NEW ANGLIA LOCAL ENTERPRISE PARTNERSHIP

GROWING BUSINESS FUND

GUIDANCE FOR APPLICANTS - March 2021

New Anglia Local Enterprise Partnership (New Anglia LEP) is working in partnership with new Anglia

Growth Hub, Finance East and Suffolk County Council to deliver the highly successful Growing

Business Fund (GBF). This funding programme provides direct grants to local businesses intending to

grow and create new jobs.

The Growing Business Fund offers grants between £25,000 and £250,000.

There are no formal deadlines for grant applications, which can be submitted at any time.

All enquiries regarding the Growing Business Fund should be directed to:

New Anglia Growth Hub

Tel.: 0300 333 6536

New Anglia LEP covers Norfolk and Suffolk; it is very supportive of the development of businesses

across the two counties and offers a range of support in the form of various grants and loans.

Businesses also have free access to New Anglia Growth Hub services, whose qualified advisers will

visit your business to meet you, one to one, and provide business advice, offer suggestions and

signpost to help (if needed) to grow your business.

One of New Anglia LEP’s most successful and flagship initiatives, The Growing Business Fund has

awarded just over £ £29.5m in grants to 284 projects generating £219.6m of private match funding

and creating 3,226 jobs. The process is very simple, and provided you are eligible and able to work

with us, we can award a grant within a few weeks.

After an initial discussion with the New Anglia Growth Hub and completion of an Expression of

Interest form, a full due diligence audit will be carried out by Finance East, an independent financial

company. Then your application will be considered by an independent panel who meet monthly. They

award the grants, subject to their full discretion.

After the grant is awarded you will be assigned a case worker from Suffolk County Council who will

support you throughout the claims process.

We suggest that you read these guidelines and talk to a Growth Hub adviser at the earliest

opportunity, even if you are not sure if this is the most appropriate route for you. Our advisers will le to

signpost other options if the Growing Business Fund is not suitable.

If you intend to make a formal application to the Growing Business Fund, you must read and

ensure you understand all the content of this Guidance.

You will be asked to sign a declaration to this effect

Please note, we cannot be held responsible for any advice on eligibility

you may receive from third parties.

1. IS YOUR BUSINESS ELIGIBLE?

1.1

Legal Status

Grant applicants may be sole traders, partnerships, limited companies, social enterprises,

not-for-profit businesses, and registered charities, so long as they are engaged in an

economic activity.

1.2

Established Businesses

The GBF aims to support established businesses that are ready to

grow and expand further. Grants are available to start-up businesses or those in the

very earliest stages of trading with evidence of a strong potential to trade immediately.

1.3

Business Sectors

The GBF is open to applicants from different business sectors, although there are some

exceptions beyond our control, such as, businesses involved in primary agriculture and

horticulture, fisheries, aquaculture, forestry, steel, synthetic fibres, retail (including farm

shops and post offices), pubs and hotels, care sectors, health and medical services,

financial services, restaurants, cafes, hairdressers, haulage (not vehicles) passenger

transport, education, estate and employment agencies are also not eligible.

1.4

Business Size

The GBF is able to support Micro, Small and Medium

businesses. For more details of these size definitions, visit:

1.5

Amount of Funding Available

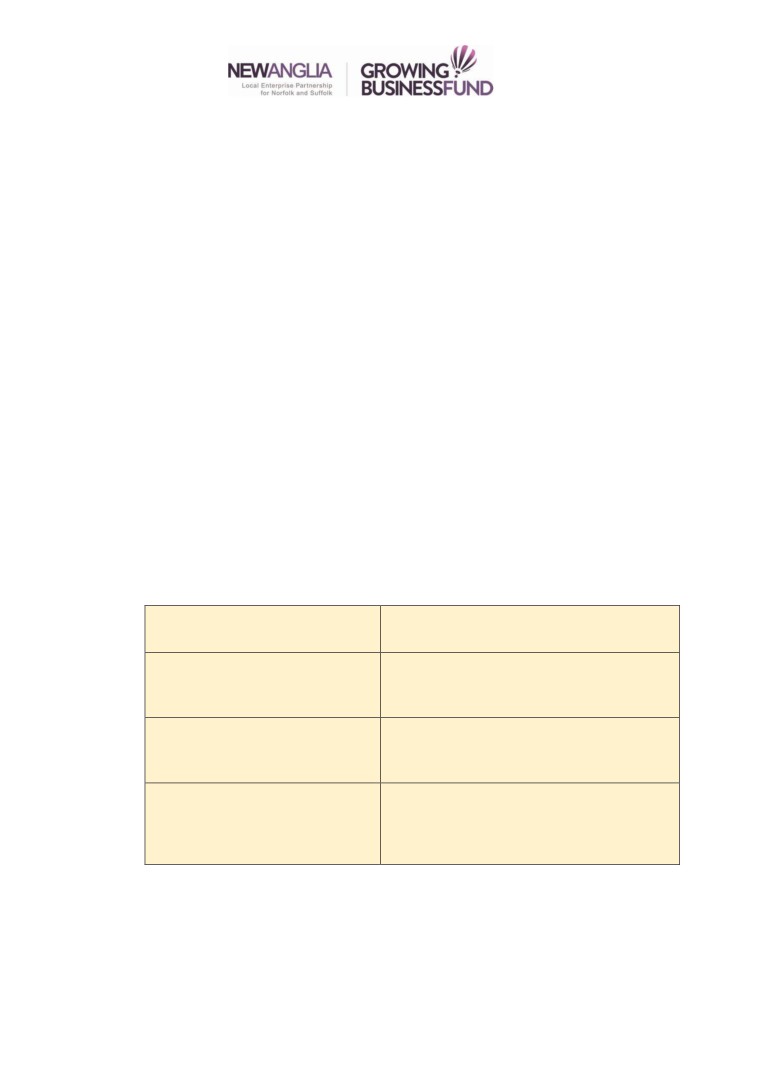

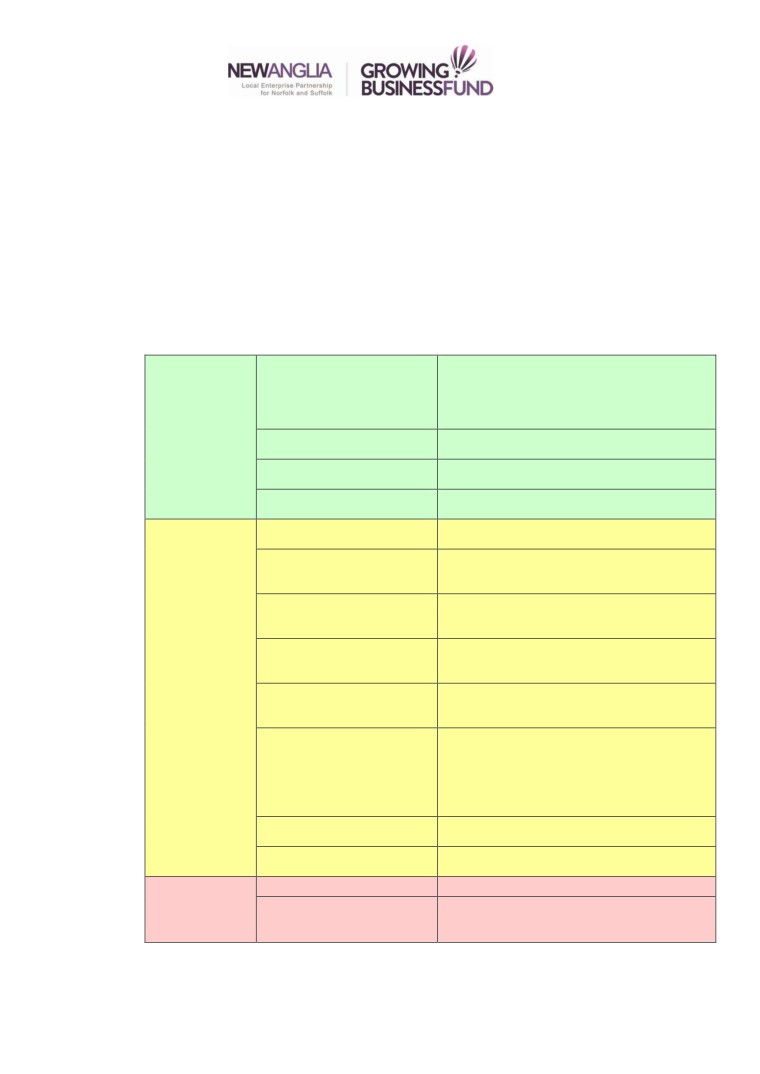

The table below gives more detail on the maximum levels of grant funding available:

Business Size

Maximum Grant Award

(Usually based on data as at the end

(all grants awarded will be in the range £25,001 to

of your last financial year)

£250,000)

Micro - fewer than 10 employees,

Usually up to a maximum of 20% of total

and annual turnover or annual

expansion costs

Balance Sheet total not exceeding

€2m

Small - fewer than 50 employees,

Usually up to a maximum of 20% of total

and annual turnover or annual

expansion costs

Balance Sheet not exceeding

€10m

Medium - fewer than 250

Usually up to a maximum of 10% of total

employees and annual turnover

expansion costs or in some cases 20% if

not exceeding €50m or annual

awarded under minimis

Balance Sheet total not exceeding

€43m

1.6

Sustainable Businesses

The GBF supports growing and expanding businesses wanting to

continue their development. You must be able to demonstrate that your business is viable,

has good growth potential and will be self-sustaining in the long term. The GBF cannot

support businesses whose balance sheets indicate present or recent trading difficulties.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 2 of 12

2. IS YOUR PLANNED EXPANSION ELIGIBLE?

2.1

Location

Your proposed expansion must be taking place in, or you must at least have a business

base in, either Norfolk or Suffolk. We are particularly keen to support businesses

considering expanding and relocating to Norfolk or Suffolk.

2.2

New Job Creation

Your expansion plans must include the creation of new employment unless you are

expanding and increasing your productivity, please see 2.7.

The new jobs must be permanent new positions in the business and expected to last at

least twelve months.

Y

Your planned expansion must be based in or at least managed

o

from Norfolk or Suffolk

u

You will be required to create at least one new job for each £20,000 of grant awarded, or

for new Apprentice positions, one for each £10,000 of grant - the actual grant is not for

the jobs themselves but is to support other investment which leads to job creation.

Please note that we will also consider the level of salary and type of job created, and a

new job must be paying at least the minimum wage; we will also be seeking evidence of

future increases in that pay (to be shown in the financial forecasts). It is expected that new

jobs will be created within twelve months of grant approval and be directly related to your

expansion plan.

Where there are new jobs they must result in an increase in overall staff numbers

Any new jobs should last at least 12 months

Jobs created prior to formal Approval of your Grant cannot be counted towards your

agreed target

Y

You must create net new jobs, i.e., an overall increase in your staff numbers when

compared to the number of staff employed at the date of your grant application. Please

note that new jobs created can only be counted if they are created after the date of

approval of your grant.

New Apprenticeship positions are welcomed, but only if they are not supported by any

European, Government or Public funds, are expected to last at least twelve months and

are expected to lead to full time, long term positions in the business.

A new Full-Time job is defined as one of at least 30 hours per week, with Part Time

positions being 15 - 29 hours per week. Two such Part Time positions may therefore

count as one Full-Time equivalent position.

Please note - seasonal and ‘zero hours’ jobs cannot be considered.

Routine replacement for staff leaving also cannot be considered.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 3 of 12

2.3

Safeguarding of Jobs

We may be prepared to consider applications for funding which safeguard jobs

rather than create new ones. In this instance as a business, you must clearly demonstrate

one or more of the following:

• Significant contract loss

• Job numbers are in decline.

• An adverse trend in turnover versus profit

• The business sector as a whole is in difficulties.

• That you can demonstrate diversification into a new service or product

In all cases your business must have the potential to be viable in the medium to long term

Please talk to your Growth Hub adviser to discuss, this list is not exhaustive.

2.4

Readiness of the Planned Expansion

New Anglia LEP wishes to support expansion that is ready to commence immediately.

after Grant Approval. Where needed, you must provide confirmation at the time of your

application that all necessary planning permissions and any other permits and licences

to operate, are actually in place or confirmation that they are not required

If a grant including property expenditure is approved, it is also expected that:

• Freehold property should be in the name of the trading business - we will not support

property Holding Companies, or property in the names of Directors / Owners, or in

their pension funds

• If rented, the Lease should have a minimum of three years unexpired term

All necessary planning permissions, permits, and licences must be in place.

Your expansion plan should be ready to begin.

2.5

Funding for Your Expansion Plan

Grant applications can only be considered when you are able to provide confirmation that

all the remaining funds needed for your expansion plans are in place. You will be

expected to provide clear evidence of this, including an email funding agreement in

principle, or finance Offer Letters, Bank statements, etc.with your application.

Simple ‘quotations’ for finance are not sufficient.

Some of the most common sources of additional funds are shown below, but this list is not

intended to be exhaustive, and other funds may be acceptable:

• Bank or Asset Finance;

• Company funds;

• Director / Partner / Owner or private individual contributions; evidence of

funds being available will be required

• Private or personal investment;

• Private or personal loans;

• Venture capital investment.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 4 of 12

Please note that future cash flow or profit, or “in-kind” support which does not represent

actual funds are not eligible, nor can we allow any other grants or funding from Public

Sector sources (UK Government, European Union, Local Authorities etc.)

2.6

Need for Grant Funding

Your grant application must also, explain why you require a grant, what difference

it will make to your business, and why you have been unable to obtain all the finance you

Why do you require a grant, and what difference will it make to your business?

Have you maximised other funding sources before making a grant application?

need for your expansion. This is important, as grant funds cannot be used to support

expansion plans where other funding appears to be available, or where the expansion

would proceed regardless.

2.7

Increase in Productivity

It is possible to apply for a grant to increase productivity and efficiencies due to

innovation, new equipment or working methods, and without necessarily employing

additional staff. In this instance we would expect you to provide robust measures and later

evidence of how that increase in productivity or outputs might take place before the panel

meeting. Each business will have its own measurement, for instance, you may measure

sales per employee, speed of output, or sales per space, turnover per employee.

We will expect to see robust forecasts indicating future growth and evidence of an order

book.

You will also need to provide written confirmation that your business (at Group level if

appropriate) has not closed down the same or similar activity in the European Economic

Area in the two years prior to your application for grant funding, and you do not have plans

to close such an activity in the two years following completion of the new expansion.

Please note, further restrictions may apply if you make an investment within three years

from the start date of the expansion in another investment in the same local area, i.e.,

Norfolk or Suffolk.

*a new establishment is a new place of business which is intended to be stable, regular

and to continue for an indefinite period. Usually this would require the place of business

to be fully functional, autonomous and self-standing (although it may share back office

functions such as IT and HR)

** a new activity is an activity which does not fall under the same four-digit NACE or SIC

code as the activities previously undertaken at the establishment, or by the business in

the local area.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 5 of 12

3. WHAT EXPANSION COSTS ARE ELIGIBLE?

New Anglia wishes only to support well considered expansion plans which lead directly to

business growth and/or job creation, not simply expenditure on routine improvements and

upgrades which are incidental to expected growth in business. We will only consider costs

which are directly related to expansion plans.

The table below outlines the main investments which can and cannot be included in

overall expansion plans, and those costs which are specifically eligible for grant

payments.

Please note that grant awards in respect of expenditure relating to property

whether on construction, purchase, or improvement will be limited to 10%

Our strong preference is to support equipment and other expenditure which

focuses on improving productive capacity, rather than simple expansion of

property.

Acceptable costs

Premises (construction,

But not the purchase of your current leased

and

purchase, extension,

premises, improvements required to simply

eligible for grant

improvement)

comply with national or EU standards, or

payments

routine refurbishment. Investment Property

purchase cannot be funded

(ALL

Fixtures and fittings, furniture

Some fixtures and fittings may be regarded as

businesses)

property improvements

Plant and equipment,

machinery, tooling

IT Equipment, software,

licences

Acceptable

Marketing, including costs for

Must be related to the expansion plan and not

overall costs,

participation in trade fairs

a general running cost or regular advertising

but may not be

Creation of a new website

Not routine maintenance / updates

eligible for grant

related to the proposed

payments

expansion

Professional fees (legal,

Not consultancy related to your grant

(Micro, Small

planning, architectural etc.)

application, tax consultancy, or regular legal

and Medium

services

businesses)

Recruitment costs for new

staff related to the proposed

expansion

Commercial vehicles,

For use within the business only. Must be an

including second hand

outright purchase from a bona fide business

with a VAT receipt.

Training

Only where essential for new staff to become

effective in the business, and where provided

and invoiced externally.

Not training that is carried out simply to

comply with national mandatory standards e.g.

health & safety, first aid etc.

Stock

Only where a one-off addition to stock is

deemed essential to the expansion

Other costs may also be

Depending on the details of your expansion

considered

Ineligible project

Research and Development

costs

Working capital / routine

Including costs such as rent, rates, utilities,

operating costs

current and new personnel wages and other

overheads.

VAT cannot be included in any of your costs, unless you are unable to reclaim it.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 6 of 12

No spend prior to the date your grant is Approved can be

allowed against your overall expansion costs

Do not start your expenditure until you have received

and formally accepted your Grant Offer

Please note that NO expenditure on your expansion plan is permitted before the

date of your grant Approval.

This is checked very carefully against invoice dates and Bank statements or other

payment evidence, during the Claims and Monitoring period (see Section 4.5). Any

expenditure which is found to have been authorised or actually incurred prior to your

Grant Approval will be deducted from your overall expansion costs, and your grant will be

reduced as a result. You are strongly advised not to commence your expenditure until you

have received and formally accepted your Grant Offer.

4.

HOW TO APPLY FOR GRANT FUNDING

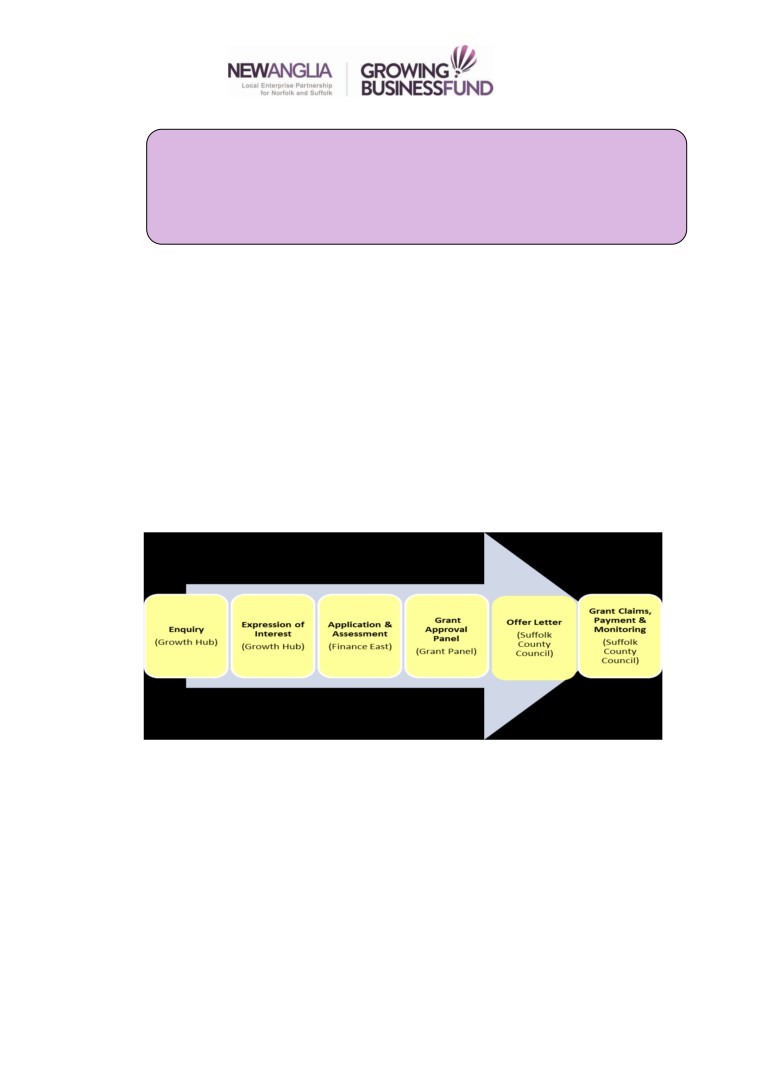

New Anglia LEP is working in partnership with Growth Hub (GH), Finance East (FE) and

Suffolk County Council (SCC) to deliver the GBF The diagram below outlines the GBF

grant application process:

4.1 Enquiry

Businesses wishing to apply for a GBF grant award should first contact

the New Anglia Growth Hub (see the contact details on page 1).

A Business Growth Adviser will arrange to discuss your expansion plans with you.

If your intended expansion appears to meet the main eligibility criteria for the GBF, your

Adviser will help you to complete an Expression of Interest form

This form must NOT be handwritten.

4.2 Expression of Interest

Your Expression of Interest form will enable us to further assess your eligibility for grant

support. A hard copy of the form, with original handwritten signature must be provided to

the Growth Hub. Please note that completion of an Expression of Interest form must not in

any way be taken as an indication that a full grant Application will be approved.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 7 of 12

4.3

Application and Assessment

Your Expression of Interest form, when fully completed will be passed to FE

an external organisation engaged by New Anglia LEP to fully assess grant applications

and make recommendations to the Grant Panel.

FE will work with you during the assessment stage of your grant application. They will

send you a formal Application form for completion, and request supporting information in

order to properly assess your expansion plan and its suitability for the GBF. Supporting

information will include, but not be limited to, details about your business, its Directors /

Partners / Owners, its shareholders, business plan, and both historic and forecast

financial performance.

Your Application may be sent to FE electronically in the first instance, however, a

hardcopy with original signatures must be provided. Your Application should be signed in

accordance with your normal signing arrangements, i.e., the usual number of owners,

directors or shareholders. FE will undertake a detailed assessment of your proposed

expansion based on the Application Form and the supporting information provided. If

necessary, you will be asked to supply further information.

An assessment will also be made of the competition in your sector and the extent to which

your expansion might affect other similar businesses. Applications which appear to

duplicate or take business from other businesses locally will in general not be supported.

The overall assessment of your Application is likely to involve at least one meeting with

the owners, directors or shareholders of your business, and a visit to your premises.

You will be expected to progress to the full Application stage within three months

from the date your Expression of Interest EOI Form is accepted by the Growth Hub.

Any longer and you may have to resubmit a new Expression of Interest form.

Once assessment of your Application has been completed, FE will prepare a Report and

recommendation and this will be submitted to the Grant Approval Panel which will take a

final decision on your grant Application. Each application is considered on its own merit

4.3

Grant Panel

All eligible Applications are considered by a Grant Panel, which meets

monthly. Details of the panel can be found here

Please note, your Application will NOT be considered by the Panel until we have

received your original signed hardcopies of both the Expression of Interest and

Application Forms.

The Panel will consider the Report prepared by FE and will reach a decision on your grant

request based on the information provided and the extent to which your expansion plan

meets the main objectives of the GBF.

The Panel’s final decision on your Application and will be communicated to you as soon

as possible by phone and email.

Should your Application be rejected by the Panel, an explanation will be given.

Please note there is no right of appeal against the Panel’s decision. New Anglia LEP is

prepared to consider representations from unsuccessful applicants only if they feel that

their Application has not been handled in accordance with the process outlined in this

Guidance document.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 8 of 12

4.4

Offer Letter

If your grant Application is approved, SCC, New Anglia’s partner organisation undertaking

the management of grants, will send you a formal grant Offer Letter that will include the

following:

• The amount of grant you have been offered and the State Aid regulations under

which it has been approved;

• Conditions of the Offer - both Standard Conditions and any requested by the Panel;

• The job creation requirements and other results that must be achieved;

• How to submit Claims and Monitoring returns, how to obtain your grant funds, and

the final date by which you must claim the grant;

• Details of the overall agreed expansion expenditure, and those items specifically

eligible for the payment of grant;

• How your project will be monitored by SCC, and contact information for your grant

Caseworker at SCC;

• A Grant Acceptance Form which needs to be signed and returned to SCC;

SCC will also arrange to visit you to discuss the Offer Letter in detail, to ensure that you

fully understand the Terms and Conditions of the grant, the process for Claims, and so on.

Once your grant has been approved, you may start spending money on the agreed

expansion costs and grant eligible items categories, but not before. Breaches of this

condition is likely to result in your overall expansion costs, and grant, being reduced or

even withdrawn.

The Offer Letter, Standard Conditions, Grant Acceptance Form and any other

attachments sent to you, form the Grant Agreement between you and SCC. This is a

legally binding Agreement, and you should ensure you read and understand all the

content. The Grant Acceptance Form should be signed in accordance with your business’

usual signing arrangements.

4.5

Grant Claims, Payment and Monitoring

You will be expected to complete and submit Claim and Monitoring Forms to SCC to

evidence progress with your expansion plan and job creation, and to enable the agreed

grant to be paid. The Forms must be supported by the following documents:

•

Invoices;

•

Receipts or bank statements showing these invoices have been paid;

•

Any other evidence required by SCC;

You will be expected to provide evidence for the total expansion expenditure in due

course, not just the grant-related items, although you are not expected to wait until it has

all taken place before you claim the grant.

You will also be asked to complete an Asset Register Update Form for all capital

purchases, such as buildings or items of equipment, where individual items cost £5,000 or

more and have a useful life of at least one year.

To evidence the creation of the agreed jobs, you will be asked to supply signed Contracts

of Employment and produce “before” and “after” extracts from your payroll records

showing that the new staff are being paid and represent increases to your overall staff

numbers.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 9 of 12

Your expansion plan will be monitored by SCC until all the agreed spend has taken place,

the new jobs have been created, or jobs safeguarded, and any other agreed actions have

been taken; however, SCC may continue monitoring your plan after that, if deemed

necessary, and will arrange this separately if required. You must assist SCC with any

evaluation of your expansion plan and the use of the grant which they are required to

undertake under the terms of the grant programme.

SCC will also, at a suitable point in your expansion, undertake at least one monitoring visit

to your business. This is likely to be towards the end of your plan, when evidence of the

increased productivity, expansion, spend, and job creation will again be assessed.

Your expansion plan will be considered to be finally complete when all expenditure has

Taken, all required outputs have been achieved, a monitoring visit has taken place and all

outstanding queries, if any, have been resolved.

You must keep a satisfactory record of all your expenditure on the plan, and of any fees,

costs or other payments made to staff. SCC may ask to see your records at any

reasonable time, and you must comply with any such request. You must keep the records

for ten years beyond the monitoring period.

5

FURTHER GRANT APPLICATIONS

If you have already received a grant or grants and would like to submit another application

for funding for further expansion, this is acceptable, as long as you can demonstrate that

the previous expansion plans have been fully completed as expected, and all conditions

have been complied with, including job creation.

A new expansion plan must not duplicate any previous application(s) and the additional

funding to be used must be different to that used as part of your previous application(s).

Now that we have limited grant funding there must be a lapse of at least 3 years

between applications: priority will be given to first time applicants.

6

PUBLICITY

Successful grant applicants will be expected to acknowledge as widely as possible the

support and involvement of New Anglia LEP in their expansion plans.

The New Anglia LEP logo must appear on all publicity related to the expansion, such as

websites, site boards (where applicable), leaflets / brochures etc. You must use the

following wording: ‘This expansion was supported by New Anglia Local Enterprise

Partnership through the Growing Business Fund’

New Anglia LEP must approve, in advance, any publicity or other material to be released

to the media in connection with the grant. New Anglia LEP also reserves the right to refer

to any individual business, and the funding offered, in any of its own publicity material.

New Anglia may also prepare a Case Study for its website and / or a Press Release for

local media on your expansion, in order to help to promote the grant programmes. You will

be expected to assist and provide New Anglia with relevant information, including

photographs, logos, quotes etc. New Anglia may also publish your business name, the

amount of the awarded grant and brief information about your expansion, in any overall

summaries of grants awarded.

Brief details of the grant will appear in minutes of the GBF panel meeting which are held

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 10 of 12

7.

DATA PROTECTION

General Data Protection Regulation (GDPR) and Freedom of Information Act 2000

New Anglia LEP is the `Data Controller’ for ‘New Anglia Business Growth Programme’

(including the Growing Business Fund) related personal data and controls and processes

personal data (including sensitive special data) under the lawful bases of Article 6 (1) (e)

and Article 9 (2) (g) of the European Union ‘General Data Protection Regulation’ (2016/679).

New Anglia LEP and its partners (Finance East and Suffolk County Council) will use the

information you provide to assess your grant Application, to administer and analyse

applications, and for research purposes. We may give copies of all or some of this

information to individuals and organisations we consult with when assessing applications,

administering the grant programmes, monitoring projects and evaluating funding processes

and impacts. These organisations may include accountants, external evaluators and other

organisations or groups involved in delivering the grant programmes.

We may use personal information provided by you in order to conduct appropriate identity

checks. Personal information that you provide may be disclosed to a credit reference or

fraud prevention agency, which may keep a record of that information.

If you provide false or inaccurate information in your Application or at any point in the life

of any grant funding, we award to you and fraud is identified, we will provide details to fraud

prevention agencies, to prevent fraud and money laundering.

Data is recorded on the ‘New Anglia Business Growth Programme’ Customer Relationship

Management System (CRM) which is shared with ‘New Anglia Business Growth

Programme’ partners (New Anglia Local Enterprise Partnership, Nwes, Menta, Suffolk

Chamber of Commerce and Finance East) and Norfolk and Suffolk local authorities.

Data may be shared with ‘New Anglia Business Growth Programme’ partners as well as

the Ministry of Housing, Communities and Local Government and to the Department for

Business, Energy and Industrial Strategy for the purpose of supporting your

business/organisation and for reporting and statistical analysis.

The Freedom of Information Act 2000

Data recorded by the ‘New Anglia Business Growth Programme’ is subject to the

Freedom of Information Act 2000.

The Freedom of Information Act 2000 gives members of the public the right to request

information that is held. This includes information received from third parties, such as,

although not limited to, grant applicants, grant holders, contractors and people making a

complaint. If information is requested under the Act it will be released, subject to some

exemptions, although you may be consulted first. If you think that information you are

providing may be exempt from release if requested, you should let us know when you

apply.

As a Public Authority, SCC is subject to the provisions of the Act. As part of SCC’s duties

under the Act it may be required to disclose information forming part of any contract to

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 11 of 12

anyone who makes a reasonable request. SCC has absolute discretion to apply any

exemptions under the Act.

The Freedom of Information Act recognises that there will be valid reasons why some kind

of information may not be disclosed, such as if its release would damage commercial

interests or if it would contain personal information about another individual. SCC is not

obliged to deal with vexatious or repeated requests or, in some cases if the cost exceeds

an appropriate limit. Information supplied for the purposes of evidence of supporting

information for GBF that any applicant wishes to remain confidential must be clearly

marked as confidential. This marking will be considered in the event of a request under the

Freedom of Information Act, but the preservation of confidentiality cannot be guaranteed

due to the statutory obligations of the Public Authority.

In addition, information will be supplied for statistical purposes to the Ministry of

Communities and Local Government and to the Department for Business, Energy and

Industrial Strategy

The LEP’s Privacy Policy, which sets out how we use and protects any information that

you provide to the LEP and its delivery partners, can be found on the LEP’s website and is

also available upon request.

New Anglia Local Enterprise Partnership Growing Business Fund Guidance for Applicants - March 2021

Page 12 of 12