COMPANY REGISTRATION NUMBER: 07685830

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Financial statements

31 March 2018

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Financial statements

Year ended 31 March 2018

Contents

Page

Officers and professional advisers

1

Strategic report

2

Directors' report

4

Independent auditor's report to the members

6

Consolidated statement of comprehensive income

9

Consolidated statement of financial position

10

Company statement of financial position

11

Consolidated statement of cash flows

12

Notes to the financial statements

13

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Officers and professional advisers

The board of directors

Mr D Field - Chair

Ms J Wheeler

Mr S Oliver

Prof T Whitley

Mrs L Rix

Mr J Griffiths

Dr N Savvas

Mr D Ellesmere

Mr A Proctor

Prof D Richardson

Mr D Keen

Mrs S Ruddock

Mr J Reynolds

Mr M Hicks

Mr W Nunn

Mr A Waters

Registered office

Mills & Reeve LLP

1 St James Court

Norwich

Norfolk

NR3 1RU

Auditor

Lovewell Blake LLP

Chartered Accountants & statutory auditor

Excelsior House

9 Quay View Business Park

Barnards Way

Lowestoft

NR32 2HD

- 1 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Strategic report

Year ended 31 March 2018

New Anglia Local Enterprise Partnership continues drive economic growth across Norfolk and Suffolk,

investing in key projects and supporting the region's businesses.

New Anglia LEP, with local authority and business partners, launched the new Economic Strategy for

Norfolk and Suffolk in autumn 2017, highlighting the key themes for local growth - Our Offer to the World,

Driving Inclusion and Skills and Driving Business Growth and Productivity.

The LEP's Local Growth Fund with Government - totalling £290million since 2014 - is being used to support

projects and programmes which will boost skills, drive innovation, provide targeted business support and

improve transport and infrastructure. Projects funded through the Growth Deal are already benefiting the

area, including the new Broadland Northway road to the north of Norwich, the Bury St Edmunds relief road

and the flagship International Aviation Academy Norwich, which is delivering industry-leading training in

aviation careers.

The LEP's business support programmes continue to offer free and impartial advice, helping firms to grow,

develop and innovate. The level of business support awarded by the LEP through its business grants has

passed £20million, created over 2,200 jobs and attracted more than £96million in private investment.

The LEP's Enterprise Zone sites deliver space for businesses to grow. The ten-site Space to Innovate Zone

celebrated its second anniversary in spring 2018 and is already delivering on its targets. To date, the zone

is home to 56 companies, employing 247 people.

Investments through the Growing Places Fund, which provides loans to kick-start development projects, are

helping to transform the area, with projects like the Winerack on Ipswich Waterfront and the Norwich Castle

Keep showcasing the range of investments being made, from unlocking development sites to supporting

historically-important cultural tourism attractions.

LEP projects are each monitored against a series of KPIs, with their progress rag rated.

Throughout the year, the LEP continues to look to the future. Work with local authorities and businesses on

the delivery and implementation plans for the Economic Strategy continues and collaborative working has

also enhanced the recent developed of the East Integrated Transport Strategy and a Local Energy East

Strategy.

The LEP's reserves increased in this financial year. This is largely due to Growth Deal funding received

from Government and is committed to specific projects. This funding will be advanced to those projects

during the next financial year.

The majority of the LEP's funding is secured from Government, both core funding and project funding. A

principal risk is the Government withholding this funding, which has materialised in the case of two other

LEPs.

New Anglia LEP mitigates this risk by ensuring all funding is utilised in compliance with Government rules

and its governance and processes are "best in class".

In a deep dive review carried out by the Government in February 2018, New Anglia LEP's governance was

rated as outstanding in all six areas inspected.

- 2 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Strategic report (continued)

Year ended 31 March 2018

This report was approved by the board of directors on 6 September 2018 and signed on behalf of the board

by:

Mr D Field - Chair

Director

Registered office:

Mills & Reeve LLP

1 St James Court

Norwich

Norfolk

NR3 1RU

- 3 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Directors' report

Year ended 31 March 2018

The directors present their report and the financial statements of

the

group

for

the

year

ended

31 March 2018.

Directors

The directors who served the company during the year were as follows:

Mr D Field - Chair

Ms J Wheeler

Mr C Noble

Mr C Jordan

Mr S Oliver

Prof T Whitley

Mrs L Rix

Mr J Griffiths

Mr M Goodall

Ms D Tanner OBE

Dr N Savvas

Mr D Ellesmere

Mr A Proctor

Prof D Richardson

Mr D Keen

Mrs S Ruddock

Mr J Reynolds

Mr M Pendlington

Mr A Waters

Mr D Keen was appointed as a director on 19 July 2017.

Mrs S Ruddock was appointed as a director on 19 July 2017.

Mr J Reynolds was appointed as a director on 17 January 2018.

Mr M Hicks was appointed as a director on 24 May 2018.

Mr W Nunn was appointed as a director on 4 June 2018.

Mr M Goodall retired as a director on 21 June 2017.

Ms D Tanner OBE retired as a director on 21 June 2017.

Mr M Pendlington retired as a director on 20 September 2017.

Mr C Noble retired as a director on 24 May 2018.

It is with regret that the directors report that Mr C Jordan passed away on 9 June 2018.

Events after the end of the reporting period

Particulars of events after the reporting date are detailed in note 22 to the financial statements.

Reserves policy

The majority of the LEP's reserves are designated for specific projects. In addition the LEP aims to achieve

a level of general reserves sufficient to enable it to cover core operational expenditure and certain

programme costs which are reimbursed at a later date when those programmes have sufficient funds.

Disclosure of information in the strategic report

The company has prepared a strategic report in accordance with section 414C of the Companies Act 2006.

- 4 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Directors' report (continued)

Year ended 31 March 2018

Directors' responsibilities statement

The directors are responsible for preparing the strategic report, directors' report and the financial

statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law

the directors have elected to prepare the financial statements in accordance with United Kingdom Generally

Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law). Under company

law the directors must not approve the financial statements unless they are satisfied that they give a true

and fair view of the state of affairs of the group and the company and the profit or loss of the group for that

period.

In preparing these financial statements, the directors are required to:

select suitable accounting policies and then apply them consistently;

make judgments and accounting estimates that are reasonable and prudent;

prepare the financial statements on the going concern basis unless it is inappropriate to presume that

the company will continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and

explain the company's transactions and disclose with reasonable accuracy at any time the financial position

of the company and enable them to ensure that the financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the company and hence for taking

reasonable steps for the prevention and detection of fraud and other irregularities.

Auditor

Each of the persons who is a director at the date of approval of this report confirms that:

so far as they are aware, there is no relevant audit information of which the group and the company's

auditor is unaware; and

they have taken all steps that they ought to have taken as a director to make themselves aware of any

relevant audit information and to establish that the group and the company's auditor is aware of that

information.

This report was approved by the board of directors on 6 September 2018 and signed on behalf of the board

by:

Mr D Field - Chair

Director

Registered office:

Mills & Reeve LLP

1 St James Court

Norwich

Norfolk

NR3 1RU

- 5 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Independent auditor's report to the members of New Anglia Local Enterprise

Partnership Limited

Year ended 31 March 2018

Opinion

We have audited the financial statements of New Anglia Local Enterprise Partnership Limited (the 'parent

company') and its subsidiaries

(the 'group') for the year ended

31 March 2018 which comprise the

consolidated statement of comprehensive income, company statement of comprehensive income,

consolidated statement of financial position, company statement of financial position, consolidated

statement of cash flows and the related notes, including a summary of significant accounting policies. The

financial reporting framework that has been applied in their preparation is applicable law and United

Kingdom Accounting Standards, including FRS 102 The Financial Reporting Standard applicable in the UK

and Republic of Ireland (United Kingdom Generally Accepted Accounting Practice).

In our opinion the financial statements:

give a true and fair view of the state of the group's and of the parent company's affairs as at 31 March

2018 and of the group's surplus for the year then ended;

have been properly prepared in accordance with United Kingdom Generally Accepted Accounting

Practice;

have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and

applicable law. Our responsibilities under those standards are further described in the auditor's

responsibilities for the audit of the financial statements section of our report. We are independent of the

group in accordance with the ethical requirements that are relevant to our audit of the financial statements

in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in

accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to

report to you where:

the directors' use of the going concern basis of accounting in the preparation of the financial

statements is not appropriate; or

the directors have not disclosed in the financial statements any identified material uncertainties that

may cast significant doubt about the group's or the parent company's ability to continue to adopt the

going concern basis of accounting for a period of at least twelve months from the date when the

financial statements are authorised for issue.

- 6 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Independent auditor's report to the members of New Anglia Local Enterprise

Partnership Limited (continued)

Year ended 31 March 2018

Other information

The directors are responsible for the other information. The other information comprises the information

included in the annual report, other than the financial statements and our auditor’s report thereon. Our

opinion on the financial statements does not cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information

and, in doing so, consider whether the other information is materially inconsistent with the financial

statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material misstatements, we are required to determine

whether there is a material misstatement in the financial statements or a material misstatement of the other

information. If, based on the work we have performed, we conclude that there is a material misstatement of

this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

the information given in the strategic report and the directors' report for the financial year for which the

financial statements are prepared is consistent with the financial statements; and

the strategic report and the directors' report have been prepared in accordance with applicable legal

requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and the parent company and its environment

obtained in the course of the audit, we have not identified material misstatements in the strategic report or

the directors' report.

We have nothing to report in respect of the following matters in relation to which the Companies Act 2006

requires us to report to you if, in our opinion:

adequate accounting records have not been kept by the parent company, or returns adequate for our

audit have not been received from branches not visited by us; or

the parent company financial statements are not in agreement with the accounting records and

returns; or

certain disclosures of directors' remuneration specified by law are not made; or

we have not received all the information and explanations we require for our audit.

- 7 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Independent auditor's report to the members of New Anglia Local Enterprise

Partnership Limited (continued)

Year ended 31 March 2018

Responsibilities of directors

As explained more fully in the directors' responsibilities statement, the directors are responsible for the

preparation of the financial statements and for being satisfied that they give a true and fair view, and for

such internal control as the directors determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the group's and the parent

company's ability to continue as a going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the directors either intend to liquidate the

group or the parent company or to cease operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes

our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate,

they could reasonably be expected to influence the economic decisions of users taken on the basis of these

financial statements.

A further description of our responsibilities for the audit of the financial statements is located on the

of our auditor’s report.

Use of our report

This report is made solely to the company's members, as a body, in accordance with chapter 3 of part 16 of

the Companies Act 2006. Our audit work has been undertaken so that we might state to the company's

members those matters we are required to state to them in an auditor's report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the

company and the company's members as a body, for our audit work, for this report, or for the opinions we

have formed.

Paul Briddon FCA BSc (Senior Statutory Auditor)

For and on behalf of

Lovewell Blake LLP

Chartered Accountants & statutory auditor

Excelsior House

9 Quay View Business Park

Barnards Way

Lowestoft

NR32 2HD

- 8 -

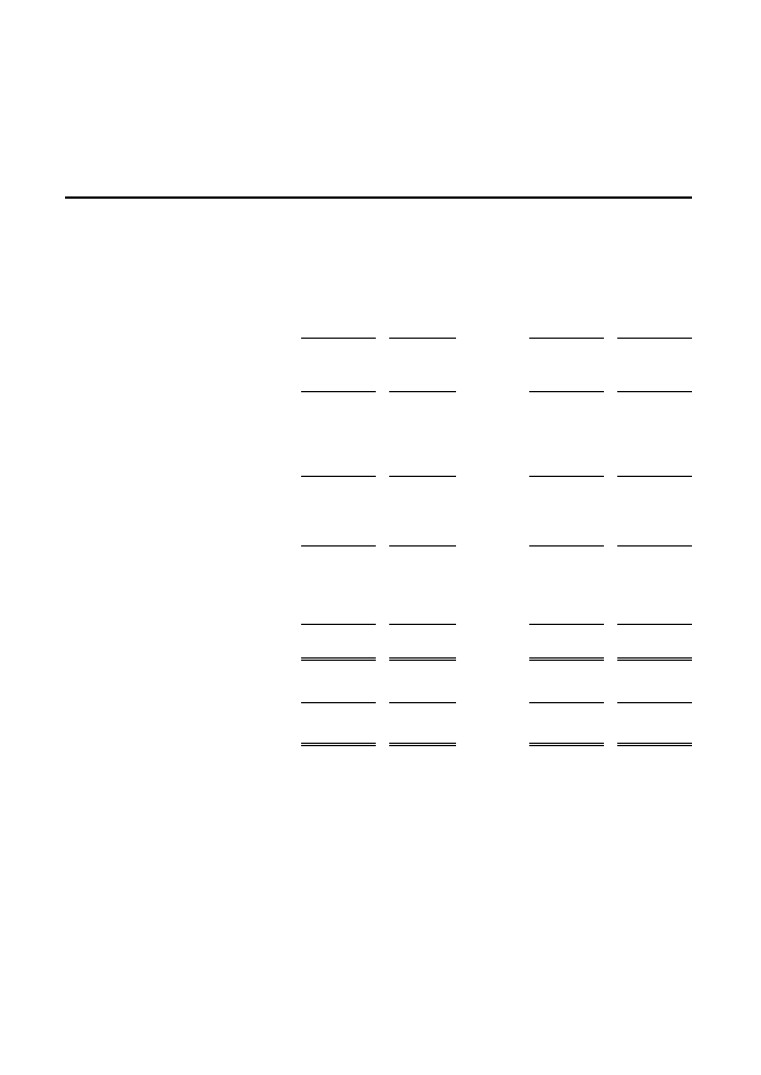

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Consolidated statement of comprehensive income

Year ended 31 March 2018

Designated

Project

Operational

Funding

Activity

Total

Total

2018

2018

2018

2017

£

£

Note

£

£

Operational income

-

1,379,015

6

1,379,015

#

986,328

Grant and project income

42,774,342

-

6

42,774,342

#

39,395,189

42,774,342

1,379,015

44,153,357

#

40,381,517

Grants issued

(26,382,074)

-

(26,382,074)

#

(37,422,327)

(26,382,074)

-

(26,382,074)

(37,422,327)

Gross surplus

16,392,268

1,379,015

17,771,283

#

2,959,190

Administrative expenses

(1,470,329)

(1,184,220)

(2,654,549)

#

(2,090,768)

Operating surplus

14,921,939

194,795

7

15,116,734

#

868,422

Interest receivable

431,299

2,454

433,753

#

222,176

Surplus on ordinary activities before

taxation

15,353,238

197,249

15,550,487

#

1,090,598

Taxation

(6,875)

(466)

11

(7,341)

#

(25,048)

Surplus for the financial year

15,346,363

196,783

15,543,146

#

1,065,550

Retained earnings at the start of the year

26,499,749

347,707

26,847,456

#

25,781,906

Retained earnings at the end of the year

41,846,112

544,490

42,390,602

#

26,847,456

All of the activities of the group are classed as continuing.

The notes on pages 12 to 23 form part of these financial statements.

- 9 -

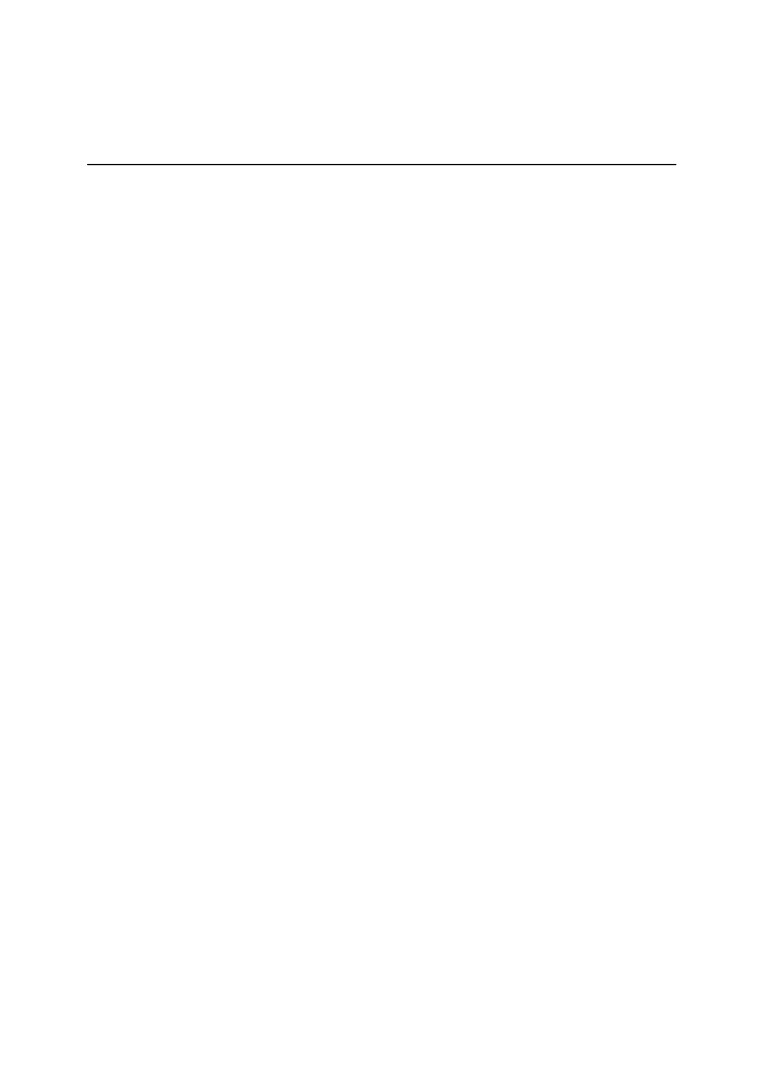

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Consolidated statement of financial position

31 March 2018

2018

2017

Note

£

£

Fixed assets

Tangible assets

12

25,642

24,905

Investments

13

11,048,314

9,965,837

11,073,956

9,990,742

Current assets

Debtors

14

3,281,016

2,287,159

Investments

16

-

597,000

Cash at bank and in hand

15

28,401,612

14,363,034

31,682,628

17,247,193

Creditors: Amounts falling due within one year

17

(365,982)

(390,479)

Net current assets

31,316,646

16,856,714

Total assets less current liabilities

42,390,602

26,847,456

Net assets

42,390,602

26,847,456

Capital and reserves

Other reserves, including the fair value reserve

20

41,846,112

26,499,749

Income and expenditure account

20

544,490

347,707

Members funds

42,390,602

26,847,456

These financial statements were approved by the

board of directors and

authorised for issue on

6

September 2018, and are signed on behalf of the board by:

Mr D Field - Chair

Director

Company registration number: 07685830

The notes on pages 13 to 23 form part of these financial statements.

- 10 -

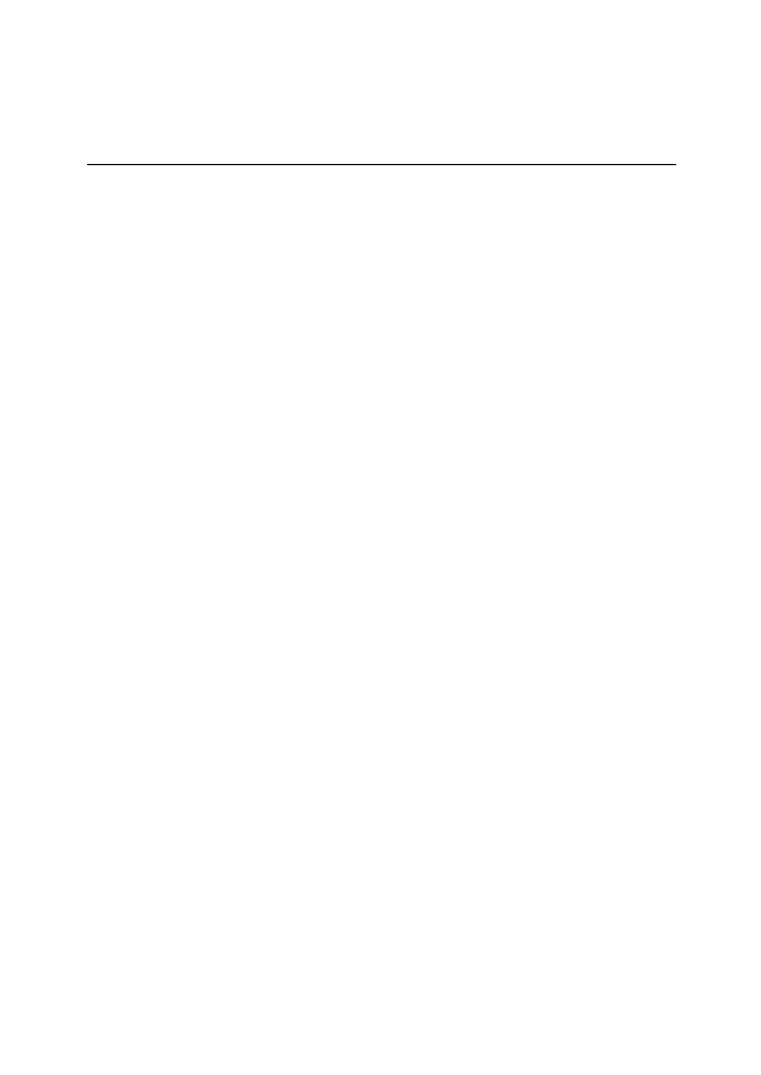

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Company statement of financial position

31 March 2018

2018

2017

Note

£

£

Fixed assets

Tangible assets

12

25,642

24,905

Investments

13

9,482,226

8,842,749

9,507,868

8,867,654

Current assets

Debtors

14

4,819,312

3,384,439

Investments

16

-

597,000

Cash at bank and in hand

15

28,401,612

14,363,034

33,220,924

18,344,473

Creditors: Amounts falling due within one year

17

(362,998)

(389,479)

Net current assets

32,857,926

17,954,994

Total assets less current liabilities

42,365,794

26,822,648

Net assets

42,365,794

26,822,648

Capital and reserves

Other reserves, including the fair value reserve

20

41,821,304

26,474,941

Income and expenditure account

20

544,490

347,707

Members funds

42,365,794

26,822,648

These financial statements were approved by the

board of directors and

authorised for issue on

6

September 2018, and are signed on behalf of the board by:

Mr D Field - Chair

Director

Company registration number: 07685830

The notes on pages 13 to 23 form part of these financial statements.

- 11 -

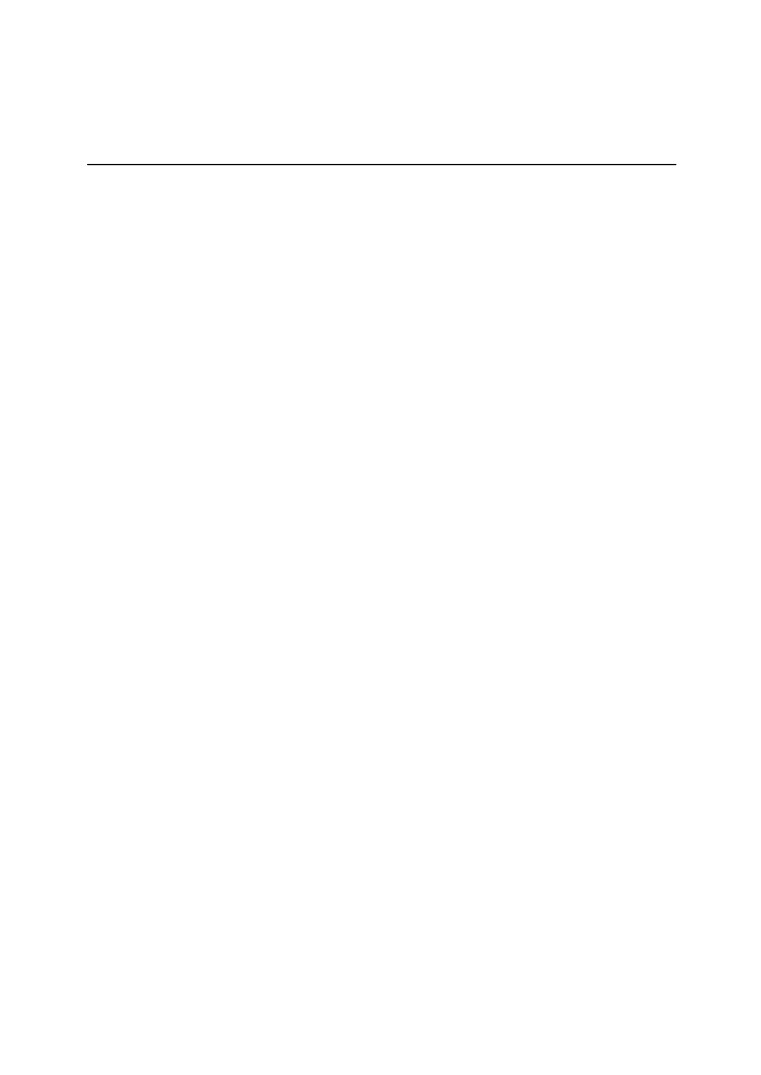

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Consolidated statement of cash flows

Year ended 31 March 2018

2018

2017

£

£

Cash flows from operating activities

Surplus for the financial year

15,543,146

1,065,550

Adjustments for:

Depreciation of tangible assets

14,807

11,958

Other interest receivable and similar income

(433,753)

(222,176)

Tax on surplus on ordinary activities

7,341

25,048

Accrued (income)/expenses

(12,234)

189,818

Changes in:

Trade and other debtors

(993,857)

(1,653,602)

Trade and other creditors

9,282

(2,930)

Cash generated from operations

14,134,732

(586,334)

Interest received

433,753

222,176

Tax paid

(28,889)

(8,964)

Net cash from/(used in) operating activities

14,539,596

(373,122)

Cash flows from investing activities

Purchase of tangible assets

(15,544)

(9,302)

Cash advances and loans granted

(1,639,477)

(693,368)

Purchases of other investments

(443,000)

(868,000)

Proceeds from sale of other investments

1,597,000

670,000

Net cash used in investing activities

(501,021)

(900,670)

Net increase/(decrease) in cash and cash equivalents

14,038,575

(1,273,792)

Cash and cash equivalents at beginning of year

14,363,034

15,636,826

Cash and cash equivalents at end of year

28,401,609

14,363,034

The notes on pages 13 to 23 form part of these financial statements.

- 12 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements

Year ended 31 March 2018

1.

General information

New Anglia Local Enterprise Partnership Limited is a company limiited by guarantee and is

incorporated in England. the address of its registered office is 1 St James Court, Norwich, Norfolk,

NR3 1RU. The address of the trading office is Centrum, Norwich Research Park, Norwich, Norfolk,

NR4 7UG. The nature of the company's operations and its principal activities are set out in the

strategic report on page 2.

2.

Statement of compliance

These financial statements have been prepared in compliance with FRS 102, 'The Financial Reporting

Standard applicable in the UK and the Republic of Ireland'.

3.

Accounting policies

Basis of preparation

The financial statements have been prepared on the historical cost basis.

Consolidation

The consolidated financial statements incorporate the accounts of New Anglia Local Enterprise

Partnership Limited and its subsidiary company, New Anglia Capital Limited, made up to 31 March

2018. Although the subsidiary company is limited by guarantee and has no share capital, the directors

consider it appropriate to consolidate on the grounds that it is under the control of the parent.

The parent company has applied the exemption contained in section 408 of the Companies Act 2006

and has not included its individual statement of comprehensive income.

Comparatives for New Anglia Capital Limited have been incorporated into the comparative year

figures where appropriate.

- 13 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

3.

Accounting policies (continued)

Judgements and key sources of estimation uncertainty

The preparation of the financial statements requires management to make judgements, estimates and

assumptions that affect the amounts reported. These estimates and judgements are continually

reviewed and are based on experience and other factors, including expectations of future events that

are believed to be reasonable under the circumstances.

Significant judgements

The judgements (apart from those involving estimations) that management has made in the process of

applying the entity's accounting policies and that have the most significant effect on the amounts

recognised in the financial statements are as follows:

• Tangible fixed assets

Tangible fixed assets are depreciated over their useful lives taking into account residual values,

where appropriate. The actual lives of the assets and residual values are assessed annually and

may vary depending on a number of factors. In re-assessing asset lives, factors such as

technological innovation, product life cycles and maintenance programmes are taken into

account. Residual value assessments consider issues such as future market conditions, the

remaining life of the asset and projected disposal values.

Key sources of estimation uncertainty

Accounting estimates and assumptions are made concerning the future and, by their nature, will rarely

equal the related actual outcome. The key assumptions and other sources of estimation uncertainty

that have a significant risk of causing a material adjustment to the carrying amounts of assets and

liabilities within the next financial year are as follows:

• Depreciation and the estimation of the residual value of the asset at the end of its useful

economic life.

• Recoverability of the loans issued as investments.

Revenue recognition

Income arising in the year is analysed into either Operational Activity or Designated Project Funding.

Operational Activity includes income received to cover the day to day core funding requirements of the

LEP such as administration costs and staff remuneration. It also includes income to fund certain

projects undertaken directly by the LEP. Designated Project Funding includes income received for

specific projects which are then distributed by the LEP to third parties. They are generally funds

provided by Government or other agencies. Costs directly attributable to designated projects are

charged against this income and shown as an expense. Where the LEP incurs costs which may be

partly attributable to Operational Activity and partly to designated projects then the Board allocate

such expenditure based on a fair and reasonable assessment of the time and cost expended on each

project.

- 14 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

3.

Accounting policies (continued)

Taxation

The taxation expense represents the aggregate amount of current and deferred tax recognised in the

reporting period. Tax is recognised in the Income and expenditure account, except to the extent that it

relates to items recognised in other comprehensive income or directly in equity. In this case, tax is

recognised in other comprehensive income or directly in equity, respectively.

Current tax is recognised on taxable surplus for the current and past periods. Current tax is measured

at the amounts of tax expected to pay or recover using the tax rates and laws that have been enacted

or substantively enacted at the reporting date.

Deferred tax is recognised in respect of all timing differences at the reporting date. Unrelieved tax

losses and other deferred tax assets are recognised to the extent that it is probable that they will be

recovered against the reversal of deferred tax liabilities or other future taxable profits. Deferred tax is

measured using the tax rates and laws that have been enacted or substantively enacted by the

reporting date that are expected to apply to the reversal of the timing difference.

Tangible assets

Tangible assets are initially recorded at cost, and subsequently stated at cost less any accumulated

depreciation and impairment losses. Any tangible assets carried at revalued amounts are recorded at

the fair value at the date of revaluation less any subsequent accumulated depreciation and

subsequent accumulated impairment losses.

Depreciation

Depreciation is calculated so as to write off the cost or valuation of an asset, less its residual value,

over the useful economic life of that asset as follows:

Office improvements

-

16.67% straight line

Equipment

-

20% - 33.33% Straight Line

Investments

Fixed asset investments are initially recorded at cost, and subsequently stated at cost less any

accumulated impairment losses.

- 15 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

3.

Accounting policies (continued)

Financial instruments

Basic financial instruments are initially recognised at the transaction price, unless the arrangement

constitutes a financing transaction, where it is recognised at the present value of the future payments

discounted at a market rate of interest for a similar debt instrument.

Such assets are subsequently carried at amortised cost using the effective interest method. Debt

instruments are subsequently measured at amortised cost.

Financial assets that are measured at cost or amortised cost are reviewed for objective evidence of

impairment at the end of each reporting date. If there is objective evidence of impairment, an

impairment loss is recognised in profit or loss immediately.

Financial assets are derecognised when (a) the contractual rights to the cash flows from the asset

expire or are settled, or (b) substantially all the risks and rewards of the ownership of the asset are

transferred to another party or (c) control of the asset has been transferred to another party who has

the practical ability to unilaterally sell the asset to an unrelated third party without imposing additional

restrictions.

Financial liabilities are derecognised when the liability is extinguished, that is when the contractual

obligation is discharged, cancelled or expires.

Pension plans

During the year, employees of the company accrued benefits under a defined benefit pension

scheme. The scheme is operated by local government and includes their own employees. As such it is

not possible to identify the company's share of the underlying assets and liabilities held within the

scheme on a consistent and reasonable basis. The scheme has therefore been accounted for as a

defined contribution scheme in accordance with FRS 102.

The company also operates a defined contribution scheme. The assets of the scheme are held

separately from those of the company. The annual contributions payable are charged to the Income

and expenditure account.

4.

Company limited by guarantee

The company is limited by guarantee and accordingly does not have share capital. Every member of

the company undertakes to contribute such amounts as may be required not exceeding £1 to the

assets of the company in the event of it being wound up while he or she is a member, or within one

year after he or she ceases to be a member.

5.

Income

Income arises from:

2018

2017

£

£

Grants

44,153,357

40,381,517

- 16 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

5.

Income (continued)

The whole of the income is attributable to the principal activity of the group wholly undertaken in the

United Kingdom.

6.

Operating surplus

Operating surplus or deficit is stated after charging:

2018

2017

£

£

Depreciation of tangible assets

14,807

11,958

7.

Auditor's remuneration

2018

2017

£

£

Fees payable for the audit of the financial statements

8,950

6,162

Fees payable to the company's auditor and its associates for other services:

Other non-audit services

12,853

14,517

8.

Staff costs

The average number of persons employed by the group during the year, including the directors,

amounted to:

2018

2017

No.

No.

Directors

16

16

Delivery team

35

30

51

46

The aggregate payroll costs incurred during the year, relating to the above, were:

2018

2017

£

£

Wages and salaries

1,331,391

1,057,164

Social security costs

142,315

109,205

Other pension costs

88,955

112,985

1,562,661

1,279,354

The directors do not receive any emoluments.

The total compensation payable in respect of 6 (2017: 5) key management personnel amounted to

£389,764 (2017: £319,902).

- 17 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

9.

Other interest receivable and similar income

2018

2017

£

£

Interest on loans and receivables

433,753

222,176

10.

Tax on surplus on ordinary activities

Major components of tax expense

2018

2017

£

£

Current tax:

UK current tax expense

7,341

25,048

Tax on surplus on ordinary activities

7,341

25,048

Reconciliation of tax expense

The tax assessed on the surplus on ordinary activities for the year is lower than (2017: lower than) the

standard rate of corporation tax in the UK of 19% (2017: 20%).

The differences are explained below:-

2018

2017

£

£

Surplus on ordinary activities before taxation

15,550,487

1,090,598

Surplus on ordinary activities by rate of tax

264,292

218,120

Effect of income not taxable

(256,951)

(193,072)

Tax on surplus

7,341

25,048

11.

Surplus for the year of the parent company

The surplus for the financial year of the parent company was £15,543,146 (2017: £1,065,550) of

which, £12.7m is growth deal funding allocated to projects and will be used in the financial year

2018/19 as grant payments as detailed in note 20.

- 18 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

12.

Tangible assets

Group and company

Land and

buildings

Equipment

Total

£

£

£

Cost

At 1 April 2017

6,312

66,473

72,785

Additions

-

15,544

15,544

Disposals

-

(14,590)

(14,590)

At 31 March 2018

6,312

67,427

73,739

Depreciation

At 1 April 2017

1,578

46,302

47,880

Charge for the year

1,052

13,755

14,807

Disposals

-

(14,590)

(14,590)

At 31 March 2018

2,630

45,467

48,097

Carrying amount

At 31 March 2018

3,682

21,960

25,642

At 31 March 2017

4,734

20,171

24,905

13.

Investments

Group

Investments

other than

loans

Loans

Total

£

£

£

Cost

At 1 April 2017

973,088

8,992,749

9,965,837

Additions

443,000

1,639,477

2,082,477

Disposals

-

(1,000,000)

(1,000,000)

At 31 March 2018

1,416,088

9,632,226

11,048,314

Impairment

At 1 April 2017 and 31 March 2018

-

-

-

Carrying amount

At 31 March 2018

1,416,088

9,632,226

11,048,314

At 31 March 2017

973,088

8,992,749

9,965,837

Company

Loans

£

Cost

At 1 April 2017

8,842,749

Additions

1,639,477

Disposals

(1,000,000)

At 31 March 2018

9,482,226

Impairment

At 1 April 2017 and 31 March 2018

-

- 19 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

13.

Investments (continued)

Company

Loans

£

Carrying amount

At 31 March 2018

9,482,226

At 31 March 2017

8,842,749

This relates to the company's interests in long term loans advanced under the Growing Places Fund

for qualifying projects.

All loan disposals represent repayment of loans due in the year.

14.

Debtors

Group

Company

2018

2017

2018

2017

£

£

£

£

Trade debtors

207,374

116,792

207,374

116,792

Prepayments and accrued income

1,481,305

786,029

1,481,305

786,029

Other debtors

1,592,337

1,384,338

3,130,633

2,481,618

3,281,016

2,287,159

4,819,312

3,384,439

15.

Cash at bank and in hand

Group and Company

2018

2017

£

£

Current account

212,147

66,289

Accountable Body funds

27,063,789

13,240,239

Deposit account

784,412

217,408

Deposit account (notice)

339,295

837,075

Current account (ERDF)

1,839

1,906

Cash in hand

130

117

28,401,612

14,363,034

The Accountable Body funds are held on deposit on behalf of the Company by Suffolk County

Council. These funds are attributable to the Growing Places, Projects Revenue Allocation,

Programmes Administration and Growth Deal with expenditure planned in future years.

16.

Investments

Group

Company

2018

2017

2018

2017

£

£

£

£

Investments

-

597,000

-

597,000

- 20 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

17.

Creditors: Amounts falling due within one year

Group

Company

2018

2017

2018

2017

£

£

£

£

Trade creditors

35,139

47,779

35,139

47,779

Accruals and deferred income

270,967

283,198

267,983

282,198

Corporation tax

7,341

28,889

7,341

28,889

Social security and other taxes

40,746

22,740

40,746

22,740

Other creditors

11,789

7,873

11,789

7,873

365,982

390,479

362,998

389,479

18.

Employee benefits

Defined contribution plans

The amount recognised in profit or loss as an expense in relation to defined contribution plans was

£50,909 (2017: £30,911).

Defined benefit plans

The amount recognised in the Income and expenditure account as an expense in relation to defined

benefit plans was £38,046 (2017: £78,294).

19.

Financial instruments

The carrying amount for each category of financial instrument is as follows:

Financial assets that are debt instruments measured at amortised cost

Group

2018

2017

£

£

Financial assets that are debt instruments measured at amortised cost

3,128,132

3,260,079

Financial liabilities measured at amortised cost

Group

2018

2017

£

£

Financial liabilities measured at amortised cost

355,657

389,479

- 21 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

Reserves

20.

Other reserves represent amounts received and held for specific long term projects as follows:

Surplus/ (deficit)

Balance

transferred from

Balance

brought

Income and

carried

forward Expenditure Account

forward

£

£

£

Group

Income and expenditure account

347,707

196,783

544,490

Growing Places Capital Infrastructure

20,042,674

2,369,086

22,411,760

Growing Places Other Capital Allocation

3,073,481

-

3,073,481

Projects Revenue Allocation

473,082

(97,765)

375,317

Programmes Administration

665,250

553,253

1,218,503

New Anglia Capital Fund

1,954,282

(66,350)

1,887,932

Enterprise Zone

236,323

674,891

911,214

Local Transport Body Reserves

31,993

-

31,993

Redundancy Reserve

22,664

(10,355)

12,309

Growth Deal

-

11,368,857

11,368,857

Growing Business Fund

-

554,746

554,746

26,847,456

15,543,146

42,390,602

Company

Income and expenditure account

347,707

196,783

544,490

Growing Places Capital Infrastructure

20,042,674

2,369,086

22,411,760

Growing Places Other Capital Allocation

3,073,481

-

3,073,481

Projects Revenue Allocation

473,082

(97,765)

375,317

Programmes Administration

665,250

553,253

1,218,503

New Anglia Capital Fund

1,929,474

(66,350)

1,863,124

Enterprise Zone

236,323

674,891

911,214

Local Transport Body Reserves

31,993

-

31,993

Redundancy Reserve

22,664

(10,355)

12,309

Growth Deal

-

11,368,857

11,368,857

Growing Business Fund

-

554,746

554,746

26,822,648

15,543,146

42,365,794

The movement on Other Reserves is an overall surplus, this reflects grant income received in excess

of the grants distributed from grant reserves during the year.

The Growing Places Capital represent funding received from HM Government for the purposes of

providing financial support for infrastructure projects.

Of this balance approximately £6.8 million is scheduled to be advanced to committed projects during

the next financial year. This is in addition to the £9.5 million which is currently advanced to existing

projects.

Projects Revenue Allocation is funding from the Growing Places fund set aside to fund a range of

economic development projects.

Programme Administration is part of the funding within Growing Places and Growth Deal to run the

programmes.

- 22 -

New Anglia Local Enterprise Partnership Limited

Company Limited by Guarantee

Notes to the financial statements (continued)

Year ended 31 March 2018

New Anglia Capital Fund has been established by New Anglia LEP with repaid funding from its

Growing Places Fund. These funds are managed by its subsidiary company, New Anglia Capital and

are co-invested with private investors to support start-ups with innovative ideas in high growth

companies.

The Redundancy Reserve relates to monies received from sponsoring authorities on the transfer of

the company's employees under Transfer of Undertakings Protection Employment regulations to fund

any potential future redundancy expenditure in respect of those employees.

Growth Deal reserve is part of the LEP's agreed Growth Deal programme from government and is

committed to specific projects. This funding will be advanced to those projects during the next

financial year.

The Growing Business Fund is a mechanism for providing financial support to businesses in Norfolk

and Suffolk. Spending decisions for the fund rest with a panel independent to the LEP. The reserve

funding has been allocated and will be used during the next financial year.

21.

Operating leases

The total future minimum lease payments under non-cancellable operating leases are as follows:

Group

Company

2018

2017

2018

2017

£

£

£

£

Not later than 1 year

40,878

54,102

40,878

54,102

Later than 1 year and not later than 5

years

168,232

168,232

168,232

168,232

209,110

222,334

209,110

222,334

22.

Events after the end of the reporting period

Since the balance sheet date, the company has received £35m from Central Government in respect of

the LEP's agreed Growth Deal programme for the financial year 2018/19.

23.

Related party transactions

Company

During the year, the company incurred rental and room hire costs from Norwich Research Partners

LLP, a partnership in which Prof D Richardson has an interest. The total amount of costs incurred

were £61,416 (2017: £57,251). At 31 March 2018 the company owed Norwich Research Partners LLP

£Nil (2017: £1,130).

During the year, the company incurred rental costs from Ardencrest Limited, a company which is a

wholly owned subsidiary of East of England Co-Operative Society Limited. Mr D Field is joint Chief

Executive Office of East of England Co-Operative Society Limited. The total amount of costs incurred

were £10,158 (2017: £11,123). At 31 March 2018 the company owed Ardencrest Limited £Nil (2017:

£1,791).

- 23 -