Registered number: 07685830

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

Page 1

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

COMPANY INFORMATION

Directors

Mr D Field (Chair)

Mr S Chapman-Allen (appointed 15 July 2019)

Mrs C Cullens

Mr D Ellesmere

Mrs CJ Green (appointed 21 April 2020)

Mr J Griffiths

Mr M Hicks

Mr P Joyner

Mr D Keen

Prof H Langton (appointed 1 August 2019)

Mr S Oliver

Mrs C Peasgood (appointed 1 January 2020)

Mr A Proctor

Mr J Reynolds

Mrs S Ruddock

Mr A Waters

Ms J Wheeler

Dr T Whitley

Mr W Nunn (resigned 16 May 2019)

Prof D Richardson (resigned 31 July 2019)

Mrs L Rix (resigned 21 April 2020)

Dr N Savvas (resigned 31 December 2019)

Registered number

07685830

Registered office

Mills & Reeve LLP

1 St James Court

Norwich

Norfolk

NR3 1RU

Independent auditors

Price Bailey LLP

Chartered Accountants & Statutory Auditors

Anglia House, 6 Central Avenue

St Andrews Business Park

Thorpe St Andrew

Norwich

Norfolk

NR7 0HR

Page 2

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

CONTENTS

Page

Group Strategic Report

4 - 7

Directors' Report

8 - 10

Independent Auditors' Report

11 - 13

Consolidated Statement of Comprehensive Income

14

Consolidated Balance Sheet

15

Company Balance Sheet

16

Consolidated Statement of Cash Flows

17

Notes to the Financial Statements

18 - 37

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

GROUP STRATEGIC REPORT

FOR THE YEAR ENDED 31 MARCH 2020

Introduction

New Anglia Local Enterprise Partnership Ltd (LEP), is a company bringing together business, local authority and

education leaders, collaborating to grow the area’s economy, create jobs and improve productivity.

Aims and Objectives

The core goal of the LEP is to drive business growth and enterprise to support inclusive growth across Norfolk

and Suffolk.

During the period, it has continued to invest in key projects and provide support to the region's businesses. Since

mid-March 2020, the LEP team has - in line with Government guidance - been working remotely and a number

of workstreams have been established to support the regional and national COVID-19 response and recovery

work. Working with local partners, the LEP launched its Economic Recovery Restart Plan in June 2020, outlining

the funding streams and support programmes in place to help businesses and employees over the next 12

months. More details of this are outlined in the ‘Political and Economic Climate’ section of this report.

Since the launch of the Economic Strategy for Norfolk and Suffolk in autumn 2017, the focus has been on

delivering on its ambitions and key themes for local growth: Our Offer to the World, Driving Inclusion and Skills

and Driving Business Growth and Productivity. The region’s draft Local Industrial Strategy, published in autumn

2019, outlines ambitions to deliver growth and become the UK’s Clean Growth Region

One of the ways to deliver and facilitate growth is through the Growth Deal programme, totalling £290million

since 2014. The funding supports projects and programmes that will boost skills, drive innovation, provide

targeted business support and improve transport and infrastructure.

Core programmes and projects

The LEP launched its new Business Resilience and Recovery Scheme in April 2020. The £3.5m grant fund helps

support short-term projects and longer-term diversifications for businesses during and recovering from the

Covid-19 crisis.

Two state-of-the-art skills facilities, funded through New Anglia LEP’s Growth Deal, are now supporting students

and local businesses. The STEM Innovation Campus at West Suffolk College and the Energy Skills Centre at

East Coast College, which both opened in autumn 2019, will help to grow the next generation of engineers,

innovators, and developers to support our key sectors.

The redevelopment of the headquarters building for the Centre for Environment, Fisheries and Aquaculture

Science (CEFAS) in Lowestoft, supported by our Growth Deal, is under way, providing updated laboratories and

offices.

The New Anglia LEP Enterprise Zones continue to attract new companies and support new jobs. The new

headquarters for flavours firm Treatt is taking shape on the site in Bury St Edmunds and Amazon has built a new

distribution centre on the site at Sproughton, near Ipswich.

The LEP's business support programmes and flagship Growth Hub continue to offer free and impartial advice,

helping hundreds of firms to grow, develop and innovate. The milestone of £30m of grants awarded through LEP

programmes was reached in spring 2020.

The new Growth Through Innovation Fund supports companies investing in research and development projects.

A second round of Innovative Project Fund grants were awarded in early 2020. Financial support from Norfolk

and Suffolk local authorities, funded through pooled business rates, saw the Fund make £1.5m available for

innovative, revenue projects across both counties.

Page 4

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

GROUP STRATEGIC REPORT (CONTINUED)

FOR THE YEAR ENDED 31 MARCH 2020

Core programmes and projects (continued)

The LEP’s strategic aim to promote our Offer to the World has taken a significant step forward with the launch of

the region’s new place brand, Norfolk & Suffolk Unlimited, in September 2019. Bringing together public and

private sector partners, the new brand is used to promote business location and inward investment opportunities.

It has its own website and has already been showcased at a property event in London and a food and drink

event in Amsterdam.

The LEP’s Growing Places Fund scheme continues to support a range of projects. The New Wolsey Theatre in

Ipswich and St Peter’s cultural venue in Sudbury have been awarded more than £200,000 to redevelop and

modernise their facilities and other investments, including the new visitor centre at Carlton Marshes, are due to

open to the public this year.

The LEP’s industry councils for agri-food, ICT/digital and all energy are bringing together business leaders to

structure work to develop our key sectors.

Performance and financial overview

LEP projects are monitored against a series of key performance indicators (KPIs). These include performance

against spend and the delivery of agreed outputs. Each programme reports against KPIs in a performance report

which can be found on the LEP’s website.

The LEP’s internal KPIs cover finances and performance against the LEP’s delivery plan.

KPIs include financial and output performance against annual targets for our key projects including Growth Deal,

Enterprise Zone and Growth Programme.

Each member of the LEP team has their own individual objectives which form part of the LEP’s overall delivery

plan. The LEP’s Working Well initiative continues to support the team’s health and wellbeing.

The LEP's reserves increased in this financial year. This is largely due to Growth Deal funding received from

Government and is committed to specific projects but not yet spent. This funding will be made available to those

projects during the next financial year as they progress.

The LEP has been awarded a total of £290million by Government to deliver the Growth Deal over a six-year

period. The funding profile varies from year to year. In 2019-20 the annual allocation was £24.6million, leaving

£47.4million for the year 2020-21. In previous years we received our allocation in April. Receipt from Government

of our 2020-21 allocation will be staged - with 2/3 to be paid in May and 1/3 to be paid in September, the final

payment being subject to a review of progress.

The majority of the LEP's funding is secured from Government, both core funding and project funding. Other

funding is secured from the European Union, from business rates generated on the LEP’s Enterprise Zone sites

and through contributions from local authority partners.

A principal risk is the Government withholding this funding in full or in part, which has materialised in the case of

two other LEPs. New Anglia LEP mitigates this risk by ensuring all funding is utilised in compliance with

Government rules and its governance and processes are "best in class".

In its annual review with Government in February 2020, the LEP’s governance and delivery were both rated as

good. Strategic impact is rated as either meeting requirements or not meeting requirements. New Anglia LEP

was rated as meeting requirements.

Page 5

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

GROUP STRATEGIC REPORT (CONTINUED)

FOR THE YEAR ENDED 31 MARCH 2020

Political and economic climate

The Covid-19 pandemic poses the most significant threat to our economy in decades. New Anglia LEP is at the

forefront of work to ensure local businesses have access to the support and advice they need. Working with the

Norfolk and Suffolk Resilience Forums, the LEP team has been supporting business support and recovery

projects. This has included advisers speaking directly to business owners to helping protect our key sectors,

sharing intelligence with Government, helping frontline services source vital supplies and supporting businesses

as they reopen from lockdown. A significant volume of LEP resource and time has been redirected towards

supporting the local and national COVID-19 response.

We are undertaking this work with partners - our Industry Councils and sector groups provide key insight into

local challenges and our Local Authorities are the ‘feet on the ground’ to ensure communities and businesses

have the help they need during the pandemic.

The LEP has been working with local partners to produce the Norfolk and Suffolk Economic Recovery Restart

Plan (launched June 2020) which is available online at newanglia.co.uk/covid-economic-recovery. The plan

outlines the role the LEP and local public and private sector partners will play in helping businesses reopen

safely over the coming months. Work to develop the Renew plan, which covers longer-term actions, is already

beginning.

Our recovery will require work across administrative boundaries working with partners in Cambridgeshire and

other parts of the country. It will need a joined-up focus on what our businesses need to deliver, both now and in

the future.

New Anglia Capital Ltd

New Anglia Capital Ltd (NAC) is a wholly owned subsidiary of New Anglia Local Enterprise Partnership.

New Anglia LEP has established a co-investment fund to be managed by NAC to make risk-capital co-

investments alongside entrepreneurs in high growth-potential companies based in Norfolk and Suffolk.

The principle aims of NAC include:

y

Establishing a network of business entrepreneurs and angel investors to provide a pool of risk-capital and

business finance that can support start-ups, innovative business ideas and high growth companies.

y

Identifying and providing a pipeline of investment opportunities for risk-capital investment, co-investing

with angel investors and entrepreneurs that meet the company criteria, including creating new jobs.

y

Investment opportunities should also promote the wider objectives of New Anglia LEP e.g. support for

sectors including engineering, life sciences, agri-tech, health, energy, ICT and digital tech.

Risks to New Anglia Capital include identifying and maintaining an effective level of investors in the region and

the risk of failure of individual companies in which NAC has an equity share

Page 6

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

GROUP STRATEGIC REPORT (CONTINUED)

FOR THE YEAR ENDED 31 MARCH 2020

Section 172(1) Statement

New Anglia Local Enterprise Partnership works with businesses, local authority partners and education

institutions to drive growth and enterprise in Norfolk and Suffolk. The LEP is transforming the economy by

securing funds from government to help businesses grow, through the delivery of ambitious programmes to

ensure that businesses have the funding, support, skills, and infrastructure needed to flourish.

Members of New Anglia LEP’s Board operate with the aim of ensuring that the organisation maintains its

reputation for high standards of business conduct and good governance. The Board considers and understands

the long-term effect of its decisions on the regional business community, our stakeholders and employees.

The LEP’s aims and objectives are set out in its current Delivery Plan. The Non-Executive Director Agreement

outlines the high standards of ethical and professional conduct expected of Board members in ensuring that the

LEP’s values and obligations to stakeholders - our public sector partners, local businesses, further and higher

education partners and Government - are met. It states that Board members will provide entrepreneurial

leadership within a framework of prudent and effective controls which enable risk to be assessed and managed.

The Standards of Conduct Policy sets out the principles by which Board members and employees are expected

to adhere to the highest standards of governance and propriety. It uses the Nolan Principles as the core of the

code of conduct, following the guidelines established by the Committee on Standards in Public Life, which

provides independent advice to the prime minister on standards of conduct of holders of all public office. We

hold monthly board meetings, regular meetings of our sub boards, committees and sector groups and weekly

updates for our employees.

The LEP’s Local Assurance Framework sets out how its Board is formed and governed, how decisions are made

and how programmes are funded and managed. The Assurance Framework also provides the Government with

assurance that the LEP is operating correctly.

As well as investing in capital and revenue projects across the region, the LEP supports local procurement

where possible. The LEP has committed to reducing its carbon footprint, by reducing printing, encouraging fewer

car journeys / car sharing and implementing agile working for its staff.

Further information about the LEP’s governance, including details of its Board members, can be found on the

This report was approved by the board on

and signed on its behalf.

($)#

$-

-*

Mr D Field (Chair)

Director

Page 7

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

DIRECTORS' REPORT

FOR THE YEAR ENDED 31 MARCH 2020

The directors present their report and the financial statements for the year ended 31 March 2020.

Directors

The directors who served during the year were:

Mr D Field (Chair)

Mr S Chapman-Allen (appointed 15 July 2019)

Mrs C Cullens

Mr D Ellesmere

Mr J Griffiths

Mr M Hicks

Mr P Joyner

Mr D Keen

Prof H Langton (appointed 1 August 2019)

Mr S Oliver

Mrs C Peasgood (appointed 1 January 2020)

Mr A Proctor

Mr J Reynolds

Mrs S Ruddock

Mr A Waters

Ms J Wheeler

Dr T Whitley

Mr W Nunn (resigned 16 May 2019)

Prof D Richardson (resigned 31 July 2019)

Mrs L Rix (resigned 21 April 2020)

Dr N Savvas (resigned 31 December 2019)

Directors' responsibilities statement

The directors are responsible for preparing the Group Strategic Report, the Directors'

Report

and

the

consolidated financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the

directors have elected to prepare the financial statements in accordance with applicable law and United Kingdom

Accounting Standards (United Kingdom Generally Accepted Accounting Practice), including Financial Reporting

Standard 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland'. Under company

law the directors must not approve the financial statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and the Group and of the profit or loss of the Group for that period.

In preparing these financial statements, the directors are required to:

y

select suitable accounting policies for the Group's financial statements and then apply them consistently;

y

make judgments and accounting estimates that are reasonable and prudent;

y

state whether applicable UK Accounting Standards have been followed, subject to any material departures

disclosed and explained in the financial statements;

y

prepare the financial statements on the going concern basis unless it is inappropriate to presume that the

Group will continue in business.

Page 8

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

DIRECTORS' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 MARCH 2020

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain

the Company's transactions and disclose with reasonable accuracy at any time the financial position of the

Company and the Group and to enable them to ensure that the financial statements comply with the Companies

Act 2006. They are also responsible for safeguarding the assets of the Company and the Group and hence for

taking reasonable steps for the prevention and detection of fraud and other irregularities.

Results and dividends

The surplus for the year, after taxation, amounted to £428,464 (2019 - £11,913,510).

Future developments

Our Local Assurance Framework has been updated to reflect the changes in our responsibilities. This was

reviewed and approved by Directors at the LEP Board meeting held in March 2020.

A successful board recruitment process has been undertaken.

C-J Green has been appointed to fill the vacancy that arose as a result of the resignation of Lindsey Rix, and as

Chair Designate.

Our current Chair, Doug Field, comes to the end of his term at the end of September. At this point C-J Green will

take on the role of Chair.

Kathy Atkinson has been appointed as a private sector board member from October 2020.

The changes which we have all experienced in recent weeks will have a profound impact on our economy. New

Anglia LEP is at the forefront of work to ensure local businesses have access to the support and advice they

need, and resource has been redirected towards supporting the local and national COVID-19 response. Looking

ahead, they will also play a key role in recovery.

Alongside our response to COVID-19, our focus on plans to deliver inclusive growth across our region has not

changed. We continue to work with partners to work towards the targets in our Economic Strategy and to deliver

the interventions in our Local Industrial Strategy.

Disclosure of information to auditors

Each of the persons who are directors at the time when this Directors' Report is approved has confirmed that:

y

so far as the director is aware, there is no relevant audit information of which the Company and the

Group's auditors are unaware, and

y

the director has taken all the steps that ought to have been taken as a director in order to be aware of any

relevant audit information and to establish that the Company and the Group's auditors are aware of that

information.

Page 9

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

DIRECTORS' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 MARCH 2020

Post balance sheet events

The COVID-19 pandemic impacted at the very end of the financial year and did not impact on the 2019 - 2020

statement of accounts.

In April 2020 the Board agreed to support a new intervention, the Business Resilience and Recovery scheme

with an initial budget of £3.5m to provide support to businesses in the New Anglia region in the form of advice,

guidance and grant support for initial resilience and longer term recovery.

The impact on grant funding received from Government is continually assessed/reviewed by New Anglia LEP in

relation to grants and loans available to businesses. COVID-19 is now a factor in the assessment and

continuous dialogue with Government.

Auditors

The auditors, Price Bailey LLP, will be proposed for reappointment in accordance with section 485 of the

Companies Act 2006.

This report was approved by the board on

and signed on its behalf.

($)#

$-

-*

Mr D Field (Chair)

Director

Page 10

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

INDEPENDENT AUDITORS' REPORT TO THE SHAREHOLDERS OF NEW ANGLIA LOCAL ENTERPRISE

PARTNERSHIP LIMITED

Opinion

We have audited the financial statements of New Anglia Local Enterprise Partnership Limited (the 'parent

Company') and its subsidiaries (the 'Group') for the year ended 31 March 2020, which comprise the Group

Statement of Comprehensive Income, the Group and Company Balance Sheets, the Group Statement of Cash

Flows and the related notes, including a summary of significant accounting policies. The financial reporting

framework that has been applied in their preparation is applicable law and United Kingdom Accounting

Standards, including Financial Reporting Standard 102 ‘The Financial Reporting Standard applicable in the UK

and Republic of Ireland' (United Kingdom Generally Accepted Accounting Practice).

In our opinion the financial statements:

y

give a true and fair view of the state of the Group's and of the parent Company's affairs as at 31 March

2020 and of the Group's profit for the year then ended;

y

have been properly prepared in accordance with United Kingdom Generally Accepted Accounting

Practice; and

y

have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable

law. Our responsibilities under those standards are further described in the Auditors' responsibilities for the audit

of the financial statements section of our report. We are independent of the Group in accordance with the ethical

requirements that are relevant to our audit of the financial statements in the United Kingdom, including the

Financial Reporting Council's Ethical Standard, and we have fulfilled our other ethical responsibilities in

accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to

report to you where:

y

the directors' use of the going concern basis of accounting in the preparation of the financial statements is

not appropriate; or

y

the directors have not disclosed in the financial statements any identified material uncertainties that may

cast significant doubt about the Group's or the parent Company's ability to continue to adopt the going

concern basis of accounting for a period of at least twelve months from the date when the financial

statements are authorised for issue.

Other information

The directors are responsible for the other information. The other information comprises the information included

in the Annual Report, other than the financial statements and our Auditors' Report thereon. Our opinion on the

financial statements does not cover the other information and, except to the extent otherwise explicitly stated in

our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in

Page 11

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

INDEPENDENT AUDITORS' REPORT TO THE SHAREHOLDERS OF NEW ANGLIA LOCAL ENTERPRISE

PARTNERSHIP LIMITED (CONTINUED)

doing so, consider whether the other information is materially inconsistent with the financial statements or our

knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material

inconsistencies or apparent material misstatements, we are required to determine whether there is a material

misstatement in the financial statements or a material misstatement of the other information. If, based on the

work we have performed, we conclude that there is a material misstatement of this other information, we are

required to report that fact.

We have nothing to report in this regard.

Opinion on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

y

the information given in the Group Strategic Report and the Directors' Report for the financial year for

which the financial statements are prepared is consistent with the financial statements; and

y

the Group Strategic Report and the Directors' Report have been prepared in accordance with applicable

legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the Group and the parent Company and its environment

obtained in the course of the audit, we have not identified material misstatements in the Group Strategic Report

or the Directors' Report.

We have nothing to report in respect of the following matters in relation to which the Companies Act 2006

requires us to report to you if, in our opinion:

y

adequate accounting records have not been kept by the parent Company, or returns adequate for our

audit have not been received from branches not visited by us; or

y

the parent Company financial statements are not in agreement with the accounting records and returns; or

y

certain disclosures of directors' remuneration specified by law are not made; or

y

we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the Directors' Responsibilities Statement on page 8, the directors are responsible for

the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such

internal control as the directors determine is necessary to enable the preparation of financial statements that are

free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the Group's and the parent

Company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and

using the going concern basis of accounting unless the directors either intend to liquidate the Group or the

parent Company or to cease operations, or have no realistic alternative but to do so.

Page 12

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

INDEPENDENT AUDITORS' REPORT TO THE SHAREHOLDERS OF NEW ANGLIA LOCAL ENTERPRISE

PARTNERSHIP LIMITED (CONTINUED)

Auditors' responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an Auditors' Report that includes our

opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in

accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise

from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be

expected to influence the economic decisions of users taken on the basis of these financial statements.

A further description of our responsibilities for the audit of the financial statements is located on the Financial

Auditors' Report.

Use of our report

This report is made solely to the Company's shareholders in accordance with Chapter 3 of Part 16 of the

Companies Act 2006. Our audit work has been undertaken so that we might state to the Company's

shareholders those matters we are required to state to them in an Auditors' Report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company

and the Company's shareholders for our audit work, for this report, or for the opinions we have formed.

Aaron Widdows ACA FCCA (Senior Statutory Auditor)

for and on behalf of

Price Bailey LLP

Chartered Accountants

Statutory Auditors

Anglia House, 6 Central Avenue

St Andrews Business Park

Thorpe St Andrew

Norwich

Norfolk

NR7 0HR

Date:

Page 13

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

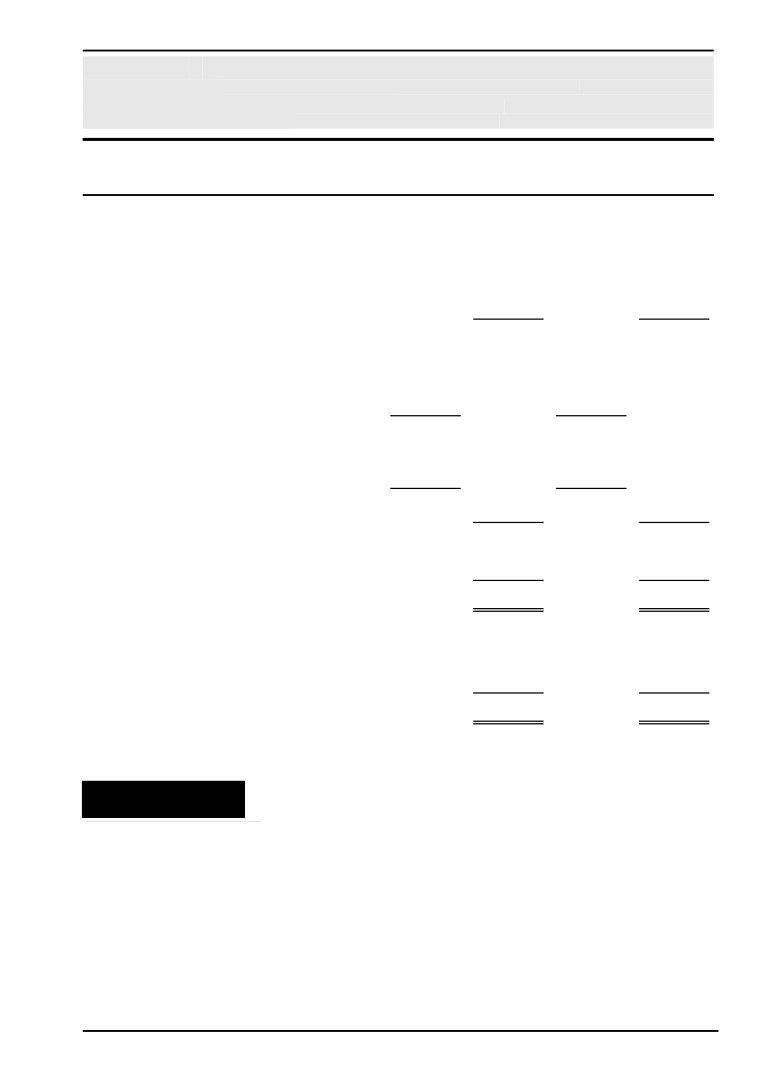

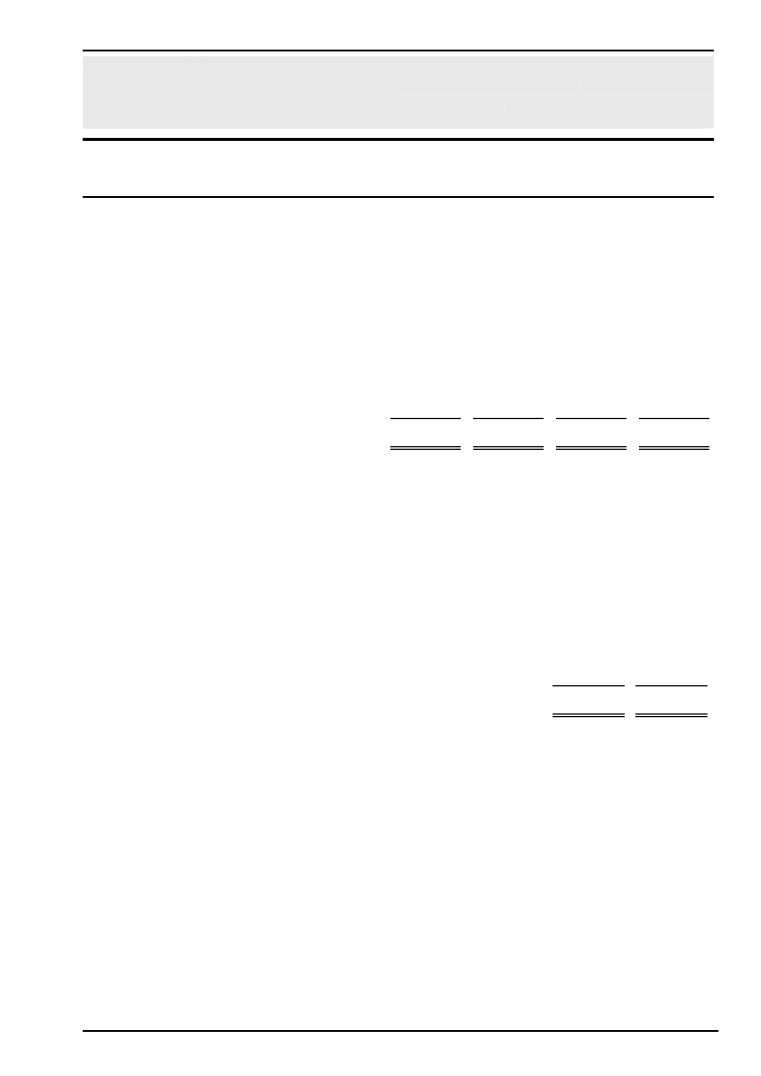

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 MARCH 2020

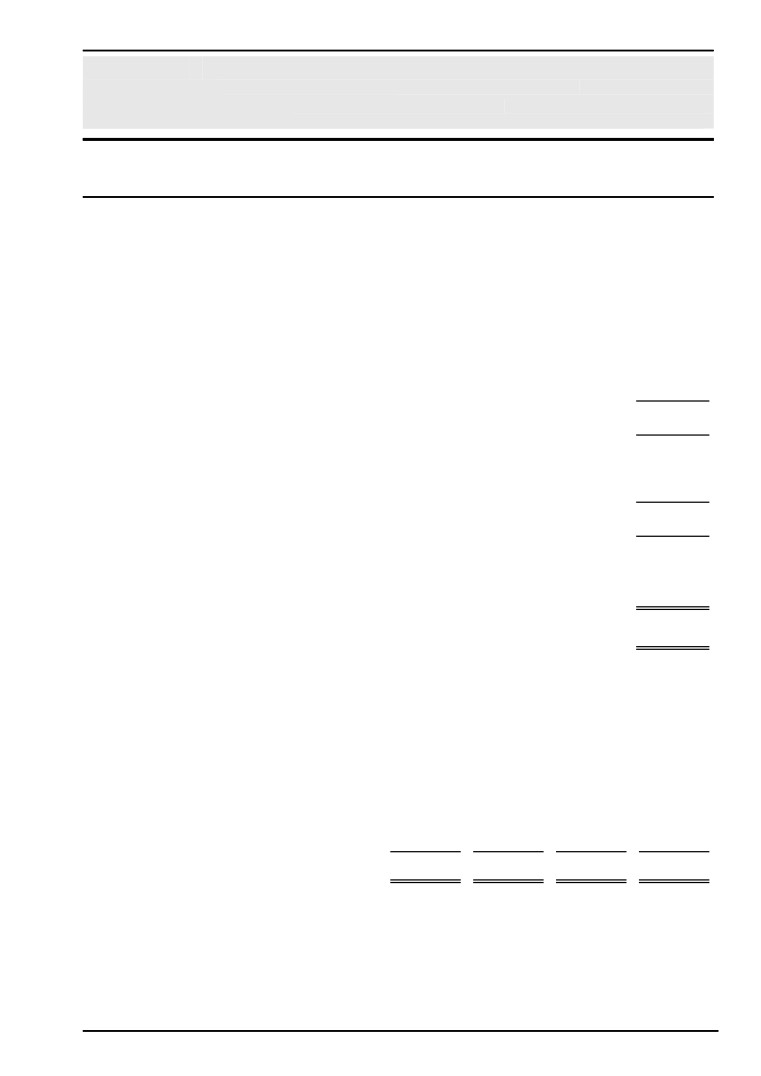

Designated

Project

Operational

Funding

Activity

Total

Total

2020

2020

Note

2020

2019

£

£

£

£

Operational income

-

2,104,990

2,104,990

1,882,461

Grant and project income

28,029,415

-

28,029,415

37,183,542

_________

_________

_________

_________

28,029,415

2,104,990

4

30,134,405

39,066,003

Grants issued

(25,932,402)

-

(25,932,402)

(23,343,151)

Impairment of investments

-

-

-

(620,000)

_________

_________

_________

_________

Gross surplus

2,097,013

2,104,990

4,202,003

15,102,852

Administrative expenses

(2,135,538)

(2,113,396)

(4,248,934)

(3,583,210)

_________

_________

_________

_________

Operating surplus

(38,525)

(8,406)

5

(46,931)

11,494,830

Interest receivable

514,174

38,620

552,794

452,085

Net finance costs

(5,000)

15

(5,000)

(2,000)

_________

_________

_________

_________

Surplus on ordinary activities

before taxation

475,649

25,214

500,863

11,944,915

Taxation

(65,383)

(7,016)

8

(72,399)

(56,217)

_________

_________

_________

_________

Surplus for the financial year

410,266

18,198

428,464

11,913,510

Actuarial gain / (loss) on defined

benefit pension scheme

-

88,000

15

88,000

(68,000)

_________

_________

_________

_________

Total Comprehensive Income

for the year

410,266

106,198

516,464

11,845,510

Retained earnings at the

start of the year

53,730,993

505,119

14

54,236,112

42,390,602

_________

_________

_________

_________

Retained earnings at the

end of the year

54,141,259

611,317

54,752,576

54,236,112

All of the activities of the group are classed as continuing.

The notes on pages 18 to 37 form part of these financial statements.

Page 14

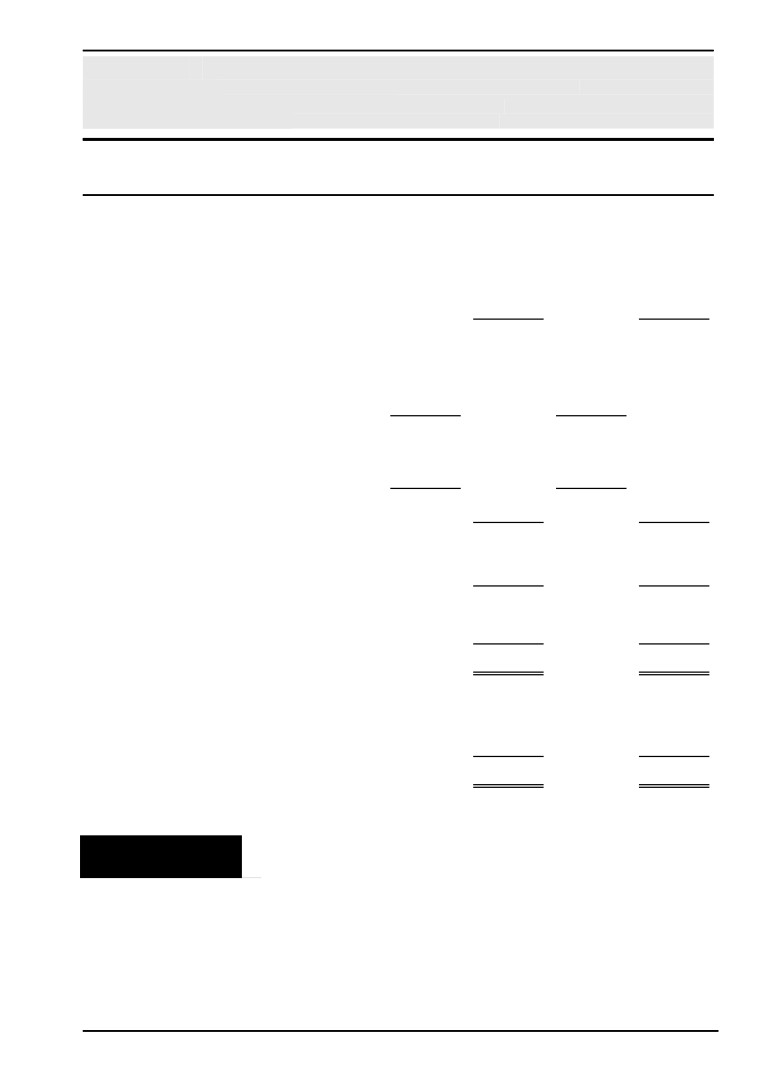

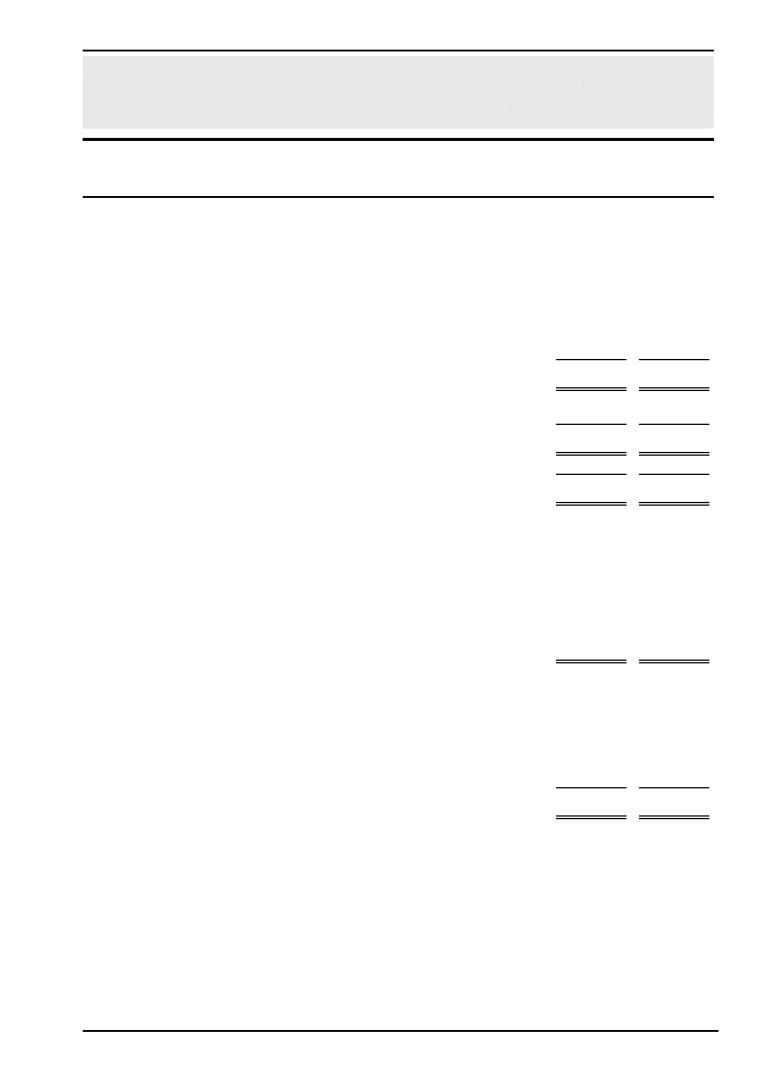

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

REGISTERED NUMBER: 07685830

CONSOLIDATED BALANCE SHEET

AS AT 31 MARCH 2020

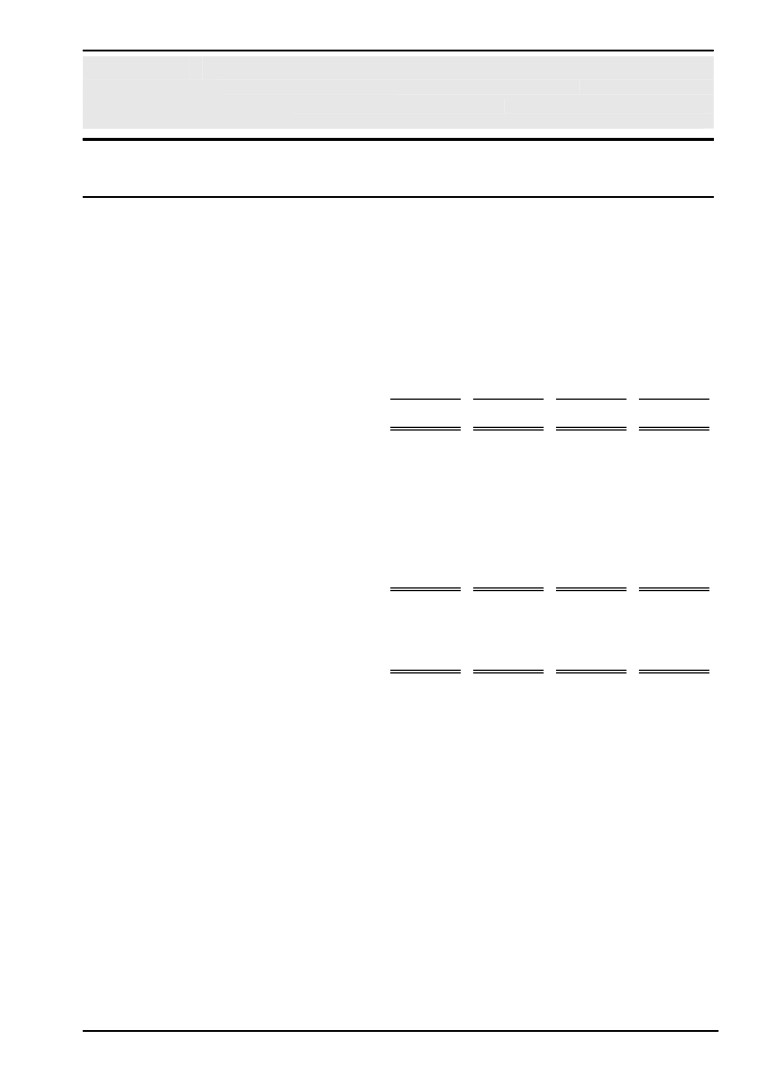

2020

2019

Note

£

£

Fixed assets

Tangible assets

9

48,026

45,339

Investments

10

12,034,642

14,007,925

12,082,668

14,053,264

Current assets

Debtors: amounts falling due within one year

11

3,502,305

2,595,382

Cash at bank and in hand

40,004,253

38,445,893

43,506,558

41,041,275

Creditors: amounts falling due within one

year

12

(676,650)

(685,427)

Net current assets

42,829,908

40,355,848

Net assets excluding pension liability

54,912,576

54,409,112

Pension liability

(160,000)

(173,000)

Net assets

54,752,576

54,236,112

Capital and reserves

Other reserves

53,981,259

53,557,993

Profit and loss account

771,317

678,119

MEMBER FUNDS

54,752,576

54,236,112

The financial statements were approved and authorised for issue by the board and were signed on its behalf by:

($)#

$-

-*

Mr D Field (Chair)

Director

Date:

The notes on pages 18 to 37 form part of these financial statements.

Page 15

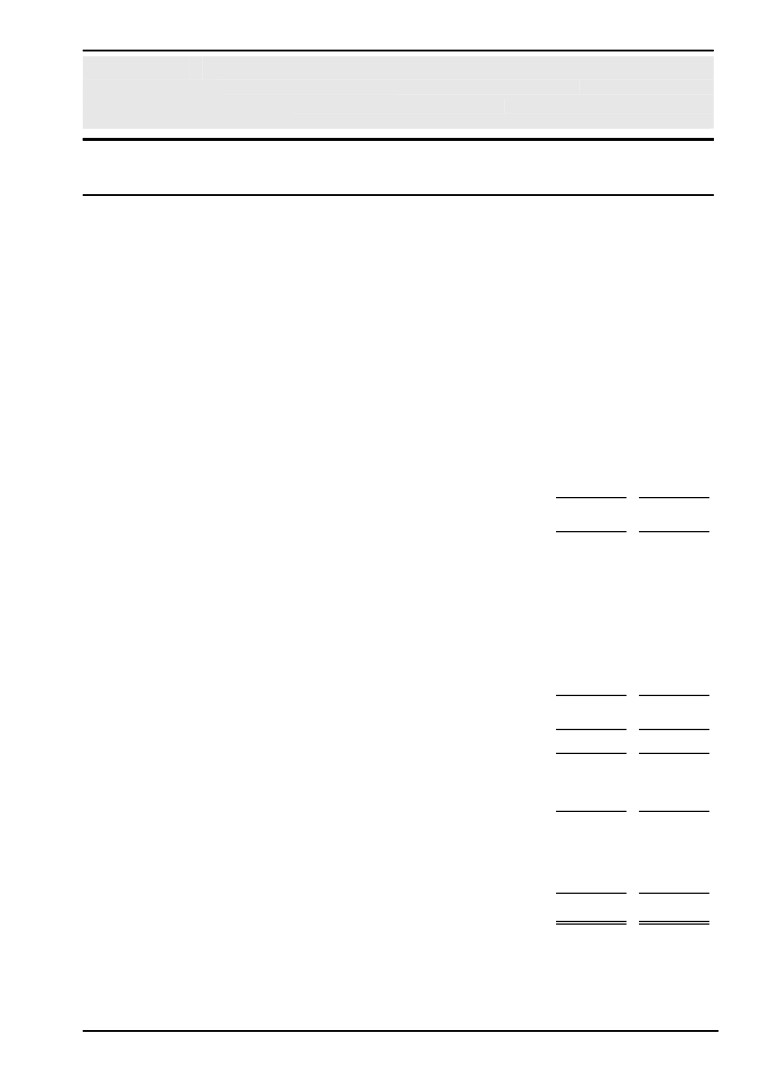

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

REGISTERED NUMBER: 07685830

COMPANY BALANCE SHEET

AS AT 31 MARCH 2020

2020

2019

Note

£

£

Fixed assets

Tangible assets

9

48,026

45,339

Investments

10

9,788,409

12,001,092

9,836,435

12,046,431

Current assets

Debtors: amounts falling due within one year

11

5,720,119

4,577,407

Cash at bank and in hand

40,004,253

38,445,893

45,724,372

43,023,300

Creditors: amounts falling due within one

year

12

(673,039)

(685,427)

Net current assets

45,051,333

42,337,873

Total assets less current liabilities

54,887,768

54,384,304

Net assets excluding pension liability

54,887,768

54,384,304

Pension liability

(160,000)

(173,000)

Net assets

54,727,768

54,211,304

Capital and reserves

Other reserves

53,956,451

53,533,185

Profit and loss account carried forward

771,317

678,119

54,727,768

54,211,304

The financial statements were approved and authorised for issue by the board and were signed on its behalf on

-*

Mr ($)#Fi $-d (Chair)

Director

The notes on pages 18 to 37 form part of these financial statements.

Page 16

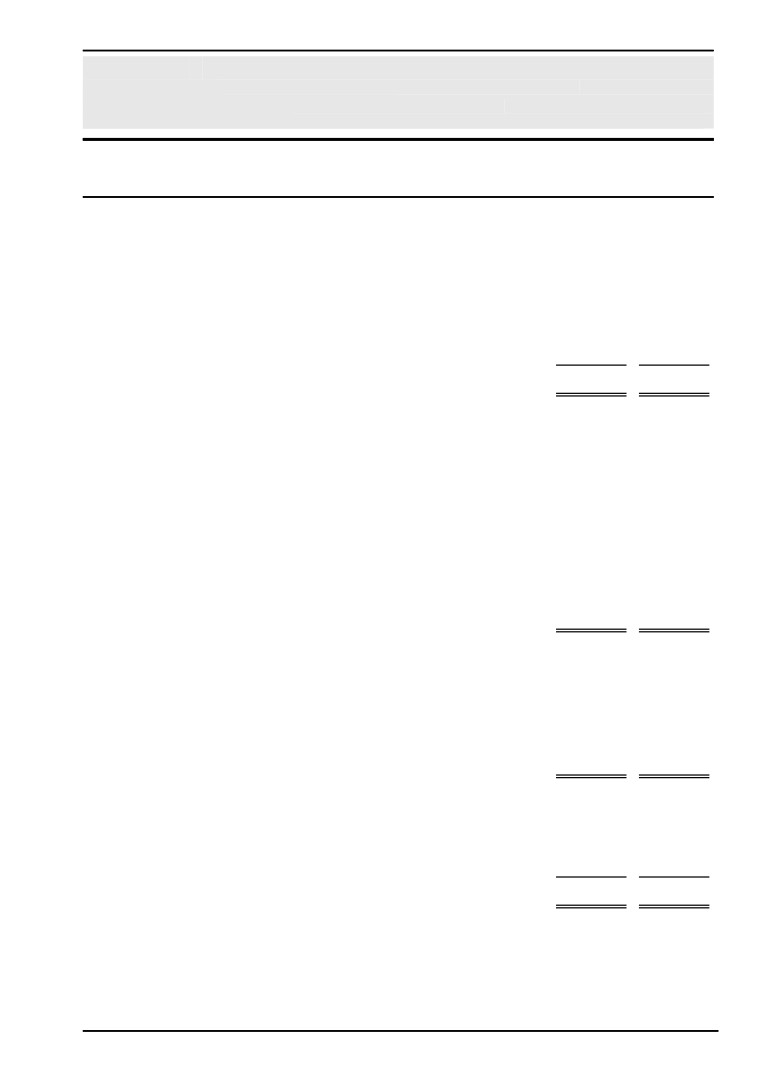

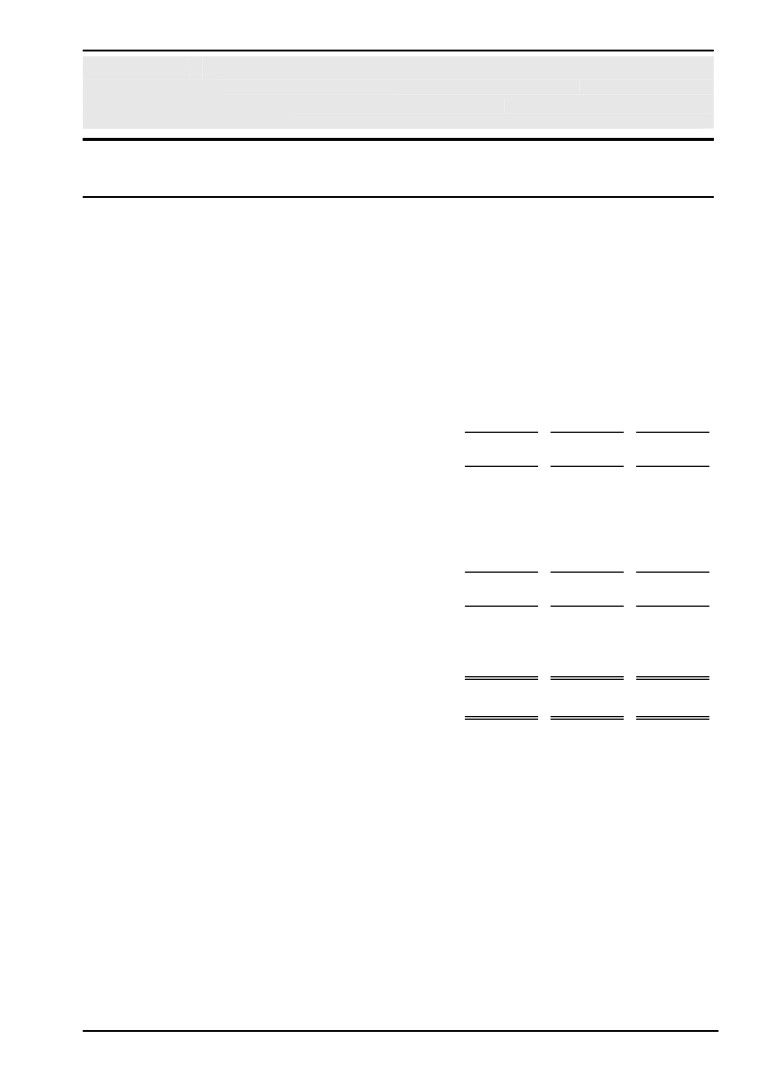

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 MARCH 2020

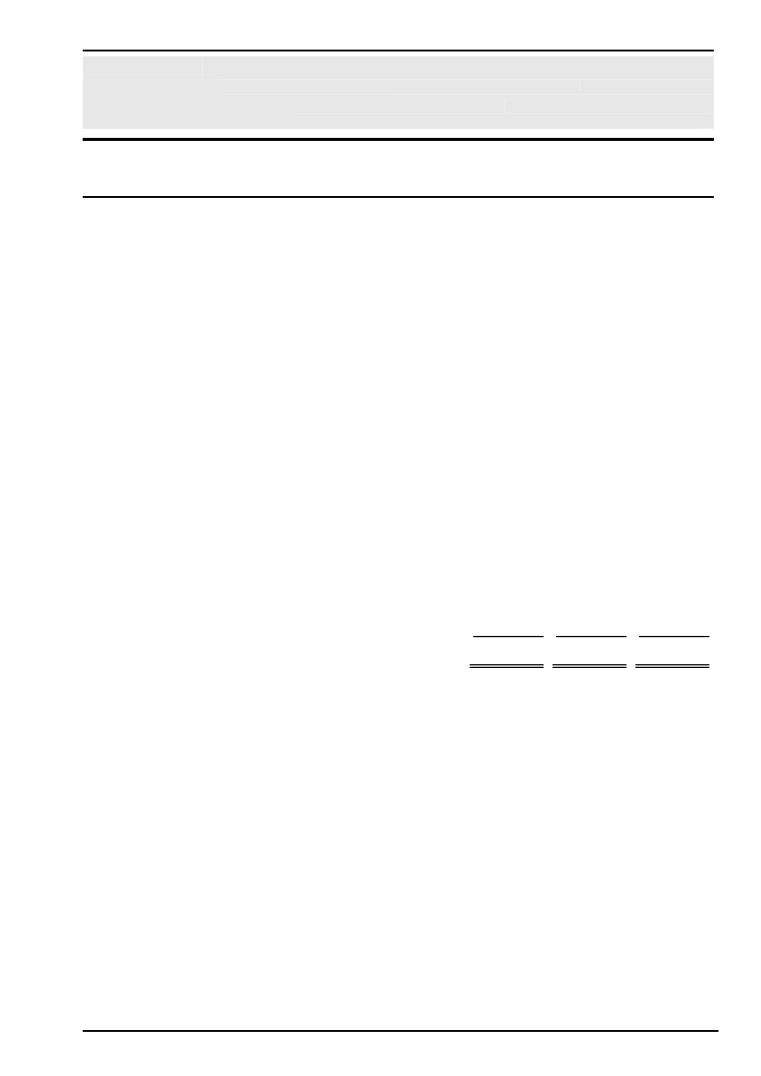

2020

2019

£

£

Cash flows from operating activities

Surplus for the financial year

428,464

11,913,510

Adjustments for:

Depreciation of tangible assets

24,291

18,674

Loss on disposal of tangible assets

1,103

-

Interest received

(577,794)

(452,085)

Taxation charge

72,399

56,217

(Increase)/decrease in debtors

(448,303)

875,074

(Decrease)/increase in creditors

(25,120)

270,569

Increase in provisions

-

620,000

Increase in net pension assets/liabs

75,000

105,000

Corporation tax (paid)

(56,057)

(7,341)

Net cash generated from operating activities

(506,017)

13,399,618

Cash flows from investing activities

Purchase of tangible fixed assets

(28,081)

(38,371)

New loans to associates

-

(6,549,870)

Associates loans repaid

2,312,683

3,681,004

Purchase of unlisted and other investments

(339,400)

(710,745)

Interest received

94,175

262,645

Income from investments

25,000

-

Net cash from investing activities

2,064,377

(3,355,337)

Net increase in cash and cash equivalents

1,558,360

10,044,281

Cash and cash equivalents at beginning of year

38,445,893

28,401,612

Cash and cash equivalents at the end of year

40,004,253

38,445,893

Cash and cash equivalents at the end of year comprise:

Cash at bank and in hand

40,004,253

38,445,893

40,004,253

38,445,893

The notes on pages 18 to 37 form part of these financial statements.

Page 17

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

1.

General information

New Anglia Local Enterprise Partnership Limited is a private company limited by guarantee and is

incorporated in England. The address of the registered office is Mills & Reeve LLP, 1 St James Court,

Norwich, Norfolk NR3 1RU. The address of the trading office is Centrum, Norwich Research Park,

Norwich, Norfolk, NR4 7UG. The nature of the company operations and its principal activities are set out

in the strategic report.

The only subsidiary within the Group is New Anglia Capital Ltd. This is included within the consolidation.

New Anglia Capital Ltd is a private company limited by guarantee and is incorporated in England. The

address of the registered and trading offices is the same as the parent company.

2.

Accounting policies

2.1

Basis of preparation of financial statements

The financial statements have been prepared under the historical cost convention unless otherwise

specified within these accounting policies and in accordance with Financial Reporting Standard 102,

the Financial Reporting Standard applicable in the UK and the Republic of Ireland and the

Companies Act 2006.

The financial statements are presented in Sterling, rounded to the nearest £1, which is the functional

currency of the Group.

The preparation of financial statements in compliance with FRS 102 requires the use of certain

critical accounting estimates. It also requires Group management to exercise judgment in applying

the Group's accounting policies (see note 3).

The Company has taken advantage of the exemption allowed under section 408 of the Companies

Act 2006 and has not presented its own Statement of Comprehensive Income in these financial

statements.

Due to the nature of the Company's activities, the directors consider that it would be inappropriate to

present the Statement of Comprehensive Income in either of the standard formats recognised by the

Companies Act 2006. The format adopted has been selected as it presents the categories of income

and expenditure more accurately for readers of the financial statements

The following principal accounting policies have been applied:

2.2

Basis of consolidation

The consolidated financial statements present the results of the Company and its own subsidiary

("the Group") as if they form a single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

Page 18

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

2.

Accounting policies (continued)

2.3

Revenue recognition

Income arising in the year is analysed into either Operational Activity or Designated Project Funding.

Operational Activity includes income recieved to cover the day to day core funding requirements of

the LEP such as administration costs and staff remuneration. It also includes income to fund certain

projects undertaken directly by the LEP. Designated Project Funding includes income received for

specific projects which are then distributed by the LEP to third parties. They are generally funds

provided by Government or other agencies. Costs directly attributable to designated projects are

charged against this income and shown as an expense. Where the LEP incurs costs which may be

partly attributable to Operational Activity and partly to designated projects then the Board allocate

such expenditure based on a fair and reasonable assessment of the time and cost expended on

each project.

Government grants are accounted for under the performance model as permitted by Financial

Reporting Standard 102. Government grants are recognised to the extent that it is probable that the

economic benefits will flow to the Company and the revenue can be reliably measured.

Other funding is recognised to the extent that it is probable that the economic benefits will flow to the

Company and the revenue can be reliably measured.

2.4

Operating leases: the Group as lessee

Rentals paid under operating leases are charged to Consolidated Statement of Comprehensive

Income on a straight line basis over the lease term.

2.5

Interest income

Interest income is recognised in the Consolidated Statement of Comprehensive Income using the

effective interest method.

2.6

Taxation

Tax is recognised in profit or loss except that a charge attributable to an item of income and expense

recognised as other comprehensive income or to an item recognised directly in equity is also

recognised in other comprehensive income or directly in equity respectively.

The current income tax charge is calculated on the basis of tax rates and laws that have been

enacted or substantively enacted by the balance sheet date in the countries where the Company and

the Group operate and generate income.

The Company operates as a not-for-profit entity, and receives direct financial support from

constituent local authorities in addition to grants from Government. It does not carry out a trade for

tax purposes. As a result, the net surplus arising from these activities is non-trading and is exempt

from corporation tax. The Company is liable to corporation tax on bank interest and other investment

income.

Page 19

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

2.

Accounting policies (continued)

2.7

Pensions

Defined contribution pension plan

The Group oeprates a defined contribution plan for its employees. A defined contribution plan is a

pension plan under which the Group pays fixed contributions into a separate entity. Once the

contributions have been paid the Group has no further payment obligations.

The contributions are recognised as an expense in the Consolidated Statement of Comprehensive

Income when they fall due. Amounts not paid are shown in accruals as a liability in the Balance

Sheet. The assets of the plan are held separately from the Group in independently administered

funds.

Defined benefit pension plan

The Group provides retirement benefits for certain employees through the Norfolk Pension Fund, a

defined benefit pension plan. A defined benefit plan defines the pension benefit that the employee will

receive on retirement, usually dependent upon several factors including but not limited to age, length

of service and remuneration.

The liability recognised in the Balance Sheet in respect of the defined benefit plan is the present

value of the defined benefit obligation at the end of the balance sheet date less the fair value of plan

assets at the balance sheet date (if any) out of which the obligations are to be settled.

The defined benefit obligation is calculated using the projected unit credit method. Annually the

company engages independent actuaries to calculate the obligation. The present value is determined

by discounting the estimated future payments using market yields on high quality corporate bonds

that are denominated in sterling and that have terms approximating to the estimated period of the

future payments ('discount rate').

The fair value of plan assets is measured in accordance with the FRS 102 fair value hierarchy and in

accordance with the Group's policy for similarly held assets. This includes the use of appropriate

valuation techniques.

Actuarial gains and losses arising from experience adjustments and changes in actuarial

assumptions are charged or credited to other comprehensive income. These amounts together with

the return on plan assets, less amounts included in net interest, are disclosed as 'Remeasurement of

net defined benefit liability'.

The cost of the defined benefit plan, recognised in profit or loss as employee costs, except where

included in the cost of an asset, comprises:

a) the increase in net pension benefit liability arising from employee service during the period; and

b) the cost of plan introductions, benefit changes, curtailments and settlements.

The net interest cost is calculated by applying the discount rate to the net balance of the defined

benefit obligation and the fair value of plan assets. This cost is recognised in profit or loss as a

'finance expense'.

Page 20

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

2.

Accounting policies (continued)

2.8

Tangible fixed assets

Tangible fixed assets under the cost model are stated at historical cost less accumulated

depreciation and any accumulated impairment losses. Historical cost includes expenditure that is

directly attributable to bringing the asset to the location and condition necessary for it to be capable of

operating in the manner intended by management.

Depreciation is charged so as to allocate the cost of assets less their residual value over their

estimated useful lives, using the straight-line method.

Depreciation is provided on the following basis:

Office Improvements

- 16.67% straight line

Equipment

- 20 - 33% straight line

The assets' residual values, useful lives and depreciation methods are reviewed, and adjusted

prospectively if appropriate, or if there is an indication of a significant change since the last reporting

date.

Gains and losses on disposals are determined by comparing the proceeds with the carrying amount

and are recognised in profit or loss.

2.9

Impairment of fixed assets

Assets that are subject to depreciation or amortisation are assessed at each balance sheet date to

determine whether there is any indication that the assets are impaired. Where there is any indication

that an asset may be impaired, the carrying value of the asset (or cash-generating unit to which the

asset has been allocated) is tested for impairment. An impairment loss is recognised for the amount

by which the asset's carrying amount exceeds its recoverable amount. The recoverable amount is the

higher of an asset's (or CGU's) fair value less costs to sell and value in use. For the purposes of

assessing impairment, assets are grouped at the lowest levels for which there are separately

identifiable cash flows (CGUs). Non-financial assets that have been previously impaired are reviewed

at each balance sheet date to assess whether there is any indication that the impairment losses

recognised in prior periods may no longer exist or may have decreased.

2.10 Valuation of investments

Investments in unlisted companies are initally measured at cost, and subsequently stated at cost less

accumulated impairment.

Once an impairment loss has been identified for an asset measured at cost less impairment, its

amount is measured as the difference between the asset's carrying amount and the amount for which

the asset could be sold at the reporting date. This amount is then recognised in the Consolidated

Statement of Comprehensive Income.

2.11 Debtors

Short term debtors are measured at transaction price, less any impairment. Loans receivable are

measured initially at fair value, net of transaction costs, and are measured subsequently at amortised

cost using the effective interest method, less any impairment.

Page 21

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

2.

Accounting policies (continued)

2.12 Cash and cash equivalents

Cash is represented by cash in hand and deposits with financial institutions and Suffolk County

Council which are repayable without penalty on notice of not more than 24 hours. Cash equivalents

are highly liquid investments that mature in no more than three months from the date of acquisition

and that are readily convertible to known amounts of cash with insignificant risk of change in value.

In the Consolidated Statement of Cash Flows, cash and cash equivalents are shown net of bank

overdrafts that are repayable on demand and form an integral part of the Group's cash management.

2.13 Creditors

Short term creditors are measured at the transaction price. Other financial liabilities, including bank

loans, are measured initially at fair value, net of transaction costs, and are measured subsequently at

amortised cost using the effective interest method.

2.14 Provisions for liabilities

Provisions are made where an event has taken place that gives the Group a legal or constructive

obligation that probably requires settlement by a transfer of economic benefit, and a reliable estimate

can be made of the amount of the obligation.

Provisions are charged as an expense to the Consolidated Statement of Comprehensive Income in

the year that the Group becomes aware of the obligation, and are measured at the best estimate at

the Balance Sheet date of the expenditure required to settle the obligation, taking into account

relevant risks and uncertainties.

When payments are eventually made, they are charged to the provision carried in the Balance Sheet.

2.15 Financial instruments

The Group only enters into basic financial instrument transactions that result in the recognition of

financial assets and liabilities like trade and other debtors and creditors, loans from banks and other

third parties, loans to related parties and investments in non-puttable ordinary shares.

Financial assets that are measured at cost and amortised cost are assessed at the end of each

reporting period for objective evidence of impairment. If objective evidence of impairment is found, an

impairment loss is recognised in the Consolidated Statement of Comprehensive Income.

For financial assets measured at cost less impairment, the impairment loss is measured as the

difference between an asset's carrying amount and best estimate of the recoverable amount, which is

an approximation of the amount that the Group would receive for the asset if it were to be sold at the

balance sheet date.

Financial assets and liabilities are offset and the net amount reported in the Balance Sheet when

there is an enforceable right to set off the recognised amounts and there is an intention to settle on a

net basis or to realise the asset and settle the liability simultaneously.

Page 22

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

3.

Judgments in applying accounting policies and key sources of estimation uncertainty

The preparation of the financial statements requires management to make judgements, estimates and

assumptions that affect the amounts reported. These estimates and judgements are continually reviewed

and are based on experience and other factors, including expectations of future events that are believed

to be reasonable under the circumstances.

Significant judgements

The judgements (apart from those involving estimations) that management has made in the process of

applying the entity's accounting policies and that have the most significant effect on the amounts

recognised in the financial statements are as follows:

Impairment of investments

At the end of each reporting period, the Group assess whether there is objective evidence of impairment

of any financial assets that are measured at cost or amortised cost. If there is objective evidence of

impairment, the entity shall recognise an impairment loss in the Consolidated Statement of

Comprehensive Income immediately.

Pensions

The liability recognised in the balance sheet in respect of the group's retirement benefit obligations

represents the liabilties of the group's defined benefit pension scheme after deduction of the fair value of

the related assets. The schemes' liabilties are derived by estimating the ultimate cost of benefits payable

by the scheme and reflecting the discounted value of the proportion accrued by the year end in the

balance sheet. In order to arrive at these estimates, a number of key financial and non-financial

assumptions are made by management, changes to which could have a material impact upon the net

deficit and also the net cost recognised in the profit and loss account. The principle assumptions relate to

the rate of inflation, mortality and the discount rate. The assumed rate of inflation is important because this

affects the rate at which salaries grow and therefore the size of the pension that employees receive upon

retirement. Over the longer term, rates of inflation can vary significantly.

The overall benefits payable by the scheme will also depend upon the length of time that members of the

schemes live for; the longer they remain alive, the higher the cost of the pension benefits to be met by the

scheme. Assumptions are made regarding the expected lifetime of the schemes' members, based upon

recent national experience. However, given the rates of advance in medical science, it is uncertain

whether these assumptions will prove to be accurate in practice.

The rate used to discount the resulting cash flows is equivalent to the market yield at the statement of

financial position date on UK government securities with a similar duration to the schemes liabilities. This

rate is potentially subject to significant variation. The net cost recognised in the profit and loss account is

also affected by the return on the schemes' assets. The impact of the pension estimates on the group’s

accounts can be seen in note 16.

Key sources of estimation uncertainty

Accounting estimates and assumptions are made concerning the future and, by their nature, will rarely

equal the related actual outcome. The key assumptions and other sources of estimation uncertainty that

have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities

within the next financial year are as follows:

- Recoverability of the loans issued as investments.

- Depreciation and estimation of the residual value of the asset at the end of its useful economic life.

- Defined benefit pension scheme liability.

Page 23

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

4.

Income

Income arises from:

2020

2019

£

£

Grants

29,221,624

38,208,053

Enterprise Zones

912,781

857,950

30,134,405

39,066,003

The above income is wholly attributable to the principal activity of the group which is undertaken in the

United Kingdom

5.

Operating (loss)/profit

The operating (loss)/profit is stated after charging:

2020

2019

£

£

Depreciation of tangible fixed assets

24,291

18,674

Other operating lease rentals

77,102

77,638

Impairment of investments

-

620,000

6.

Auditors' remuneration

2020

2019

£

£

Fees payable to the Group's auditor and its associates for the audit of the

Group's annual financial statements

10,050

9,000

Fees payable to the Group's auditor and its associates in respect of:

Taxation compliance services

950

950

All other services

3,000

4,470

3,950

5,420

Page 24

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

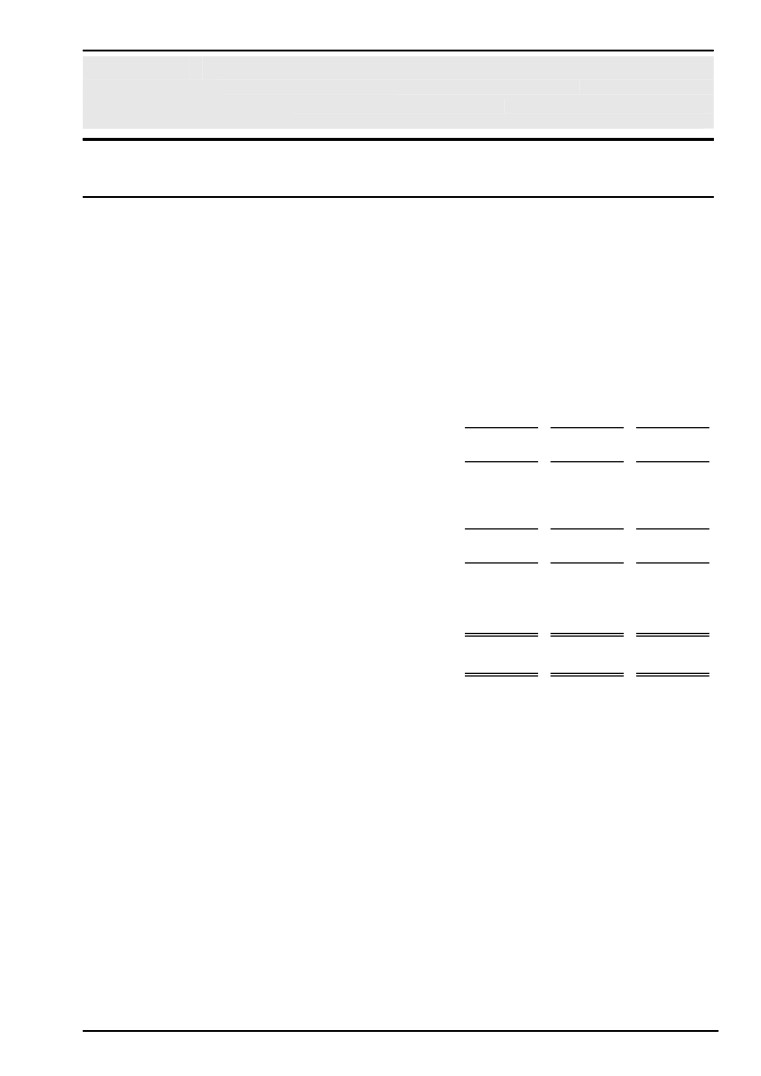

7.

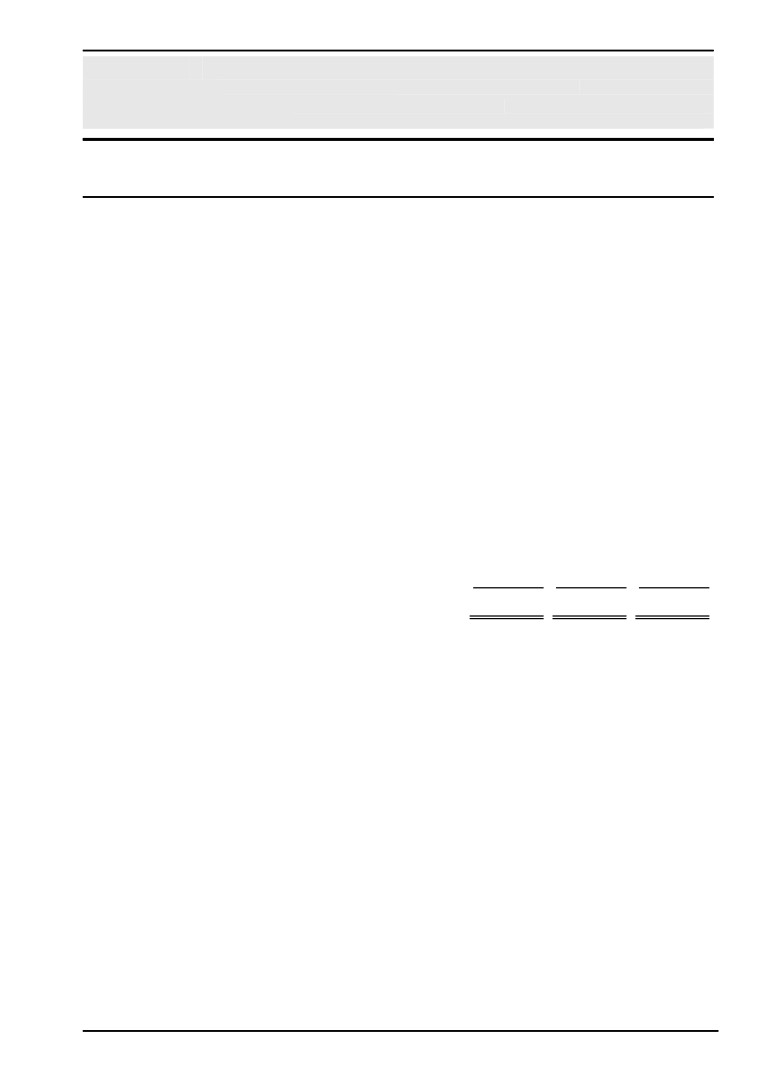

Employees

Staff costs were as follows:

Group

Group

Company

Company

2020

2019

2020

2019

£

£

£

£

Wages and salaries

2,435,361

1,957,258

2,403,612

1,921,812

Social security costs

247,639

202,285

247,639

202,285

Cost of defined benefit scheme

70,000

103,000

70,000

103,000

Cost of defined contribution scheme

133,331

139,235

133,331

139,235

2,886,331

2,401,778

2,854,582

2,366,332

The directors do not receive any emoluments.

The total remuneration payable in respect of 7 (2019: 7) key management personnel amounted to

£602,498 (2019: 574,778)

The average monthly number of employees during the year was as follows:

2020

2019

No.

No.

Leadership Team

7

7

Project Delivery Team

48

38

Administrative Team

7

5

62

50

Page 25

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

8.

Taxation

2020

2019

£

£

Corporation tax

Current tax on profits for the year

72,731

56,217

Adjustments in respect of prior periods

(332)

-

72,399

56,217

Deferred tax

Total deferred tax

-

-

Taxation on profit on ordinary activities

72,399

56,217

Factors affecting tax charge for the year

The tax assessed for the year is lower than (2019 - lower than) the standard rate of corporation tax in the

UK of 19% (2019 - 19%). The differences are explained below:

2020

2019

£

£

Surplus on ordinary activities before tax

500,863

11,969,727

Surplus on ordinary activities multiplied by standard rate of corporation tax

in the UK of 19% (2019 - 19%)

95,164

2,373,307

Effects of:

Adjustments to tax charge in respect of prior periods

(332)

-

Non-taxable income

(22,433)

(2,317,090)

Total tax charge for the year

72,399

56,217

Factors that may affect future tax charges

There were no factors that may affect future tax charges.

Page 26

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

9.

Tangible fixed assets

Group and Company

Fixtures and

Office

fittings

equipment

Total

£

£

£

Cost or valuation

At 1 April 2019

6,312

93,528

99,840

Additions

-

28,081

28,081

Disposals

-

(20,819)

(20,819)

At 31 March 2020

6,312

100,790

107,102

Depreciation

At 1 April 2019

3,682

50,819

54,501

Charge for the year on owned assets

1,053

23,238

24,291

Disposals

-

(19,716)

(19,716)

At 31 March 2020

4,735

54,341

59,076

Net book value

At 31 March 2020

1,577

46,449

48,026

At 31 March 2019

2,630

42,709

45,339

All of the Group's tangible fixed assets are held in the Parent company.

Page 27

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

10.

Fixed asset investments

Group

Other

Loans

investments

Total

£

£

£

Cost or valuation

At 1 April 2019

12,501,092

2,126,833

14,627,925

Additions

-

339,400

339,400

Disposals

(2,212,683)

(100,000)

(2,312,683)

At 31 March 2020

10,288,409

2,366,233

12,654,642

Impairment

At 1 April 2019

500,000

120,000

620,000

At 31 March 2020

500,000

120,000

620,000

Net book value

At 31 March 2020

9,788,409

2,246,233

12,034,642

At 31 March 2019

12,001,092

2,006,833

14,007,925

Page 28

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

10.

Fixed asset investments (continued)

Company

Loans

£

Cost or valuation

At 1 April 2019

12,501,092

Disposals

(2,212,683)

At 31 March 2020

10,288,409

Impairment

At 1 April 2019

500,000

At 31 March 2020

500,000

Net book value

At 31 March 2020

9,788,409

At 31 March 2019

12,001,092

11.

Debtors

Group

Group

Company

Company

2020

2019

2020

2019

£

£

£

£

Trade debtors

650,179

217,439

650,179

217,439

Amounts owed by group undertakings

-

-

2,246,233

1,982,024

Other debtors

358,480

1,209,926

330,061

1,209,926

Prepayments and accrued income

2,493,646

1,168,017

2,493,646

1,168,018

3,502,305

2,595,382

5,720,119

4,577,407

Page 29

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

12.

Creditors: Amounts falling due within one year

Group

Group

Company

Company

2020

2019

2020

2019

£

£

£

£

Trade creditors

164,149

135,604

164,149

135,604

Corporation tax

72,731

56,389

72,731

56,389

Other taxation and social security

62,866

61,354

62,866

61,354

Other creditors

20,472

20,850

20,472

20,850

Accruals and deferred income

356,432

411,230

352,821

411,230

676,650

685,427

673,039

685,427

13.

Financial instruments

Group

Group

Company

Company

2020

2019

2020

2019

£

£

£

£

Financial assets

Financial assets measured at amortised cost

55,484,605

54,926,348

53,209,953

52,919,515

Financial liabilities

Financial liabilities measured at amortised

cost

(272,844)

(249,160)

(269,234)

(249,160)

Financial assets measured at amortised cost comprise equity investments, loans made, accrued

income, trade debtors, other debtors and cash at bank

Financial liabilities measured at amortised cost comprise trade creditors, other creditors and accruals.

Page 30

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

14.

Reserves

Other reserves represent amounts received and held for specific long term projects as follows:

Balance

Surplus /

Balance

brought

(deficit) in

carried

forward

year

forward

£

£

£

GROUP

Profit and Loss Account

678,119

93,198

771,317

Growing Places Capital Infrastructure

22,580,894

196,430

22,777,324

Growth Deal

22,421,085

(3,985,925)

18,435,160

New Anglia Capital Fund

2,684,004

-

2,684,004

Growing Business Fund

330,809

2,321,308

2,652,117

Programmes Administration

1,816,940

588,441

2,405,381

Growing Places Other Capital Allocation

2,073,481

-

2,073,481

Enterprise Zone

980,293

489,009

1,469,302

Innovative Projects Fund

500,000

877,583

1,377,583

Projects Revenue Allocation

274,377

(38,714)

235,663

Capital Funds

24,808

-

24,808

Redundancy Reserve

12,309

-

12,309

Local Transport Body Reserves

31,993

(37,866)

(5,873)

Pension

(173,000)

13,000

(160,000)

54,236,112

516,464

54,752,576

Page 31

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

14.

Reserves (continued)

Balance

Surplus /

Balance

brought

(deficit) in

carried

forward

year

forward

£

£

£

COMPANY

Profit and Loss Account

678,119

93,198

771,317

Growing Places Capital Infrastructure

22,580,894

196,430

22,777,324

Growth Deal

22,421,085

(3,985,925)

18,435,160

New Anglia Capital Fund

2,684,004

-

2,684,004

Growing Business Fund

330,809

2,321,308

2,652,117

Programmes Administration

1,816,940

588,441

2,405,381

Growing Places Other Capital Allocation

2,073,481

-

2,073,481

Enterprise Zone

980,293

489,009

1,469,302

Innovative Projects Fund

500,000

877,583

1,377,583

Projects Revenue Allocation

274,377

(38,714)

235,663

Redundancy Reserve

12,309

-

12,309

Local Transport Body Reserves

31,993

(37,866)

(5,873)

Pension

(173,000)

13,000

(160,000)

54,211,304

516,464

54,727,768

Page 32

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

14.

Reserves (continued)

The movement on Other Reserves is an overall surplus, this reflects grant income received in excess of

the grants distributed from grant reserves during the year.

The Growing Places Capital Infrastructure reserve and Other Capital Allocation reserve represent funding

from HM Government for the purposes of providing financial support for Infrastructure projects and other

projects demonstrating significant regional or local economic benefit.

Of this balance approximately £3.3 million is scheduled to be advanced to committed projects during the

next financial year. This is in addition to the £12.5 million which is currently advanced to existing projects.

Projects Revenue Allocation is funding from the Growing Places fund set aside to fund a range of

economic development projects.

Growth Deal reserve is part of the LEP's agreed Growth Deal programme from government and is

committed to specific projects. This funding will be advanced to those projects during the next financial

year.

New Anglia Capital Fund has been established by New Anglia LEP with repaid funding from its Growing

Places Fund. These funds are managed by its subsidiary company, New Anglia Capital and are co-

invested with private investors to support start-ups with innovative ideas in high growth companies.

The Growing Business Fund is a mechanism for providing financial support to businesses in Norfolk and

Suffolk. Spending decisions for the fund rest with a panel independent to the LEP. The reserve funding

has been allocated and will be used during the next financial year.

Programme Administration is part of the funding within Growing Places and Growth Deal to run the

programmes.

The Enterprise Zones consist of

16 identified sites and working with nine local authority partners

encourage businesses and inward investment to locate on the Enterprise Sites, encouraging innovation

and higher skilled jobs, target support to help small businesses to grow.

The Innovative Projects Fund is a revenue based fund and is generated from the LEP’s Enterprise Zones.

The fund will prioritise projects which accelerate the LEP's growth of ambition, themes, sectors and key

growth locations in the Economic Strategy.

The Redundancy Reserve relates to monies received from sponsoring authorities on the transfer of the

company's employees under Transfer of Undertakings Protection Employment regulations to fund any

potential future redundancy expenditure in respect of those employees.

Local Transport Body Income is funding allocated by HM Government to support the Norfolk and Suffolk

Local Transport Body.

The Defined Benefit Pension reserve represents the Group's net liability position in relation to its defined

benefit pension scheme as at the year end (see note 16).

Page 33

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

15.

Pension commitments

The Group operates a Defined Contribution Pension scheme. The assets of the scheme are held

separately from the Group in an independently administered fund. The pension cost charge represents

contributions payable by the Group to the fund and amounted to £133,331 (2019: £116,631). Contributions

totalling £nil (2019: £20,827) were payable to the fund at the balance sheet date.

The Group also operates a Defined Benefit Pension Scheme.

A full actuarial valuation of the defined benefit scheme was carried out at 31 March 2020 by a qualified

independent actuary. Contributions to the scheme are made by the group based on the advice of the

actuary, with the aim of making good the deficit over the remaining working life of the employees.

Reconciliation of present value of plan liabilities:

2020

2019

£

£

Reconciliation of present value of plan liabilities

At the beginning of the year

173,000

-

Current service cost

55,000

47,000

Interest income

(23,000)

(23,000)

Interest cost

28,000

25,000

Actuarial gains/losses

(88,000)

68,000

Past service cost

15,000

56,000

At the end of the year

160,000

173,000

Composition of plan liabilities:

2020

2019

£

£

Schemes wholly funded

160,000

173,000

Total plan liabilities

160,000

173,000

2020

2019

£

£

Present value of plan liabilities

(160,000)

(173,000)

Net pension scheme liability

(160,000)

(173,000)

Page 34

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

15.

Pension commitments (continued)

The amounts recognised in profit or loss are as follows:

2020

2019

£

£

Current service cost

(55,000)

(47,000)

Past service cost

(8,000)

(56,000)

Opening difference on plan assets and liabilities

(7,000)

-

Total

(70,000)

(103,000)

Other Interest - on defined benefit liability

28,000

25,000

Interest Income on pension scheme assets

(23,000)

(23,000)

Net interest cost

5,000

2,000

Reconciliation of fair value of plan liabilities were as follows:

2020

2019

£

£

Opening defined benefit obligation

1,084,000

904,000

Opening difference on plan liabilities

3,000

-

Current service cost

55,000

47,000

Contributions by scheme participants

14,000

12,000

Actuarial gains and (losses)

(146,000)

96,000

Past service costs

8,000

-

Interest cost

28,000

25,000

Closing defined benefit obligation

1,046,000

1,084,000

Reconciliation of fair value of plan assets were as follows:

2020

2019

£

£

Opening fair value of scheme assets

911,000

848,000

Opening difference on plan assets

(4,000)

-

Interest income on plan assets

23,000

23,000

Return on plan assets

(58,000)

28,000

Contributions by employer

14,000

12,000

886,000

911,000

Page 35

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

15.

Pension commitments (continued)

The cumulative amount of actuarial gains and losses recognised in the Consolidated Statement of

Comprehensive Income was £88,000 (2019 - £(72,000)).

The Group expects to contribute £NIL to its Defined Benefit Pension Scheme in 2021.

Principal actuarial assumptions at the Balance Sheet date (expressed as weighted averages):

2020

2019

%

%

Discount rate

2.3

2.5

Future salary increases

2.5

2.7

Future pension increases

1.8

2.4

Mortality rates

- for a male aged 65 now

21.7

22.1

- at 65 for a male aged 45 now

22.8

24.1

- for a female aged 65 now

23.9

24.4

- at 65 for a female member aged 45 now

25.5

26.4

Major categories of plan assets as a percentage of total plan assets

2020

2019

Equity

48%

50%

Bonds

36%

35%

Property

14%

12%

Cash

2%

3%

Page 36

NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP LIMITED

(A Company Limited by Guarantee)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MARCH 2020

16.

Commitments under operating leases

At 31 March 2020 the Group and the Company had future minimum lease payments under non-

cancellable operating leases as follows:

Group

Group

Company

Company

2020

2019

2020

2019

£

£

£

£

Not later than 1 year

38,976

40,878

38,976

40,878

Later than 1 year and not later than 5 years

16,666

53,142

16,666

53,142

55,642

94,020

55,642

94,020

17.

Company status

The company is a private company limited by guarantee and consequently does not have share capital.

Each of the members is liable to contribute an amount not exceeding £1 towards the assets of the

company in the event of liquidation.

18.

Related party transactions

During the year, the company incurred rental and room hire costs from Anglia Innovation Partnership LLP