the region’s Digital Tech Skills priorities and its vision is

for New Anglia to be recognised as one of the 5 top tech clusters in the UK.

Given the paramount importance of developing effective business leadership and

ownership of the sector’s skills priorities, TechEast is ideally placed to be the lead

partner across New Anglia for Digital Tech Skills.

3 Leading Growth in the UK for Science, Innovation and Enterprise, Cambridge Norwich Tech Corridor (2016)

P a g e | 11

future priorities

OVERVIEW

Key needs identified during research and consultation and their fit with the three

sector priorities (P1 - Local employer skills leadership; P2 - New and Broader Talent

Pipelines; P3 - In-career learning and development):

Meet growing

Fill gaps in skills

demand for higher

provision

level qualifications

P2

&3

Tackle graduate

Build industrial

talent migration

partnerships

P1

Combine

Promote careers

P2

resources and

within schools

grow investment

Key impact categories:

GROW

INCREASE

THE DIGITAL

DIGITAL TECH

TECH ECONOMY

COMPETITIVENESS

P a g e | 12

To ensure that the New Anglia Digital Tech sector maximises its

potential for business and the wider economy and community,

TechEast and our partners share the following ambition:

Ensuring that our local skills infrastructure enables sector growth,

supporting the take-up of 10,000 jobs, through an expanding, diverse

pipeline of talent and best in class in-career development.

TARGETING THE PRIORITIES

Pinpointing the areas that will deliver a major contribution to growth of the sector

1

2

3

PRIORITY ONE

PRIORITY TWO

PRIORITY THREE

Local Employer Skills

New and broader talent

In-career learning and

Leadership

pipelines

development

What the goal is

Develop closer collaboration

Stimulate the pipeline of talent for

Ensure existing sector employees

between Digital Tech sector

the sector to overcome skills

are competent, enterprising,

business and skills providers to

shortages in higher technical and

adaptable and able to apply leading

improve the responsiveness,

management skills; create

edge solutions in a rapidly changing

accessibility and value of skills

alternative pathways for graduate-

industry through effective

outcomes for local employers and

level talent and raise awareness

coordination of bespoke in-career

residents

in schools of sector career

technical and professional learning

choices

and development

What success looks like

New Digital Skills Task Force to

Sector has access to sufficient,

A dynamic, local learning and

develop investment and excellence

diverse talent to fulfil employer

enterprise development environment

in the sector's skills offer, articulating

business growth aspirations,

facilitating high quality continuing

and responding to employer needs

attract talent from elsewhere and

technical and general professional

and maximising opportunities for

provide exciting opportunities for

development for the specialist and

New Anglia's residents

residents

wider business community

Where it will have impact

Increasing Digital Tech

Increasing Digital Tech

Growing Digital Tech

Competitiveness Nationally

Competitiveness

Economy Jobs,

Nationally

Businesses, and Value

Growing Digital Tech

Economy Jobs,

Businesses, and Value

P a g e | 13

Priority 1 : Local Employer Skills Leadership

Growing Digital Tech Competitiveness and the Digital Economy

Effective business leadership and ownership of the sector’s skills priorities is vital. TechEast, working

with the New Anglia Skills Board, would be ideally placed to be the lead partnership across New

Anglia for Digital Tech Skills. Central to this role is strategic responsibility for leveraging public and

private sector resources for the sector. The outcome of the recent East of England Science and

Innovation Audit will bring further impetus to developments locally.

The development of the skills plan has highlighted strong examples of how FE and HE are developing

cutting edge and employer-facing skills and qualification activity for the sector. However, the

interaction between businesses and skills providers is mixed and there is a perception that the overall

offer does not fully meet the demands of industry. New Anglia’s skills providers and universities

should therefore be supported by TechEast, to develop closer collaboration to improve the

responsiveness, accessibility and value of skills outcomes for local employers.

OBJECTIVE - Create a new Digital Tech Skills Task Force, led by TechEast, to articulate

and respond to the sector’s skills needs. The Skills Task Force should aim to maximise

the investment in skills development for the sector by leveraging resources from public

and private investment, leading to the development of a world class digital skills offer

for New Anglia’s businesses and residents.

ACTIONS

TechEast to establish a Skills Task Force as a sub-committee to the main TechEast Board,

with a recommended focus on establishing direct relationships with government on the new Industrial

Strategy and the emerging national Digital Partnership. A key output from the Task Force should be

a Digital Tech Skills Investment Strategy, including an assessment of relevant national skills

investment opportunities and identifying opportunities to collaborate with local partners such

as universities and FE Colleges to develop compelling funding proposals.

TechEast to lead the development of a Digital Tech Skills Observatory, which can support

the Digital Tech Skills Task Force. The Observatory should be developed in partnership with

national stakeholders, New Anglia’s HEIs, FE, the lead independent training stakeholder and

business partnership members. The Digital Tech Skills Observatory would establish the key skills

demands and gaps in New Anglia’s digital industry and develop mechanisms to regularly plan and

review the dissemination of key information for skills providers, careers stakeholders and Digital

Tech business networks.

TechEast should proactively build collaborative relationships with HEIs and FE (and

through to schools) across New Anglia to ensure effective channels for communicating employer-

led skills development and to ensure effective coordination of national investment opportunities.

P a g e | 14

OBJECTIVE - Improve the standard and impact of technical digital skills through

greater collaboration amongst employers to define and share skills solutions, working

in partnership with New Anglia’s skills institutions.

ACTIONS

New Anglia Skills Board and TechEast to work together to identify how the reform of

apprenticeships - the Levy, Standards and Higher-Degree level pathways - can stimulate an

enhanced, more diverse and sustainable local Digital Tech skills supply. TechEast to be

supported in leading a Skills Reform action plan that can align the high demand occupational areas

(as identified through the skills plan and ongoing role of the recommended Skills Observatory) with

updated skills standards and clear vocational pathways.

Prepare a Post-16 Digital Tech Skills Prospectus in consultation with the New Anglia FE

group and the New Anglia independent training group. Ensure the Prospectus supports key high-

impact Digital Tech occupational skill requirements and the general development of digital skills

across the New Anglia economy. The prospectus could provide ‘one-stop shop’ access to the high

quality courses available to prospective industry entrants and existing workers seeking professional

development. It will provide an invaluable resource for employers, schools, workers, young people,

and parents.

P a g e | 15

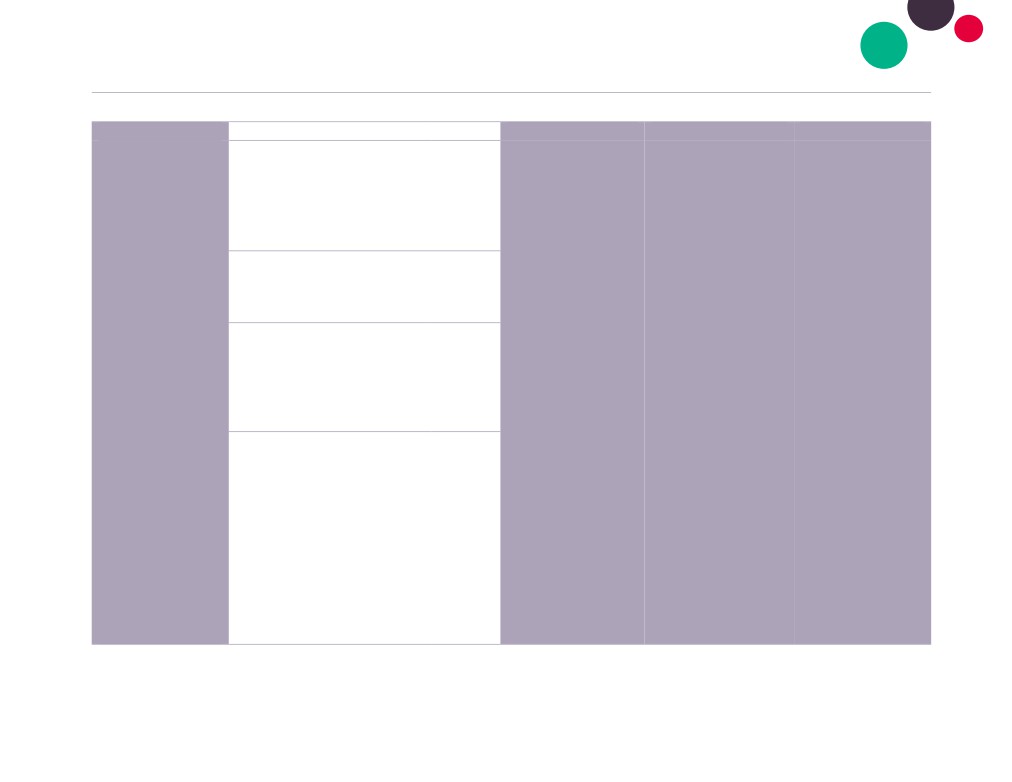

Priority 1 : Local Employer Skills Leadership : Implementation Plan

How we stand Action (Short / Medium term) Align

Outputs

Added Value

Goal

High performing sector

Establishment of a Digital

with scope to grow

NASB

Tech Skills Taskforce (DTST)

as sub group of Tech East

Board

Two nationally

significant sector

clusters

Establishment of a Digital Skills

NASB

Observatory remit for DTST

Lack of clear employer

A new cohesive,

New partnership

leadership in local

Taskforce established,

partnership skills voice for

articulating and

sector skills

Ensure effective

with clear brief and

the Digital Tech sector,

responding to employer

representation on DTST

representative

NASM

which can engage with

skills needs taking

(HEIs/FE/Schools/Other

engagement of business,

national strategic

opportunities for New

stakeholders)

education and other

opportunities for

Anglia residents into full

Lack of connectivity

stakeholders

investment

account

with Schools and

Further Education

Lead on joint review / development

of sector bespoke skills provision;

exploring potential for a Digital Tech

TechEast

prospectus that reaches out beyond

acknowledged as key

NASB

the two identified clusters to

Digital Tech employer

encompass businesses across New

sector body

Anglia including those for whom

Digital Tech is a key growth enabler

e.g. Advanced Manufacturing

HEIs of national renown

for this sector

Key: NASB: New Anglia Skills Board, NASM: New Anglia Skills Manifesto

P a g e | 16

Priority 2 : New and Broader Talent Pipelines

Growing Digital Tech Competitiveness

The skills plan consultation has highlighted a heavy and increasing reliance on graduate skills, with a

particular target of graduates with approximately two years’ post-graduation experience. There is

some evidence of employers engaging with interns and work experience that leads to permanent

employment, but overall the talent pipeline for the sector is limited. Apprenticeship provision today

plays only a minor role in Digital Tech recruitment and upskilling strategies, with numbers

being maintained, but not increasing despite a high public profile and the introduction of a

Levy.

There are skills shortages in higher technical and management skills and alternative pathways need

to be created to establish new pipelines of experienced graduate-level talent, for example through

Higher and Degree Apprenticeships, to expand the current talent pool and build on the traditional

graduate route. There is also some evidence nationally of a gender imbalance in some Digital Tech

occupations. The importance of stimulating effective career choice for entry into the sector through

schools is significant, given the replacement and growth demands identified in this analysis.

OBJECTIVE - To raise the overall profile of the Digital Tech sector across New Anglia

and establish an overarching Digital Talent Attraction Strategy to attract fresh talent

and respond to the projected high skills growth forecast for the sector.

ACTIONS

Develop a shared portal to promote the New Anglia Digital Tech sector, its

opportunities/vacancies, challenge stereotypes and inspire career entrants. Ensure place-marketing

for New Anglia has a specific focus on the Digital Tech sector, its unique infrastructure and the

careers/skills opportunities it offers.

Assess the feasibility of implementing a shared skills service for coordinating the delivery of

apprenticeship and internship/work experience activities based on occupationally critical areas

identified by the Digital Skills Task Force (including jobs brokerage and apprenticeship training

agency type services). The shared skills service would focus on the high impact roles that will drive

growth and innovation overall for the sector.

Engage with national developments aimed at creating a new Digital Partnership to raise the

profile of New Anglia Digital Tech jobs with older, skilled, talent from other parts of the UK and build

on local and regional activity, such as the East prospectus;

P a g e | 17

OBJECTIVE - To improve the aspiration of younger people to access careers within

the Digital Tech sector across New Anglia and increase their employability.

ACTION

Build connectivity with FE and Schools to increase the number of 16-18 year old career

entrants, with a focus on the emerging strategy for developing technical and coding skills within

classrooms. Engage with the Careers Enterprise Company via its devolved LEP-wide activities to

ensure coordinated, employer-sponsored, Digital Enterprise initiatives are effectively delivered

across secondary and further education. Explore the potential to build on work already being

P a g e | 18

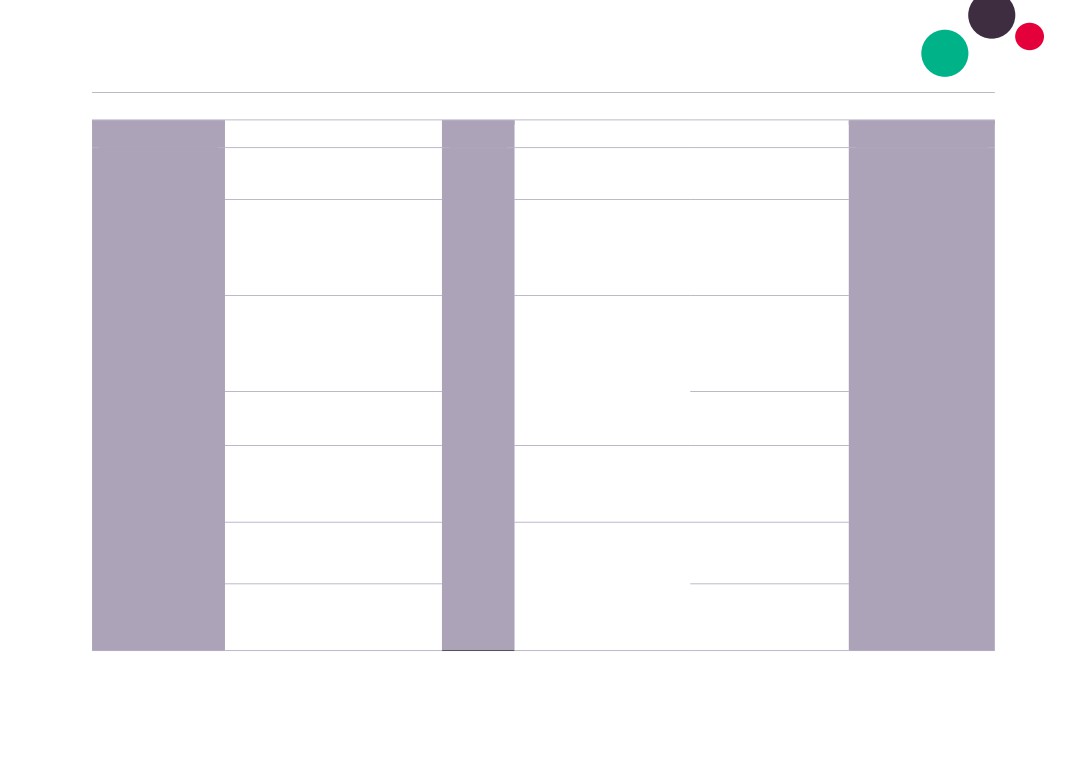

Priority 2 : New and Broader Talent Pipelines : Implementation Plan

How we stand

Action (Short / Medium term)

Align

Outputs

Added Value

Goal

Further quantitative research

Evidence will move from

Survey of the TechEast network

on the skills sets that matter to

being anecdotal to

employers

directional

Heavy reliance on new

and recent graduate

Establish a shared portal that can build

Coordinated, inspiring sector

Increase in numbers of local

recruitment

on existing activity, which promotes the

careers and skills showcase for

people inspired by a career

Digital Tech sector, its opportunities /

employers, current and future

/ job in New Anglia Digital

vacancies, challenging stereotypes and

workers, education, careers,

Tech and the diversity of

inspires potential career entrants

NASM

other stakeholders

that talent

Skills shortages in

higher technical and

Develop and optimise undergraduate

management skills

connections with the New Anglia Digital

Sector has access to

Undergraduates inspired by

Tech sector e.g. placements and

NASD

sufficient, diverse talent

Significant increase in number

local exciting Digital Tech

innovative curriculum developments

to fulfil employer

and diversity of local

opportunities

such as Computing Modules for non-

business growth

Lack of alternative

Under/Graduate programmes

supply to graduate

Digital Tech courses

and support

aspirations; and raising

A

entrants

the bar to attract talent

Increased depth and

Digital Tech Graduate Internship

from elsewhere as well

breadth of local graduate

programmes

as providing exciting

talent pool

I

opportunities for

Evidence of age and

Extended Apprenticeship provision

Significant increase in

residents

gender stereotyping in

especially new pathways through to

availability and take-up of

New talent pipelines

some Digital Tech

Degree/Post-graduate Level in areas

Digital Tech Apprenticeships

established

occupations

such as Big Data Analytics

EL

from Level 3 through to Level 7

Broader source of

Attraction of older skilled people from

Innovative employer-led

applicants for hard to fill

Slow progress with

other parts of UK

careers and job campaigns

vacancies

new apprenticeship

including demystification of

models

apprenticeships to attract

Build connectivity with FE and

New Anglia Digital Tech

widest talent pool

Schools for 18-year-old career

opportunities understood /

entrants

valued locally and beyond

Key: NASB: New Anglia Skills Board, NASM: New Anglia Skills Manifesto, NASD: New Anglia Skills Deal, A: Apprenticeships, I: icanbea…, EL: Emerging Leaders Programme

Priority 3 : In-career Learning and Development

Growing a Digital Economy

Feedback from stakeholders has highlighted that skills needs for the sector are often too specialised

and contemporary for the traditional skills funding system, and for the future there needs to be a

greater alignment between the skills offer and local skills needs. There are excellent examples of how

Digital Tech competency planning and development is being delivered by New Anglia’s HEIs, and this

provides the opportunity to align undergraduate, postgraduate and professional competency

development.

In addition, employers have emphasised the importance of developing competent and enterprising

employees that are adaptable and able to apply solutions in a rapidly changing industry. Larger

employers and SMEs both value in-career learning and continuing professional development as a

route to improving productivity in their workforce and to demonstrate value and attract prospective

new talent. There are excellent examples of such initiatives, many of which have the potential to

provide shared learning from existing resources, where employers are prepared to collaborate for

mutual benefit.

There is little evidence, however, of effective coordination of in-career development across the area.

The data analysis shows that businesses are widely spread across the New Anglia, despite the

spatial clusters in Norwich and Ipswich, which raises issues about accessibility. A joint approach

towards in-career development, bespoke for Digital Tech and promoted broadly, could help increase

talent and retain workers. Such a strategy can play a pivotal role in driving the growth of the

overall digital economy across New Anglia’s other key sectors.

OBJECTIVE - Develop an overarching In-Career Development Framework for the

Digital Tech sector, which incorporates employer-defined key competencies to

support pre-employment and builds on existing industry best practice CPD systems.

ACTIONS

Encourage a New Anglia Digital Tech culture of continuous improvement for in-career

development, incorporating local informal learning, professional assessment, CPD and with

specialisms in each cluster designed to benefit business across New Anglia

Explore opportunities for sharing learning and models in the untapped potential of current in-

career development by employers

Explore the potential for shared public/private investment in a nationally renowned professional

development infrastructure, which could include leading initiatives incorporating open-source and

other industry sponsored learning resources e.g. MOOCs

Establish connectivity between the local Digital Tech sector and the wider New Anglia and

SME community through common development needs

P a g e | 20

Priority 3 : In-career Learning and Development : Implementation Plan

How we stand

Action (Short / Medium term)

Align

Outputs

Added Value

Goal

Skills needs often too

Establish a New Anglia Digital Tech

specialist and

workplace learning infrastructure for in-

Locally-led opportunities

contemporary for

career development including informal

Substantial increase in

increasing accessibility, local

traditional funded skills

learning, CPD and professional

locally-designed, led and

relevance, reducing travel time

NASD

system

assessment with specialisms in each

delivered CPD and

and contributing to a developing

cluster to benefit businesses across

assessment opportunities

reputation as a ‘place’ for

New Anglia. Explore opportunities for

learning and professional

A dynamic, local learning

collaboration between larger employers

development

and enterprise

Technical skills

and the broader business community

development

assessment and

environment that is part

support not locally

of the New Anglia Digital

available

Consider a co-investment

Offer facilitating high

Explore the potential for shared public /

financing model to attract

quality continuing

private investment in a nationally

NASD

Significant co-investment from

funding investment which

technical and general

renowned professional development

private and public sectors

may include

professional development

Businesses are spread

infrastructure

Apprenticeship Levy funds

for both clusters; Digital

evenly across New

Tech businesses across

Anglia despite

New Anglia and other

workforce

non-specialist businesses

concentrations in each

Establish the connectivity

seeking digital

cluster

between local Digital Tech sector

Pilot of a skills offer

New, local opportunities for local

development support

expertise (perhaps through the

targeted at non-Digital

businesses to develop their

globally-positioned largest

NASD

Tech sector SMEs seeking

digital capacity locally, perhaps

businesses initially) and the

business growth through

through a digital competency

Opportunities to

digital development

approach

support up-skilling

needs of the wider economy for

through Apprenticeship

digital development support

Levy / higher and

degree apprenticeships

Key: NASB: New Anglia Skills Board, NASM: New Anglia Skills Manifesto, NASD: New Anglia Skills Deal

P a g e | 21

appendix A

Methodology

The Digital Tech sector skills plan has been developed to support the New Anglia Local Enterprise

Partnership and its partners in identifying the role that skills can play in developing a competitive and

sustainable local economy.

Underpinning the skills plan is an assessment of how skills can help promote economic development

for New Anglia and raise competitive advantage for the Digital Tech sector. Therefore, the context for

the plan involves understanding how the sector is structured - its spatial and industrial clustering and

how its relevant markets are developing.

Defining skills

• The scope of the plan is on the existing supply of skills within New Anglia and how the supply

meets the needs of Digital Tech employers, including the supply of vocational and academic

qualifications across secondary, further and higher education and of independently-provided

technical and non-technical training.

• Skills are defined in the context of employer demands for access to a competent labour

supply. The plan therefore identifies the importance of employability skills, such as aptitude

and capability, for enterprises and how these demands can be delivered so that businesses

within the sector have an adaptive and competitive workforce.

• In considering skills across the digital economy, the plan recognises the increasing

importance played by digitally-capable roles in other traditional employment sectors of

importance to New Anglia, such as public services, finance and tourism.

• The skills plan addresses strategic structural skills issues, such that may increase:

o the effectiveness of those providing skills services;

o the investment made nationally in building a world-class skills infrastructure;

o the leadership that employers can develop by articulating and taking ownership of

their future skills needs.

Evidence and intelligence

Throughout, the plan aims to be evidence-based and to reflect on existing policy and research. The

research methodology involves qualitative analysis, through employer consultation focus groups

and semi-structured stakeholder interviews, together with a detailed quantitative assessment of

labour market and economic data, contained within a separate Data Pack.

The Data Pack has been structured to complement the main stages of defining and evidencing the

priorities for the skills plan. It builds on existing intelligence previously commissioned by the New

Anglia Local Enterprise Partnership and nationally defined frameworks including the TechNation

methodology and the Department for Culture, Media and Sport.

Previous research has included a review of Digital Tech sub-sectors4, namely Gaming, Animation and

Digital Creative, Smart Energy and Big Data, as well as overall sector mapping work conducted and

developed through a Task and Finish Group development plan led by the IP Network and more

recently TechEast.

Building on this previous work, the development of the skills plan has involved several key stages:

• An inception meeting with TechEast representatives, New Anglia LEP, Norfolk and Suffolk

County Councils and business representatives. Followed with ongoing planning engagement

with the TechEast Board and its representatives

• Two task and finish group meetings with business representatives based in Ipswich and

Norfolk

• Semi-structured interviews with Further Education, Higher Education and the representative

of New Anglia’s Independent Learning Provider consortium

• A skills strategy and funding review based on national policy developments, key reports and

New Anglia Local Enterprise Partnership’s strategic skills activity

• Crosscutting discussions with other stakeholders including rural economy groups, Local

Authority Economic Development officers and current ESF skills providers

• Review/approval gateways with the TechEast and New Anglia LEP Skills Boards

4 Mapping the ICT Sector in New Anglia (2015), Regeneris

appendix B

Employer Consultation

An inception meeting and two employer consultation focus groups were held to capture the main

views from a range of employers. The focus groups were invited to assess and feedback on the three

themes established for the research, in a semi-structured format which also enabled broader

employer input.

•

Skills gaps and barriers

•

Perception of skills supply

•

Employer leadership

Skills Gaps & Barriers

SMEs within the industry often feel they lack the resources to engage with apprenticeships and/or

take on Level 3-equivalent qualified staff and develop them to a degree-equivalent level

The migration of graduates out of the area is causing an overreliance on contractors, who are

expensive and transitory

Software engineering is increasingly overlooked as a profession, with cloud-based development and

transitioning, multiplication software design and AWS capability increasingly suffering from a

shortage in skills supply

Software application development for mobile solutions are particularly important for the digital

creative industry

Technical design skills with a focus on digital capability (not graphic design) are in high demand for

SMEs and larger employers in other sectors reliant on digital channels to drive their product/service

offering

Concerns that the quality of skills supply and the migration of talent was wrapped up in a larger issue

of whether New Anglia is a desired destination and has a sense of place, and hence whether place-

marketing should do more to highlight the depth and quality of careers and lifestyle for the area

Perception of skills supply

Demand for skills within the industry is predominantly at the graduate +2 years’ experience level.

There is a degree of reticence to recruit new graduates, particularly for SMEs, due to the concerns

of losing staff at the 2-year stage to other employers after investing in them

Interns and work experience placements are highly valued, particularly during the summer and

have become an effective source of return to employment once their qualifications are in place in a

try before you buy approach

Newly graduated IT software engineers often lack key competencies, particularly in applying

solutions within an enterprise environment and being able to flexibly transition to other coding

languages to achieve new business development goals

The SMEs interviewed registered low levels of engagement with both the FE and independent

training sectors, with a lack of understanding of the training offer, coupled with concerns as to the

complexity of engaging

Employers that engage in assessment and work-based training support often rely upon London-

based providers, believing the training was a better fit for industry needs.

Engagement with schools was high priority but employers find it complex and costly. Employer

events across the area, such as Digital City, have developed interaction with Universities but not

delivered the same level of engagement with local schools. Employers felt that the start of the

talent pipeline must come from better school development of Digital Tech curriculum and employer

engagement

Employer leadership

Employers felt that greater engagement with HEIs was needed to bring current and future industry

trends into the classroom, if the quality and relevancy of the graduate offer was to be developed

Those employers clustered around the two most significant spatial concentrations for the industry -

in Norwich and Ipswich’s Adastral Park - should work together to amplify the significance of the

sector and develop shared skills plans. In turn employers felt this would help Digital Tech

development spill over into surrounding areas

Existing networks were highly valued as effective channels of support for the sector and SMEs

would welcome more engagement with them, seeing them as a route to greater understanding and

integration with HE and FE

Skills should become a more visible element of supply chain interaction with the larger employers in

the area, with resources being shared and activities co-implemented where they will drive benefit to

the primary employer and their suppliers

There is some evidence of using open source competency frameworks to map and develop in-work

employability skills (SFIA) for staff, which employers would be keen to share and develop in

partnership with education establishments in pursuit of a consistent approach towards key

competency and workforce development

P a g e | 25

Education Consultation

Consultation was held in the form of semi-structured interviews with HE, FE and independent training providers. This took place via the lead Principal for the

FE consortium, via Norwich University of the Arts and University of East Anglia, and with the group lead for the independent training consortium for New

Anglia. Questions were grouped around several key themes:

• Existing Digital Tech Skills Offer

• Current Engagement with Digital Tech Employers

• Enhancing the Digital Tech Skills Offer

Theme

HEI

FE

Independent Providers

Strong digital creative presence across Norwich with

internationally-recognised lead offers on digital

design, digital advertising, AI, digital filmmaking and

animation, computing, environmental science, life

sciences and engineering

FE seeking to be proactive, for example, local

Focus more on generic business

Existing

Business schools proactively develop ongoing

initiatives across New Anglia developing Digital Tech

training - such as business

Digital Tech

business engagement, including intern placements,

specific provision in diverse areas such as

administration/ customer service training

Skills Offer

employability skills development and business

electronic/telecommunication and gaming

- than sector specific activity

support services

Developing digital capability across other faculties,

recognising the digital economy transition that many

of the larger employers are making

P a g e | 26

Theme

HEI

FE

Independent Providers

Emerging national lead on UX design and gaming

FE needs to be better connected to the sector

engine development, with involvement in

strategically to improve the skills response

apprenticeship standard definitions for UX

Current

Existing involvement of employers in lecturing and

Some ongoing work experience placements with

Some sector specific delivery in Norwich

Engagement

consultation partners on employability/key

Digital Tech employers, but recognise this needs

in IT, digital marketing, web design,

competency development within curricula

with Digital

better coordination and development

technical apprenticeships and social

Tech

media up to Level 4

Recognise SMEs struggle with resources to take on

Employers

apprentices

FE provides a natural bridge to engage schools (both

primary and secondary) in engagement of young

A range of annual events and competitions to

people in tech skills and careers

develop the partnership with employers and foster an

ongoing digital education/industry infra-structure

Emerging plans to enhance the accessibility of

FE group keen to develop a joint Digital Tech

degree apprenticeship delivery through closer

prospectus with a coordinated offer to industry, in

coordination with SMEs

response to current and future skills demands

The value of vocational training and

apprenticeships needs to be raised,

FE increasingly interested in supporting business start-

There are a number of locally-led innovative

starting with schools and with greater

up activity with their students and would welcome

curriculum and work-based learning programmes in

involvement of employers and HEIs

more partnership development with HEIs and business

the pipeline

Enhancing

support organisations to create a more seamless offer

Reform of apprenticeships from

the Digital

frameworks to standards may risk the

Tech Skills

Recognise the importance of key competency

transferability of current vocational skills

Companies in Digital Tech need to collaborate more

development and would be keen to contribute to the

Offer

across sectors

to communicate career potential for sector jobs to

development of a regulated employability framework

increase market attraction and to drive the skills offer

recognised by schools, FE, HE, independent training

Larger employers should work more

providers and employers

closely with sector SMEs to share skills

STEM based engagement with schools does not

FE as a group consortium is a key asset for New

development

enthuse young people enough to seek a career in

Anglia and would welcome closer interaction with the

STEM subjects, with no single strategy for engaging

LEP and the Skills Board on place-marketing and the

schools on the Digital Tech sector

overall skills offer

P a g e | 27

appendix C

Digital Tech Sector Evidence Base

The following text provides an overview of the Digital Tech Data Pack produced in conjunction

with this sector plan.

The Data Pack contains a full breakdown of the major economic, skills and employment factors for

the Digital Tech Sector. In particular it builds a complete picture of historic patterns of labour

market activity, alongside the size and value of the sector contrasted with a series of economic

forecasts. The key elements of the data analysis are presented below- grouped in to three areas-

the Value, Performance and Future Forecast- of the Digital Tech sector, with the full referencing

captured in the data pack itself.

Sector Value

As highlighted in the 2016 TechNation Report and summarised in this plan - New Anglia features

two nationally significant Digital Tech clusters- at Norwich and Ipswich. The activity focused on

digital creative industry and IT and telecommunications, are recognised as the key drivers for

employment share, business location, supply chain development and jobs growth. The Location

Quotient, which measures the relative concentration of employment compared to national levels,

indicates that Suffolk Coastal with a score of 1.6, is the most deeply concentrated geographical

location for the sector overall.

The Digital Tech sector contributes approximately 4% to the New Anglia LEP area’s overall GVA

and has median average earnings that is significantly higher than the average- at £39,130, which

is a rate that has increased since 2014- from £37,065. The sectors occupational breakdown

highlights a strong representation of Director, Management and other professional roles, with

approximately a third of all roles falling within this area. Both the Burning Glass (job marketing

data) and Working Futures (labour market modelling analysis) identify a significant demand for

higher skilled workers, with around 50% of all jobs advertising activity since 2012 requiring degree

level and above qualification achievement.

Current Sector Performance

The data analysis evidences that the Digital Tech sector for New Anglia has increased in overall

size, by employment share- since 2010, with an overall increase of 9%- to 16,600 employees.

Both Norwich (3,100) and Suffolk Coastal (3,700) represent the largest spatial concentrations of

employment for the area. Comparatively, the business density of the sector is lower than Greater

Cambridge and the South East LEP and the Tech Corridor running through these areas-

represents both challenges and opportunities for New Anglia.

A greater proportion of overall workers, within the sector (most significantly those that possess

higher skills, equivalent to NVQ4 and above), travel to work outside of New Anglia- as opposed to

the same comparator areas. In fact, the analysis has identified that around 4,600 of higher skilled

P a g e | 28

workers will commute daily outside of the area- with Cambridge, Cambridgeshire, Essex and

London featuring as the main destinations.

Burning Glass job marketing data identifies there are key demands for competent jobseekers

within marketing, sales and customer service type roles. Furthermore, that vacancies are often

raised by large outsourced service providers (SERCO) and a crosscutting range of employers

from traditionally non-digital areas (National Trust, Virgin Money etc.) demonstrating the

importance of digital skills as enabling factors for the broader economy. This represents a

challenging ‘skills response’ to the demands of the sector, with an employer market that requires

technically competent, professional and commercially capable employees, which may involve

working for primary digital enterprises linked to IT software engineering, telecommunications and

digital design but also across finance, manufacturing, public services, tourism and other key

sectors.

Future Sector Forecast

The Strategic Economic Plan (SEP) for the New Anglia LEP includes a key ambition for increasing

the overall level of employment and growth of businesses, for the area. Defined as a high impact

sector, Digital Tech needs to play a key role of stimulating competitive advantage for the New

Anglia economy. Given the market demands already highlighted- skills plays a fundamental role

in developing a productive and competitive digital industry. The patterns of commuting and talent

‘migration’ out of area overall demonstrates a main challenge for the development of a skilled

local labour supply, which is accessible to local employers.

The trends highlighted through the analysis of Skills Funding Agency data (SFA Data Cube) within

the data pack, shows a relatively flat growth in apprenticeship starts since 2011. The

apprenticeship frameworks covering IT Application Specialists qualifications have shown a

significant reduction since 2011, reducing from 155 to 60 starts for the 2014/15 academic year.

The apprenticeships covered within this SFA framework are mainly non-technical in role- data

input, CRM and website content management. In contrast, the number of apprenticeship starts in

IT software and professional roles has increased. In addition, social media and digital marketing

apprenticeship starts have also become part of mainstream apprenticeship delivery since 2011.

This demonstrates a shift in apprenticeship delivery that is more in line with the industry mix

locally for the Digital Tech sector and in line with the occupational profiles analysed through

Burning Glass job marketing data.

Working Futures have modelled the forecast patterns of employment for the sector until 2024 (for

the purposes of the data pack analysis the Digital Tech definition has been approximated to the

Working Futures Media and IT sectors). The performance forecast predicts a fairly flat

employment projection overall but with an increase in the number of professional, sales/customers

service roles and a decrease in administration. This correlates with the Burning Glass existing job

market behaviour and also with the shift in apprenticeship starts. Although the employment

forecast appears disappointing at a high level, there are several key issues that need to be

considered:

• there is a predicted replacement demand of around 4,000 workers between 2017 and

2024 based mainly on estimated retirement levels, particularly within engineering and

technology and senior professional roles;

• there is predicted expansion demand (i.e. jobs growth) in the same occupational areas

and also predicted across digital roles within public service organisations; and

P a g e | 29

• the demand in higher skills (degree level and above) is set to increase, with the greatest

skills demand for the replacement share also falling down to higher qualified roles;

The Working Futures forecasting methodology harnesses a range of national labour forecasting

and economic performance sources alongside the national census. It does not explicitly take into

account measures from planned activity, such as the economic development interventions

developed by Growth Deals etc. or other sector based intervention.

By grouping the data analysis for the Digital Tech sector into themes exploring the sector’s value,

its current performance and existing forecast, several key conclusions can be made that allows a

relevant context for skills prioritisation to be developed:

• The job ‘structure’ for the sector in New Anglia is becoming more high skilled, more ‘IT

technical’ and professional overall, creating therefore an even greater demand in degree

and above qualifications;

• The demand for competencies across marketing and sales within a Digital Tech

environment is also significant and set to increase;

• There is an expanding digital economy across New Anglia- with marketing, finance,

public services and tourism- all actively recruiting in digital roles, which is set to

accelerate when replacement demands are forecasted. Therefore, the demand for digital

workers with digital skills, which are transferable across sectors- will increase;

• The strong clustering that exists spatially and the growing significance of a number of key

industries for the sector, demonstrates that a proportion of employers are able to access

higher performing workers, from a skilled labour market pool. Talent/worker migration

and residency/work placed wage rate data however highlights there are clear

weaknesses in the access to higher skilled workers locally. In short, New Anglia loses a

disproportionate amount of skilled workers to other areas impacting on the overall

potential growth of the sector locally.

P a g e | 30

REALISING

COMPETITIVE

ADVANTAGE, LOCAL

OPPORTUNITIES AND

ECONOMIC GROWTH

THROUGH BEST

SKILLS INVESTMENT

FOR DIGITAL TECH IN

NEW ANGLIA

The SkillsReach New Anglia project team comprised:

•

Roy Harper, Managing Director

•

Martin & Lynn Collison, New Anglia-based Rural / Economy specialists. Sector Leads - Agri Food Tech; Life

Sciences; Ports and Logistics; and Tourism/Culture

•

David Kirkham, Sector Lead - Digital Tech; Energy; Advanced Manufacturing and Engineering; Financial and

Insurance Services

•

Adam Peacock, Data Analyst - Project Data Lead

BG Futures, Bishop Grosseteste University Campus, Longdales Road, Lincoln, LN1 3DY

Tel: 07721 499494