Energy Sector

Data Pack

Version Final Draft

DRAFT & CONFIDENTIAL

Contents

Page

-

Introduction to the Sector Data Pack

3

-

Introduction to and Definition of the Energy Sector

3

-

The Energy Sector in New Anglia

4

o Overview

5

o GVA

7

o Employment

10

o Enterprises

29

o Wages

36

-

Energy Sector Skills Supply and Demand

38

o Qualifications

39

o Further Education Learning Aims analysis

40

o Apprenticeships

47

o Labour Insight Jobs tool sector analysis

50

o

‘Where the Work is’ tool sector analysis

57

-

A Future View of the Energy Sector

59

-

Appendices

68

o Energy sector definition

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and

future view, of the sector and any underlying issues within the area that could impact upon it. Data is presented in a navigable format without

comment with interpretation at this stage left to the reader

The Data Pack informs the Sector Evidence Report, the key findings from which help to inform the priorities developed in the Sector Skills Plan.

The Sector Evidence Report is also summarised within the Sector Skills Plan and appears in full in the its appendices.

In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority data

is available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case with

data from the Annual Population Survey and the Annual Survey of Hours and Earnings.

Introduction to and Definition of the Energy Sector

New Anglia’s Energy Sector is internationally significant, with major operational energy infrastructure assets and planned infrastructure

development across the key industries of Offshore Wind, Oil and Gas, Nuclear and Low Carbon Renewable Energy.

The unique combination of geographical phenomena, established, deep rooted expertise and investment spanning over 50 years- has helped

shape a world leading energy presence. At an aggregate level New Anglia’s combined energy output plays a pivotal role in securing the UK’s

ongoing energy demands; an output that is set to grow significantly throughout the 21st century. Furthermore, the combination of development,

expansion of existing assets and decommissioning programmes- draws together a sector of significant economic value and market opportunity;

supported by extensive, high quality, supply chains.

For the purposes of this work we have agreed with the New Anglia LEP to follow their existing definition of the Energy sector, as detailed within

the current Strategic Economic Plan (SEP) (2017). This definition focuses on the core elements of activity - oil, gas, offshore wind, onshore

wind and renewable technologies and nuclear.

3

The Energy Sector in

New Anglia

4

Overview

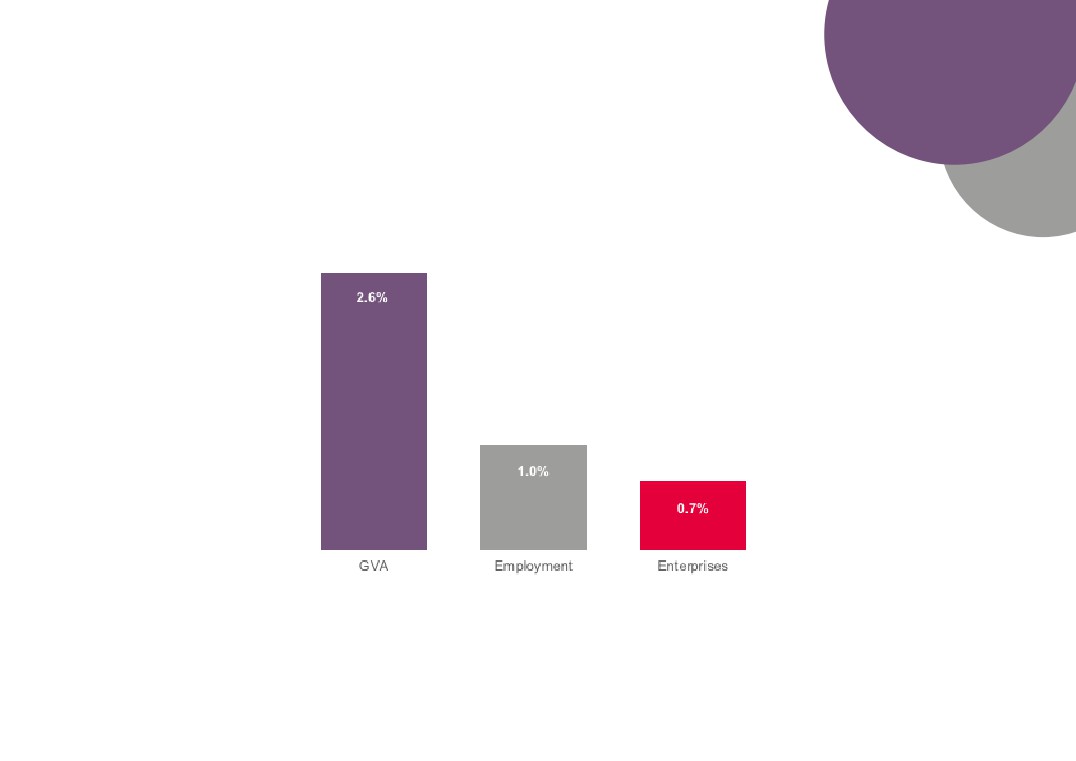

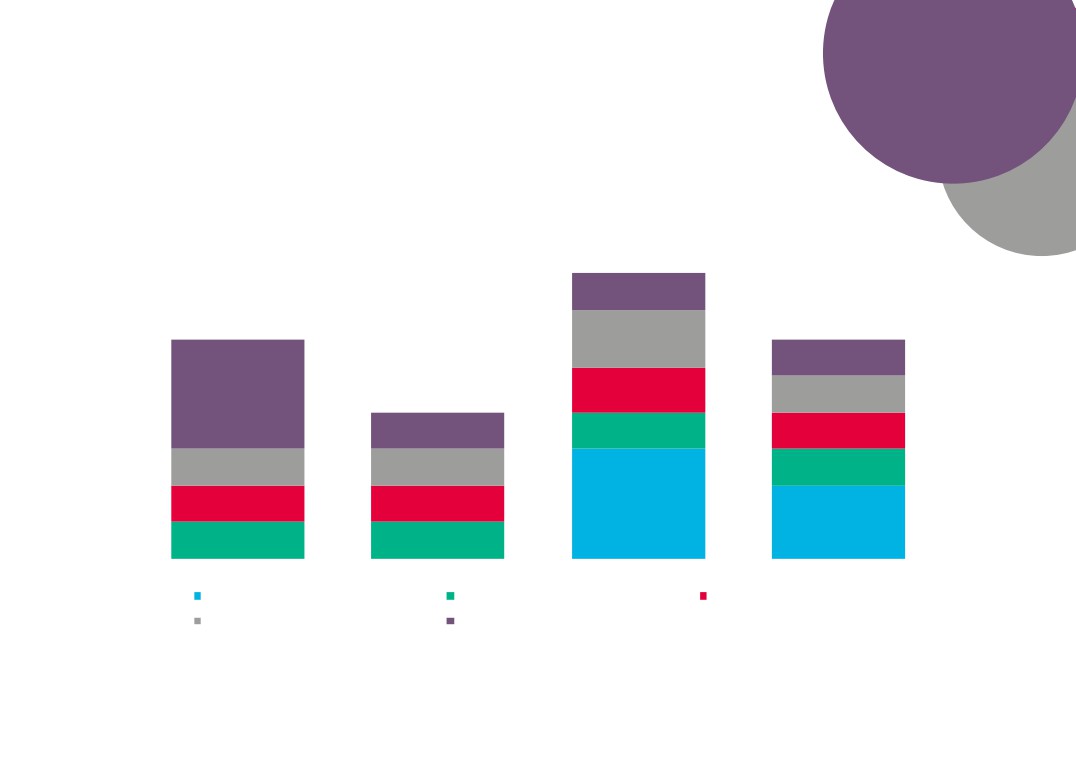

Energy sector contribution to the local economy

£940m

7,800

400

Source: New Anglia LEP Economic Strategy evidence base work

5

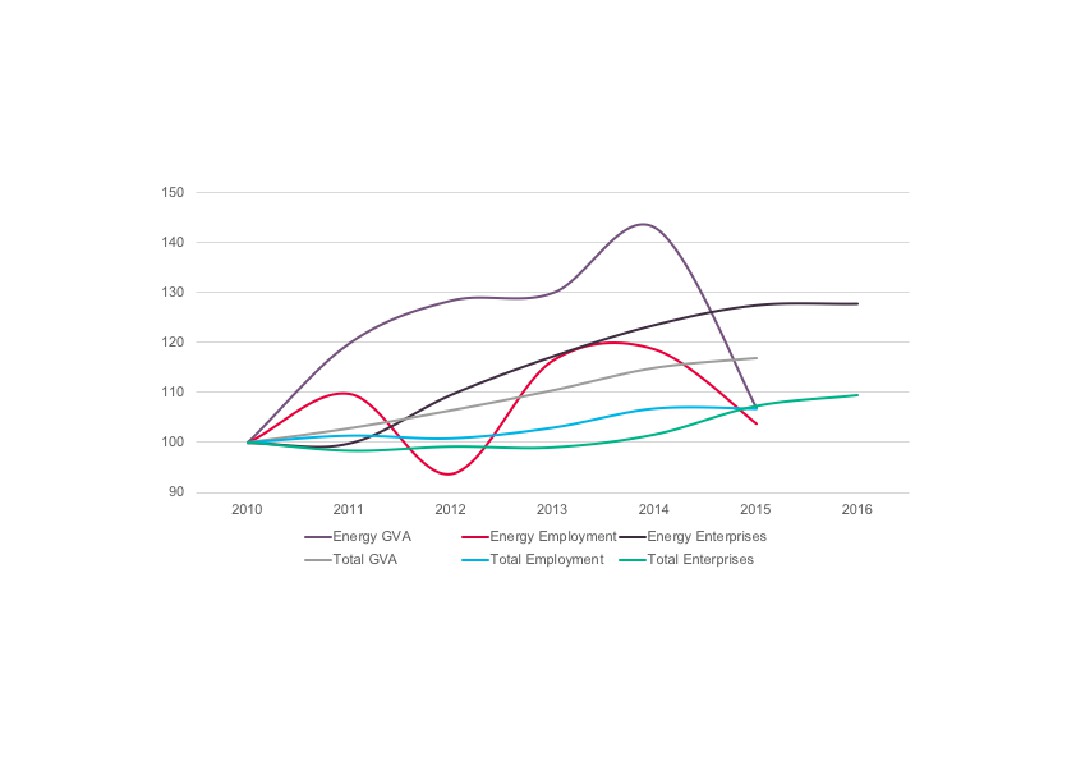

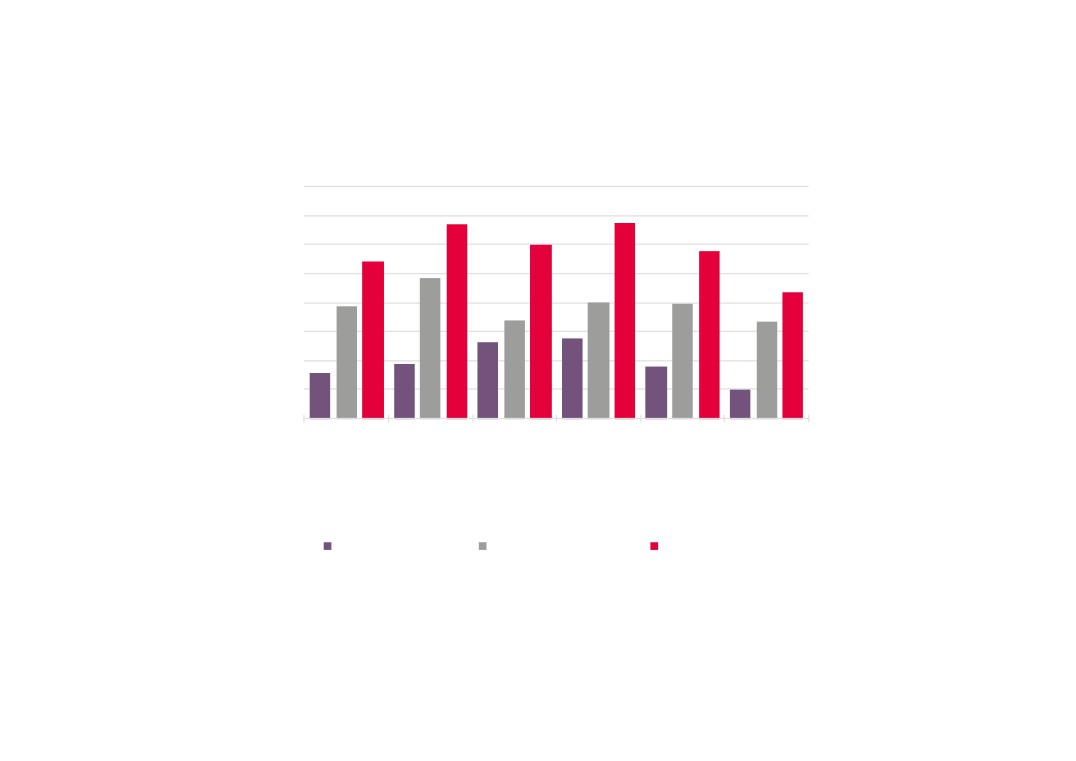

Energy sector contribution to growth in the local economy (2010=100)

Source: New Anglia LEP Economic Strategy evidence base work

6

Gross Value

Energy sector GVA (£m) across comparator

Added (GVA)

areas, 2015

New Anglia

£912m

Norfolk

£438m

Suffolk

£474m

Aberdeen City and Aberdeenshire

£2,248m

Please note that the figure for New Anglia’s

Cumbria LEP

£260m

Energy sector GVA is different to that reported

on page 6 due to a different source being used

Greater Lincolnshire LEP

£771m

for this information. This is so to enable

comparison with other areas across the UK.

Heart of the South West LEP

£1,207m

Humber LEP

£583m

South East LEP

£2,131m

Tees Valley LEP

£686m

East of England Region

£2,981m

Source: Sub-regional Gross Value Added (GVA), Office for National Statistics

7

Proportion of total GVA produced by the

Energy sector across comparator areas, 2015

New Anglia

2.6%

Norfolk

2.4%

Suffolk

2.8%

Aberdeen City and Aberdeenshire

12.4%

Cumbria LEP

2.3%

Greater Lincolnshire LEP

3.7%

Heart of the South West LEP

3.5%

Humber LEP

3.3%

South East LEP

2.5%

Tees Valley LEP

5.4%

East of England Region

2.0%

United Kingdom

3.5%

Source: Sub-regional Gross Value Added (GVA), Office for National Statistics

8

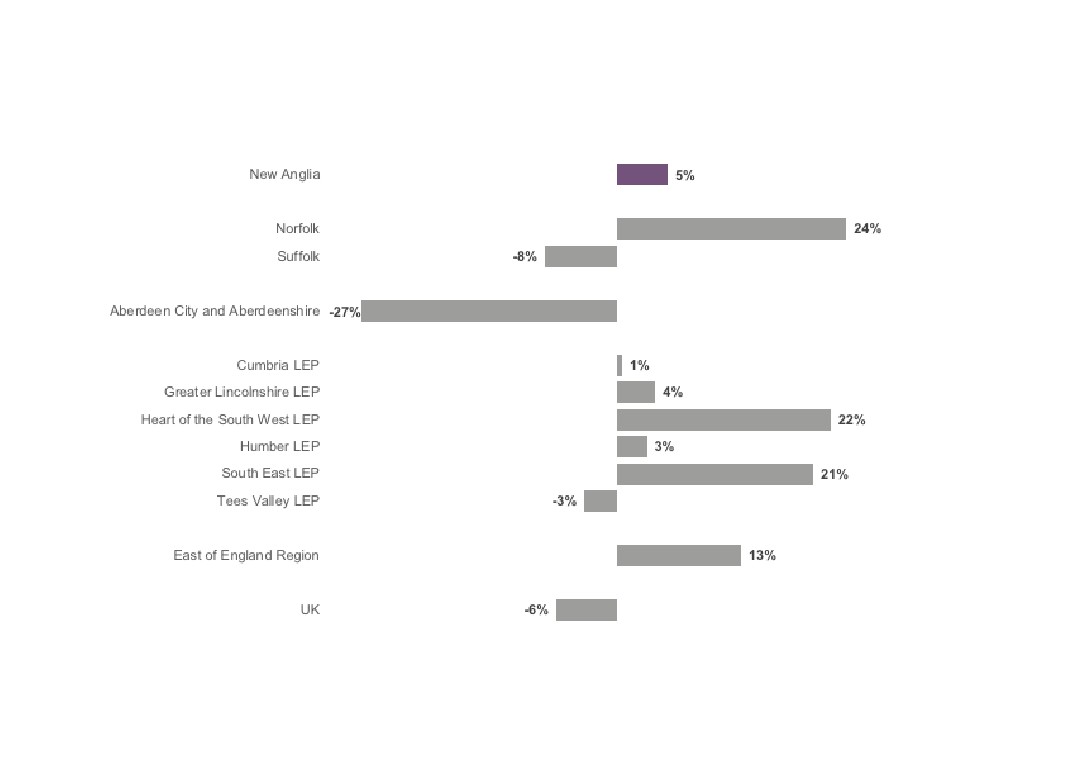

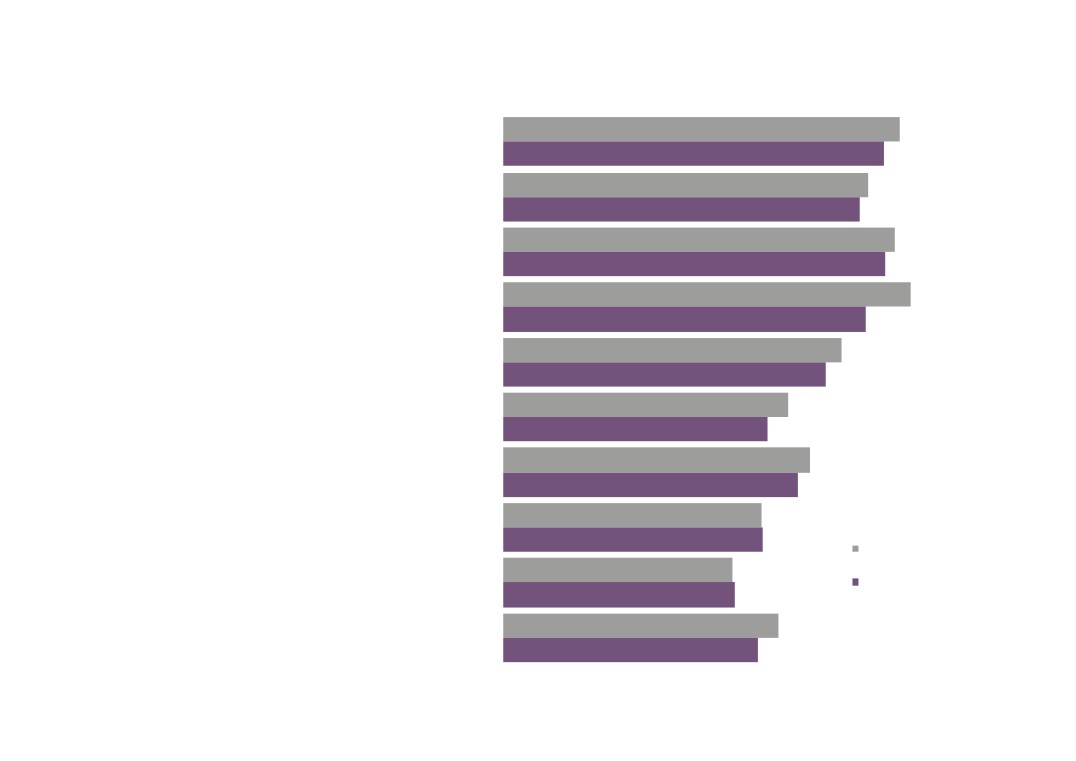

Change in Energy sector GVA across

comparator areas (2010 - 2015)

Sources: Sub-regional Gross Value Added (GVA), Office for National Statistics

9

Employment

Energy sector across comparator areas, 2015

New Anglia

7,450

Norfolk

2,645

Suffolk

4,715

Aberdeen City and Aberdeenshire

33,745

Cumbria

12,485

Greater Lincolnshire

7,600

Please note that the figure for New Anglia’s

Heart of the South West

5,250

Energy sector employment is different to that

reported on page 6 due to a different source being

Humber

6,725

used for this information. This is so to enable

comparison with other areas across the UK.

South East

10,040

Tees Valley

5,365

East of England

20,290

Source: Business Register and Employment Survey, Office for National Statistics

10

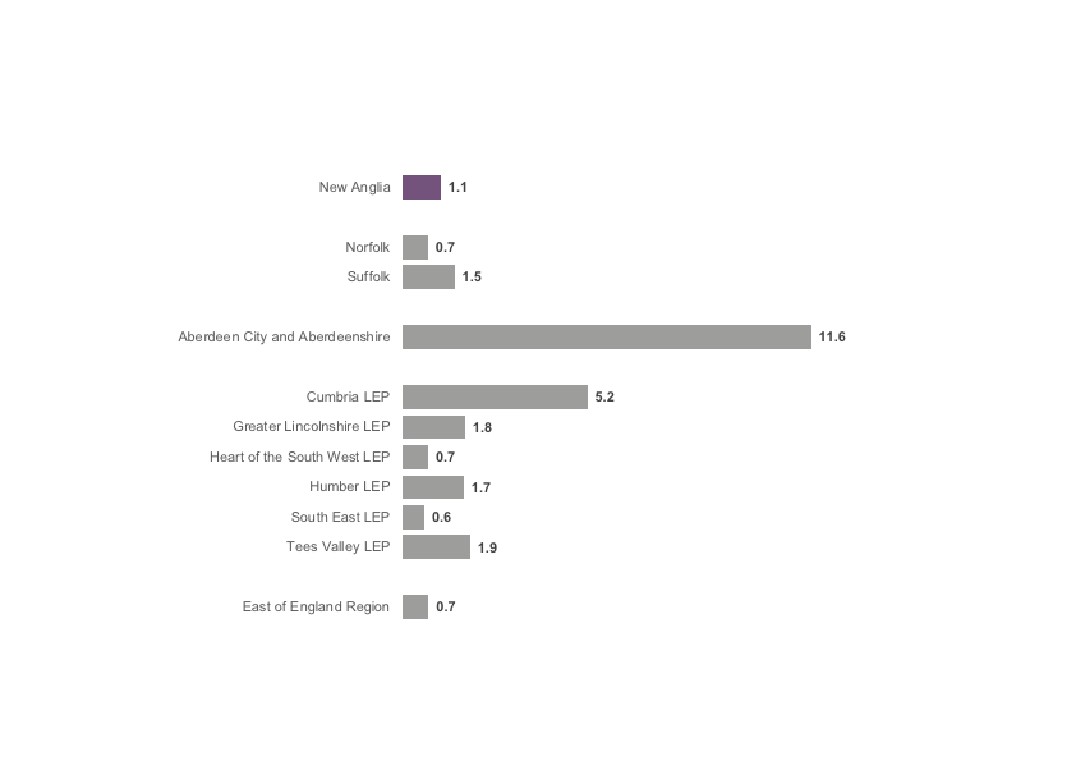

Proportion of employment provided by the

Energy sector across comparator areas, 2015

New Anglia

1.1%

Norfolk

0.7%

Suffolk

1.5%

Aberdeen City and

11.7%

Aberdeenshire

Cumbria

5.3%

Greater Lincolnshire

1.8%

Heart of the South West

0.7%

Humber

1.8%

South East

0.6%

Tees Valley

2.0%

East of England

0.8%

United Kingdom

1.0%

Source: Business Register and Employment Survey, Office for National Statistics

11

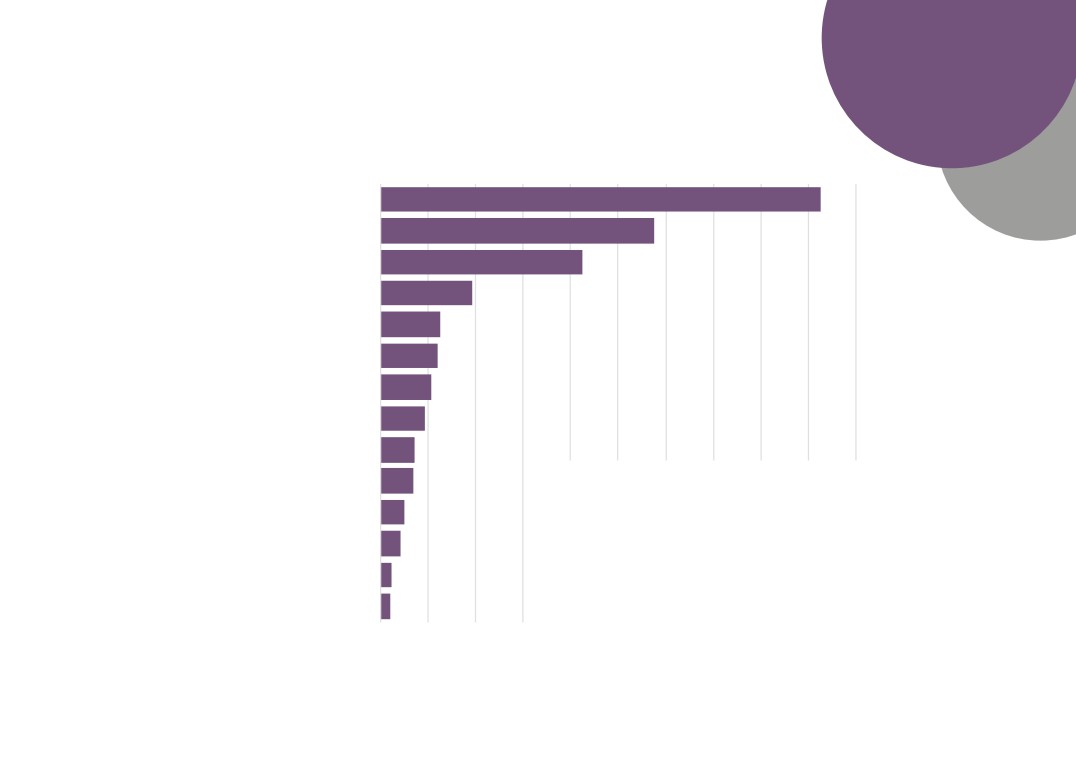

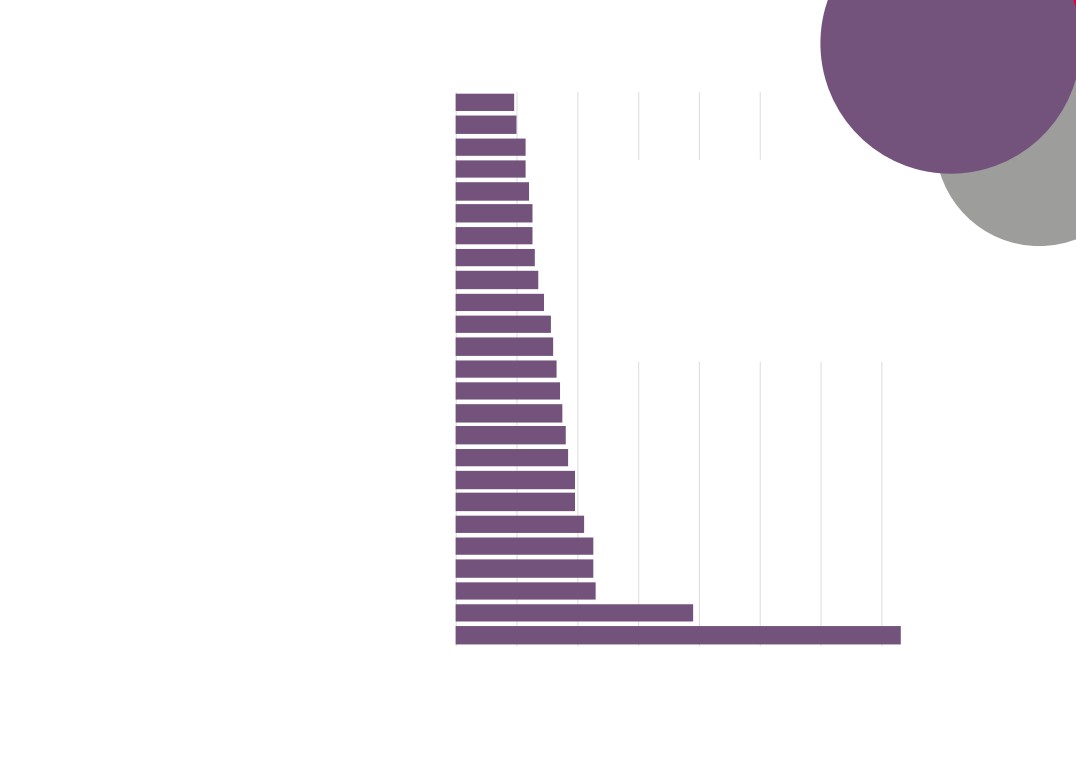

Energy sector employment across New

Anglia, 2015

Great Yarmouth

1,700

Ipswich

1,600

Suf folk Coastal

1,000

Waveney

700

St Edmundsbury

600

South Norfolk

300

Broadland

300

Norwich

300

North Norfolk

300

King`s Lynn and West Norfolk

300

Babergh

200

Breckland

100

Mid Suffolk

100

Forest Heath

0

Source: Business Register and Employment Survey, Office for National Statistics

12

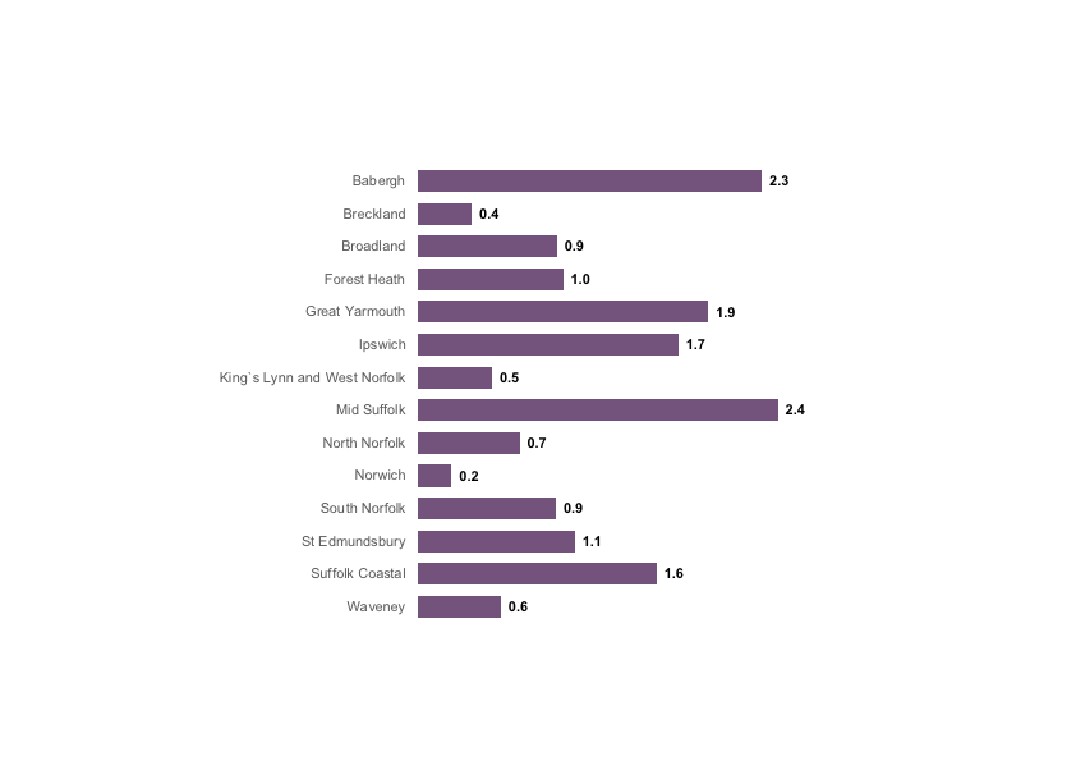

Proportion of employment provided by the

Energy sector across New Anglia, 2015

Breckland

0.4%

Broadland

1.0%

Great Yarmouth

1.9%

Kings Lynn and West

0.5%

Norfolk

North Norfolk

0.7%

Norwich

0.2%

South Norfolk

1.0%

Babergh

2.4%

Forest Heath

1.0%

Ipswich

1.8%

Mid Suffolk

2.5%

St Edmundsbury

1.1%

Suffolk Coastal

1.6%

Waveney

0.6%

Source: Business Register and Employment Survey, Office for National Statistics

13

Energy sub-sector employment: Mining / extraction, refining,

manufacture, and operation of terminals and pipelines

1,635

New Anglia

1,340

950

Norfolk

900

690

Suffolk

395

Aberdeen City and

30,900

Aberdeenshire

26,760

10,070

Cumbria

10,250

2,805

Greater Lincolnshire

2,575

2015

150

Heart of the South West

290

2010

4,100

Humber

3,495

1,100

South East

1,865

2,480

Tees Valley

3,565

Source: Business Register

and Employment Survey,

Office for National Statistics

2,745

East

3,005

14

Energy sub-sector employment: Electricity generation, storage, and

transmission (incl. fuels, nuclear, offshore, biomass)

2,480

New Anglia

1,900

310

Norfolk

270

2,120

Suffolk

1,500

510

Aberdeen City and Aberdeenshire

640

2015

Source: Business Register

and Employment Survey,

Office for National Statistics

2010

Cumbria

125

960

Greater Lincolnshire

615

1,910

Heart of the South West

3,550

1,110

Humber

1,440

2,150

South East

2,450

810

Tees Valley

1,880

4,300

East

2,950

15

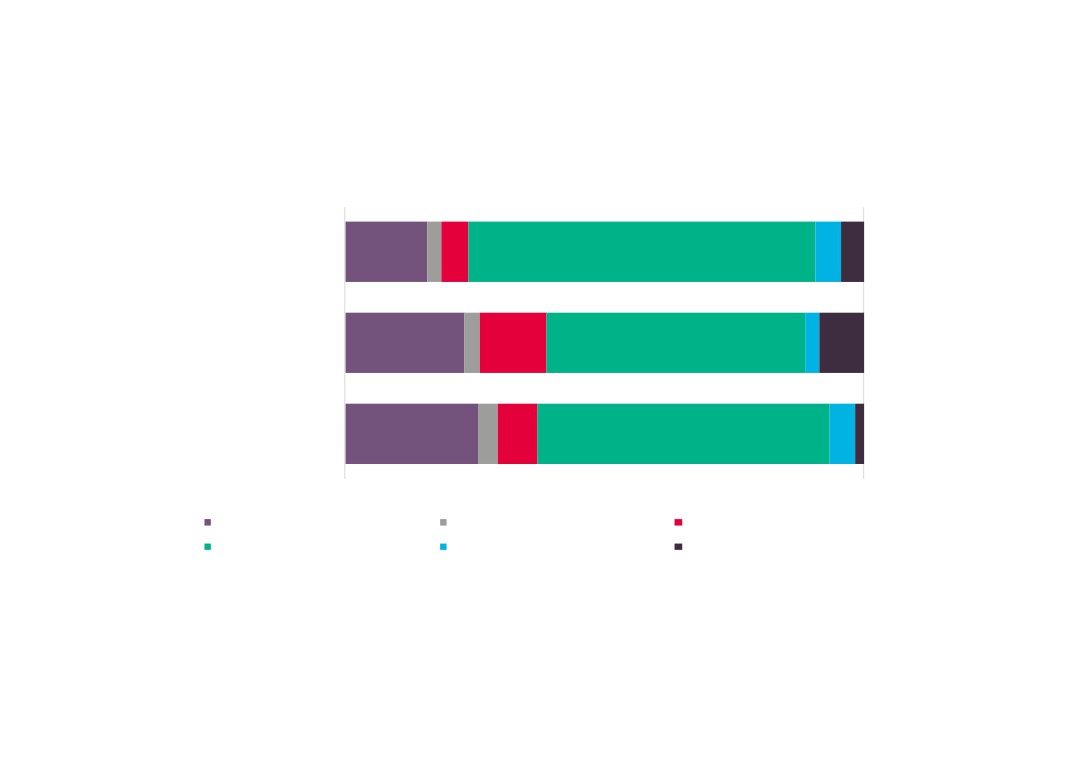

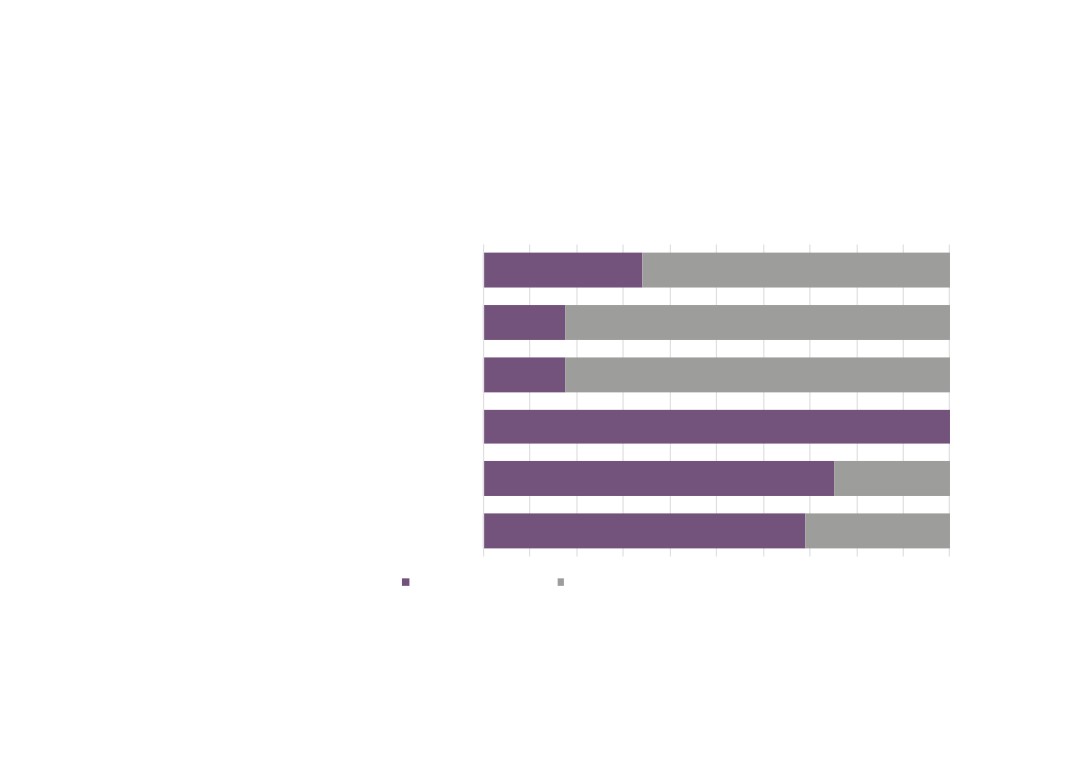

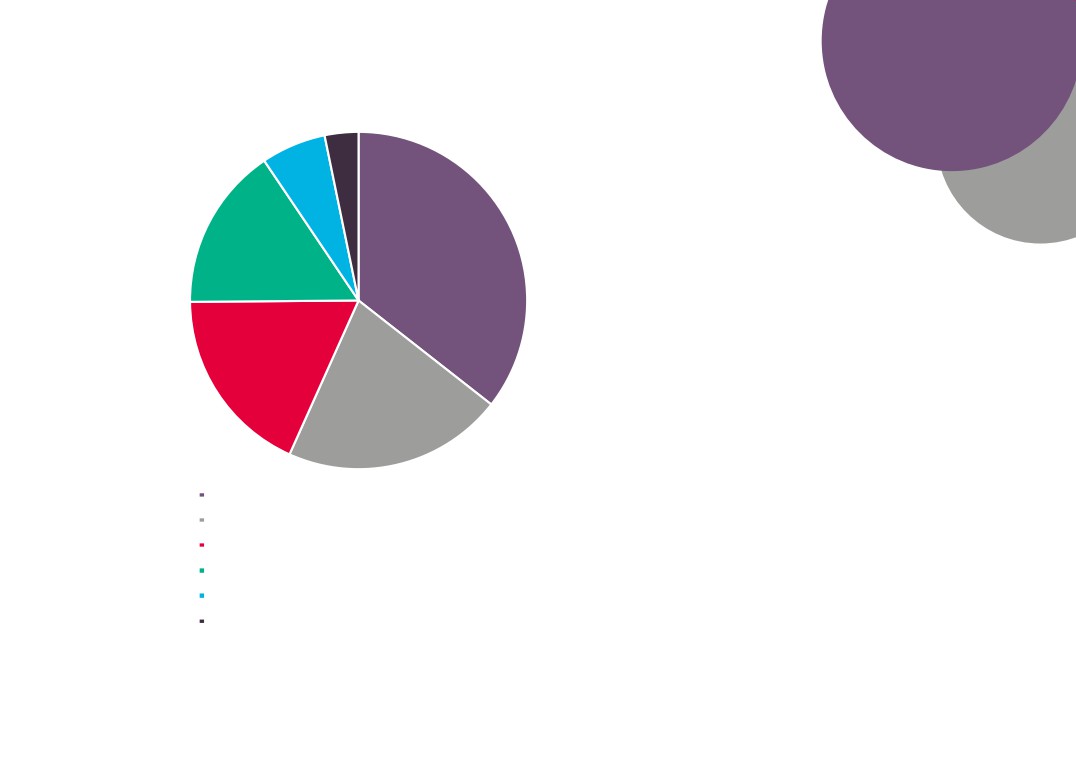

National proportions of employees, turnover and businesses

by Low Carbon and Renewable Energy (LCRE) Group, 2014

Employees (full-time

16%

3%5%

67%

5% 4%

equivalents)

Turnover (£ thousands)

23%

3%

13%

50%

3% 9%

Number of businesses

26%

4%

8%

56%

5%

0%

100%

Low carbon electricity

Low carbon heat

Energy from waste & biomass

Energy efficient products

Low carbon services

Low emission vehicles etc.

Source: Low Carbon and Renewable Energy Industrial activity, 2014, Office for National Statistics

16

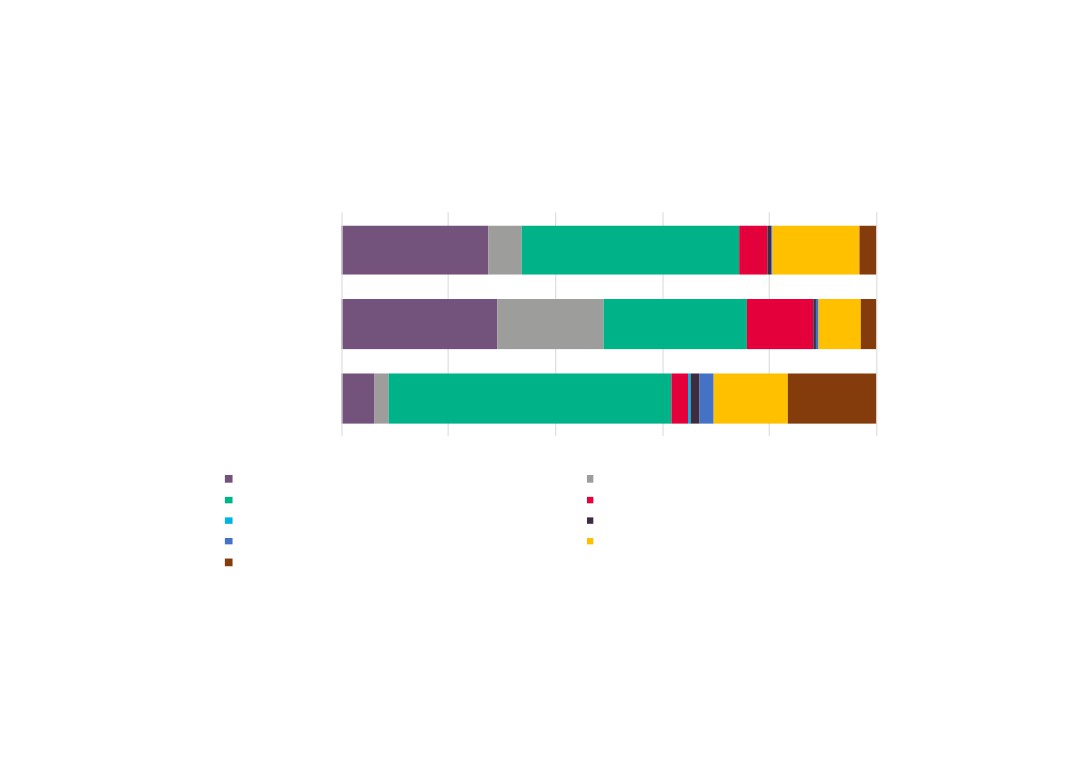

National proportions of employees, turnover and businesses

by Low Carbon and Renewable Energy (LCRE) Group by

broads industrial group, 2014

Employees (full-time

equivalents)

Turnover (£ thousands)

Number of businesses

0%

20%

40%

60%

80%

100%

Manufacturing

Energy and water

Construction

Wholesale and retail trade

Transportation and storage

Information and communication

Real estate activities

Professional, scientific, technical activities

Other

Source: Low Carbon and Renewable Energy Industrial activity, 2014, Office for National Statistics

17

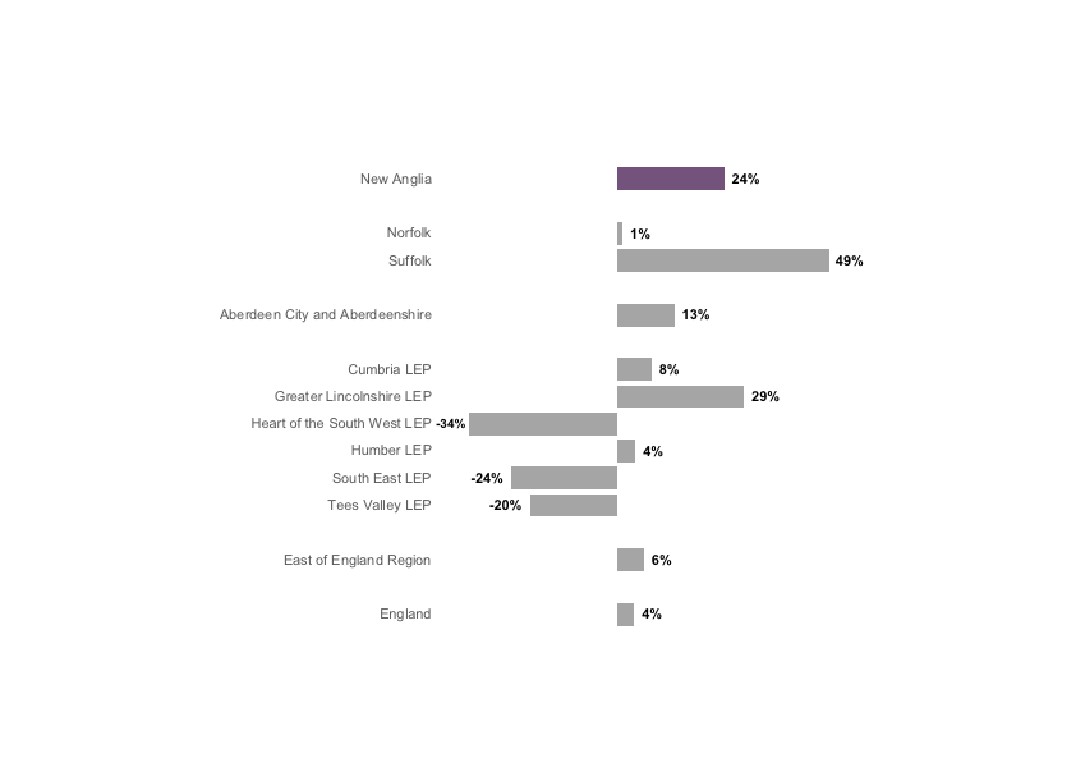

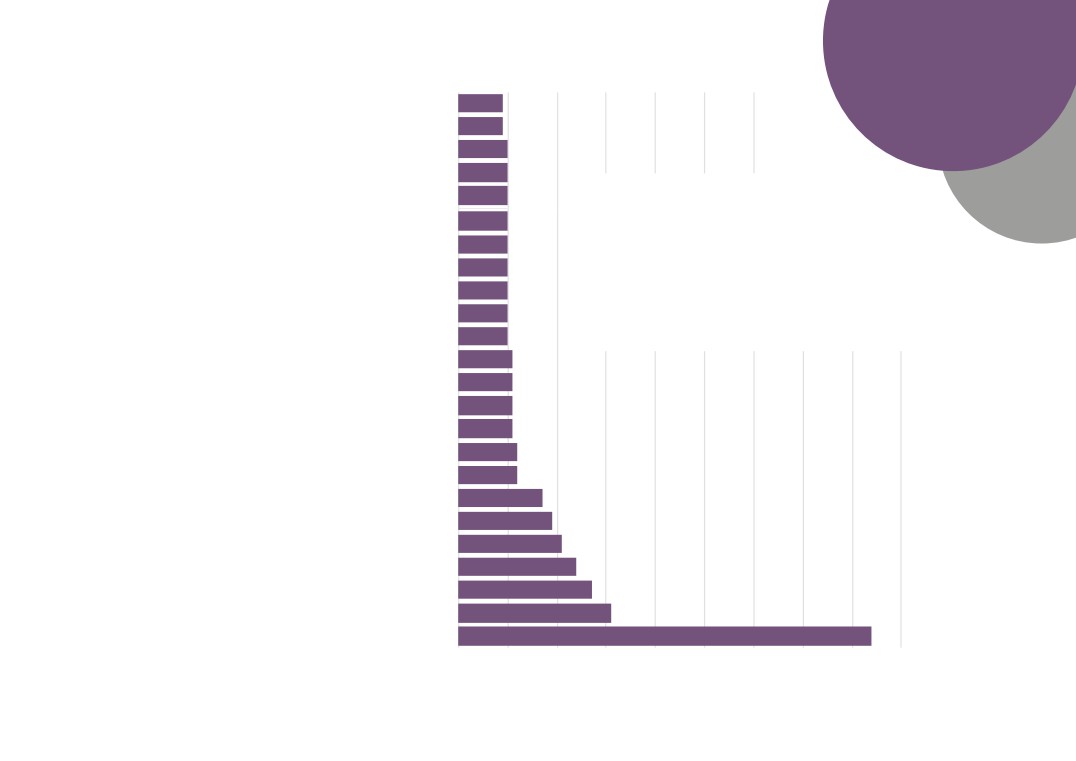

Change in Energy sector employment

across comparator areas, 2010 - 2015

Source: Business Register and Employment Survey, Office for National Statistics

18

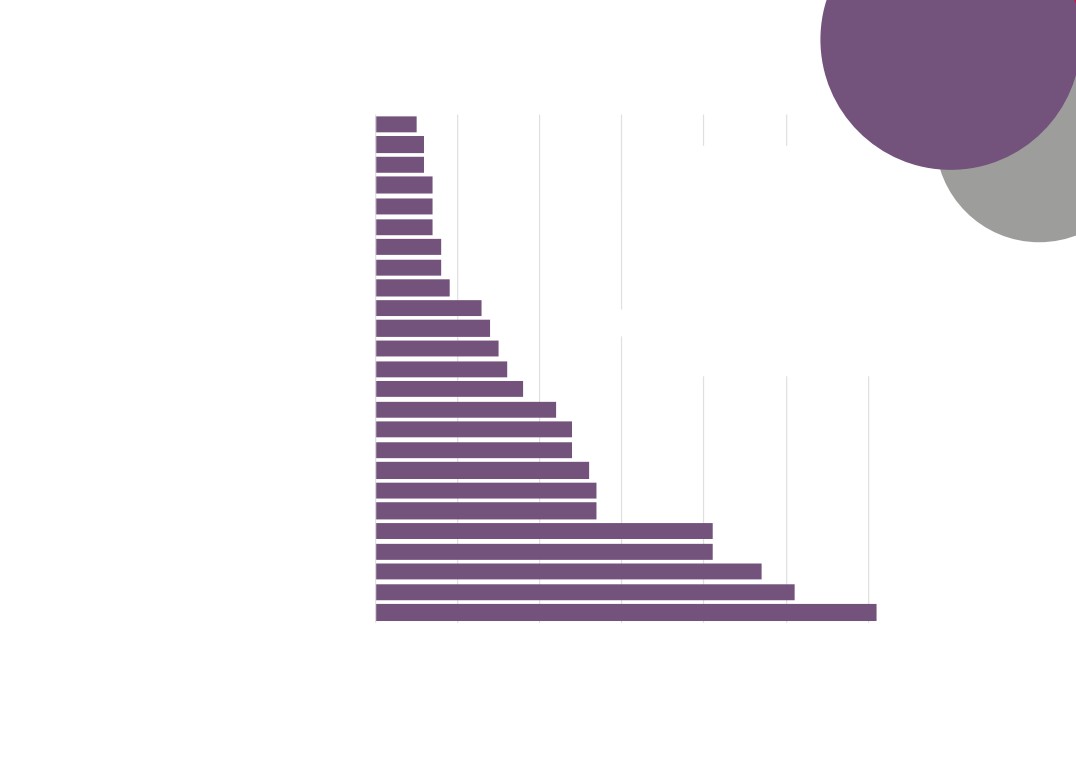

Change in Energy sector employment

across New Anglia, 2010 - 2015

Babergh

429%

Breckland

-33%

Broadland

31%

Forest Heath

-19%

Great Yarmouth

1%

Ipswich

26%

King`s Lynn and West Norfolk

8%

Mid Suffolk

211%

North Norfolk

0%

Norwich

14%

South Norfolk

-2%

St Edmundsbury

-4%

Suffolk Coastal

9%

Waveney

156%

Source: Business Register and Employment

Survey, Office for National Statistics

19

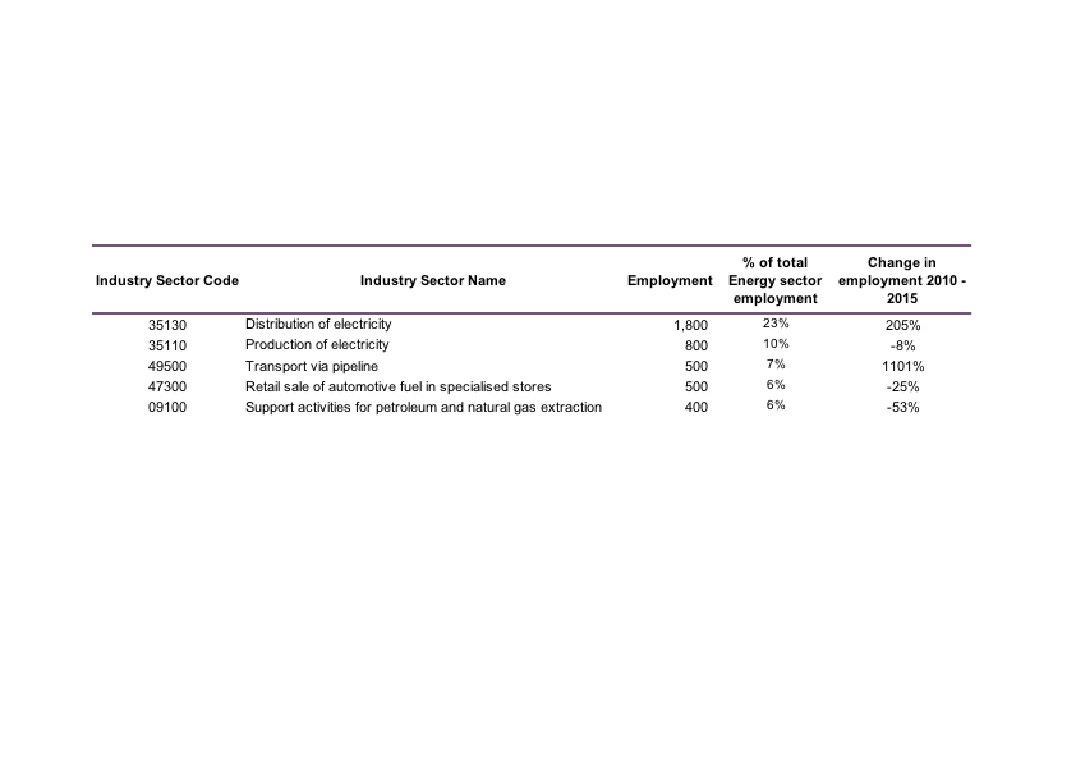

Top 5 Energy sub sectors (in employment terms), 2015

Source:

20

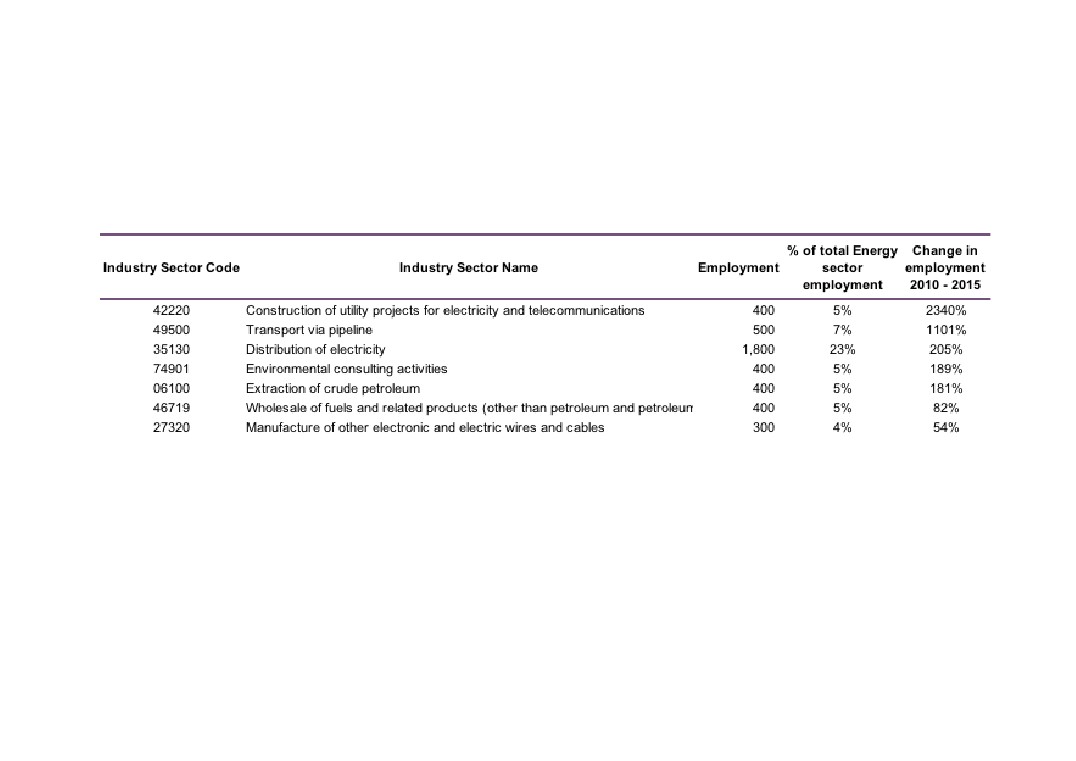

Top growth Energy sub sectors with 100 employees or more

Source:

21

Energy sector location quotients

across comparator areas, 2015

Location quotients (LQs) are a

useful way of showing a sectors

importance to the local economy

relative to the national picture. The

analysis presented here uses

employment with an LQ above 1

showing a higher concentration than

nationally, and an LQ of below than

1 a lower concentration.

Source: Business Register and Employment Survey, Office for National Statistics

22

Energy sector location quotients across

New Anglia, 2015

Source: Business Register and Employment Survey, Office for National Statistics

23

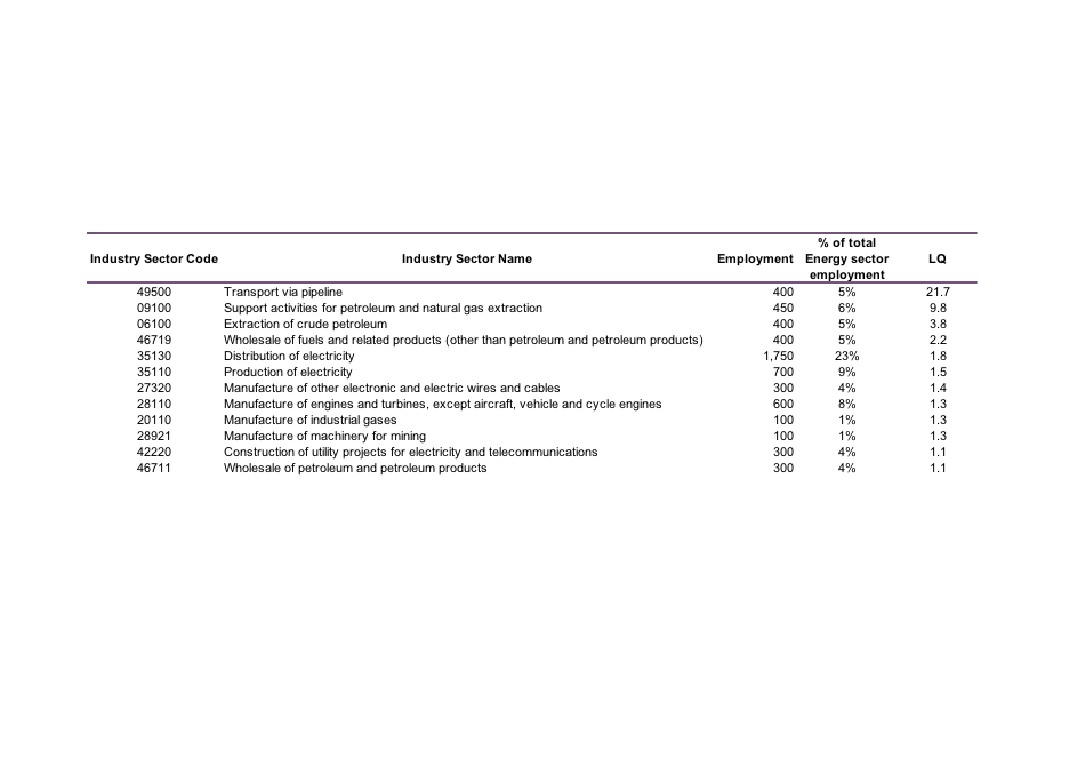

Energy sub sectors with 100+ employees and location

quotients (LQs) above 1

Source: Business Register and Employment Survey 2015, Office for National Statistics

24

Full time, part time, and self-employment

in the Energy Sector, 2015

New Anglia

57%

29%

14%

Energy

83%

8%

9%

0%

Full time

Part time

Self Employed

100%

Source: New Anglia LEP Economic Strategy evidence base work

25

Change in full time, part time, and self-employment in

the Energy sector, 2010 - 2015

18.3%

Full time

8.7%

Energy

New Anglia

-9.4%

Part time

2.1%

-47.6%

Self employed

10.0%

Source: New Anglia LEP Economic Strategy evidence base work

26

0%

100%

New Anglia LEP

35%

23%

21%

22%

Norfolk

35%

22%

21%

22%

Suffolk

36%

23%

20%

21%

Workplace Energy sector

Cumbria LEP

28%

31%

20%

21%

employment 2011 by broad

Greater Lincolnshire LEP

34%

22%

21%

24%

Heart of the South West LEP

33%

27%

19%

20%

Standard Occupational

Humber LEP

35%

22%

20%

23%

Classification (SOC) across

South East LEP

40%

24%

17%

20%

comparator areas

Tees Valley LEP

28%

28%

23%

20%

Source: 2011 Census, Office for National Statistics

East of England Region

37%

27%

18%

19%

England

35%

28%

17%

20%

112 Production Managers and Directors

212 Engineering Professionals

311 Science, Engineering and Production Technicians

812 Plant and Machine Operatives

27

0%

100%

Breckland

40%

18%

15%

27%

Broadland

42%

22%

15%

21%

Great Yarmouth

29%

27%

24%

20%

King`s Lynn and West Norfolk

30%

18%

26%

26%

Workplace Energy sector

North Norfolk

41%

18%

19%

22%

employment 2011 by broad

Norwich

31%

25%

26%

19%

Standard Occupational

South Norfolk

35%

27%

19%

20%

Classification (SOC) across

Babergh

38%

21%

15%

26%

New Anglia

Forest Heath

34%

18%

24%

25%

Ipswich

35%

27%

19%

19%

Source: 2011 Census, Office for National Statistics

Mid Suffolk

39%

20%

22%

19%

St Edmundsbury

40%

20%

21%

19%

Suffolk Coastal

28%

36%

18%

19%

Waveney

36%

18%

21%

26%

112 Production Managers and Directors

212 Engineering Professionals

311 Science, Engineering and Production Technicians

812 Plant and Machine Operatives

28

Enterprises

Energy sector enterprise numbers across

comparator areas, 2016

New Anglia

375

Norfolk

185

Suffolk

190

Please note that the figure for New Anglia’s

Energy sector enterprises is different to that

reported on page 6 due to a different source being

used for this information. This is so to enable

Aberdeen City and Aberdeenshire

360

comparison with other areas across the UK.

Cumbria LEP

175

Greater Lincolnshire LEP

270

Heart of the South West LEP

500

Humber LEP

210

South East LEP

835

Tees Valley LEP

115

East of England Region

1,385

Source: UK Business Counts, Office for National Statistics

29

Energy sector enterprises as a proportion of total

enterprises across comparator areas, 2016

New Anglia

0.6%

Norfolk

0.6%

Suffolk

0.7%

Aberdeen City and Aberdeenshire

1.6%

Cumbria LEP

0.7%

Greater Lincolnshire LEP

0.7%

Heart of the South West LEP

0.7%

Humber LEP

0.7%

South East LEP

0.5%

Tees Valley LEP

0.7%

East of England Region

0.5%

England

0.6%

Source: UK Business Counts, Office for National Statistics

30

Energy sector enterprise numbers across New Anglia, 2016

Suffolk Coastal

35

Norwich

30

Mid Suffolk

30

North Norfolk

25

King`s Lynn and West Norfolk

25

Breckland

25

St Edmundsbury

20

South Norfolk

20

Broadland

20

Waveney

15

Great Yarmouth

15

Forest Heath

15

Babergh

15

Ipswich

5

Source: UK Business Counts, Office for National Statistics

31

Energy sector enterprises as a proportion of total

enterprises across New Anglia, 2016

Babergh

0.4%

Breckland

0.5%

Broadland

0.4%

Forest Heath

0.6%

Great Yarmouth

0.5%

Ipswich

0.1%

King`s Lynn and West Norfolk

0.5%

Mid Suffolk

0.6%

North Norfolk

0.6%

Norwich

0.7%

South Norfolk

0.4%

St Edmundsbury

0.4%

Suffolk Coastal

0.6%

Waveney

0.4%

Source: UK Business Counts, Office for National Statistics

32

New Anglia

90%

7%

3%

Cumbria LEP

93%

7%

Greater Lincolnshire LEP

89%

8%

2%

Heart of the South West LEP

91%

7%

1%

Energy sector enterprises

Humber LEP

89%

7%

4%

South East LEP

90%

8%

2%

by size across

Tees Valley LEP

94%

2%

2%

comparator areas, 2016

Aberdeen City

82%

9%

5%

3%

Aberdeenshire

94%

3%

1%

East of England Region

90%

7%

2%

Please note that at Local Authority level that

businesses employing more than 250 people are

England

89%

8%

2%

not reported due to their very small numbers and

No. of employees

resulting disclosive nature.

Micro (0 to 9)

Small (10 to 49)

Medium-sized (50 to 249)

Large (250+)

Source: UK Business Counts, Office for

Babergh

88%

13%

National Statistics

Breckland

100%

Broadland

100%

Forest Heath

100%

Great Yarmouth

89%

4%

7%

Ipswich

100%

Energy sector

King`s Lynn and West Norfolk

100%

Mid Suffolk

100%

enterprises by size

North Norfolk

90%

10%

across New Anglia, 2016

Norwich

93%

7%

South Norfolk

100%

St Edmundsbury

100%

Suffolk Coastal

100%

Waveney

95%

5%

33

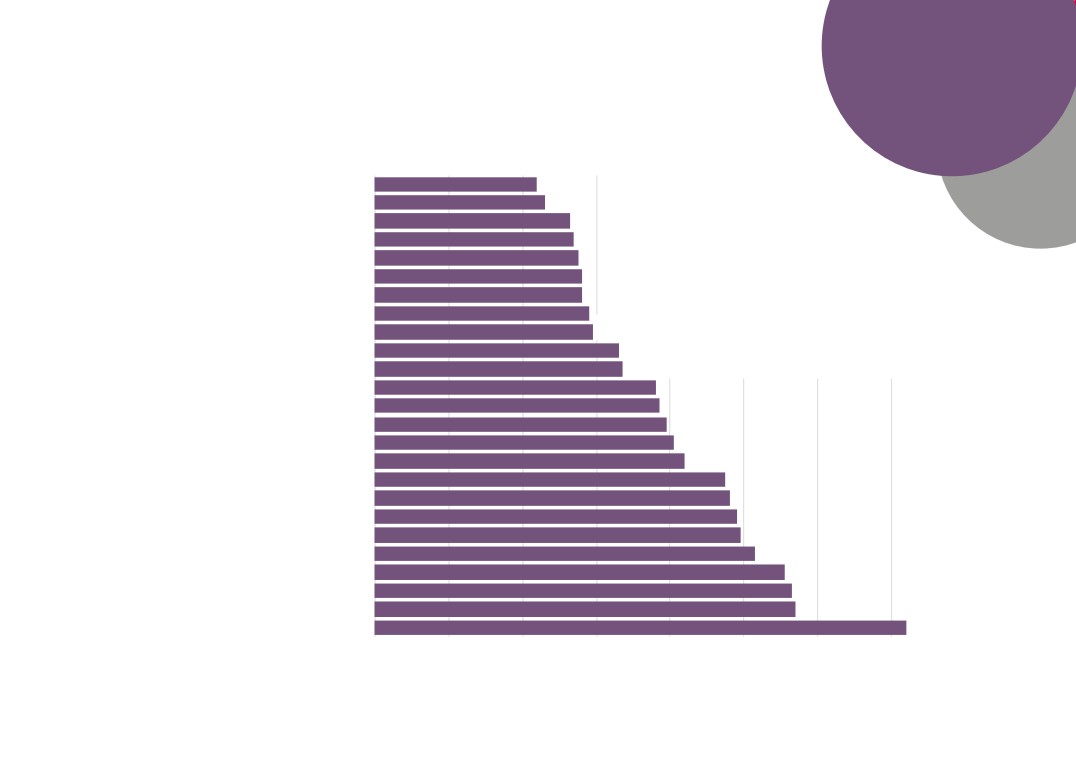

Change in Energy enterprises across

comparator areas, 2010 - 2016

New Anglia

29%

Norfolk

28%

Suffolk

46%

Aberdeen City and Aberdeenshire

38%

Cumbria LEP

35%

Greater Lincolnshire LEP

35%

Heart of the South West LEP

72%

Humber LEP

31%

South East LEP

62%

Tees Valley LEP

35%

East of England Region

49%

England

60%

Source: UK Business Counts, Office for National Statistics

34

Babergh

-40%

Breckland

25%

Broadland

300%

Forest Heath

200%

Great Yarmouth

-25%

Change in Energy

Ipswich

0%

enterprises across New

King`s Lynn and West Norfolk

0%

Anglia, 2010 - 2016

Mid Suffolk

100%

Sources: UK Business Counts, Office for

National Statistics

North Norfolk

25%

Norwich

200%

South Norfolk

100%

St Edmundsbury

0%

Suffolk Coastal

40%

Waveney

0%

35

Wages

Energy sector wages - Median gross annual pay all

employees (UK)

£45,257

Production managers and directors in mining and energy (1123)

(3%)

£43,818

£41,142

Mechanical engineers (2122)

(2%)

£40,158

Source: Annual Survey

£44,636

of Hours and Earnings,

Electrical engineers (2123)

(4%)

Office for National

£43,051

Statistics

£46,376

Electronics engineers (2124)

(20%)

£38,517

£38,486

(4%)

Production and process engineers (2127)

£36,865

£30,883

Figures in brackets

Electrical and electronics technicians (3112)

(3%)

denote percentage

£30,110

change between 2014

and 2016

£34,650

Engineering technicians (3113)

(4%)

£33,175

£29,125

Planning, process and production technicians (3116)

(0.1%)

£29,104

2016

£25,660

2014

Science, engineering and production technicians n.e.c. (3119)

(1%)

£25,507

£29,094

Energy plant operatives (8124)

(6%)

£27,343

Energy sector wages - Median gross annual pay full time employees (UK)

£45,257

Production managers and directors in mining and energy (1123)

(4%)

£43,452

£41,745

Mechanical engineers (2122)

(2%)

£40,759

£44,802

Source: Annual Survey

(3%)

Electrical engineers (2123)

of Hours and Earnings,

£43,698

Office for National

Statistics

£46,511

(12%)

Electronics engineers (2124)

£41,446

£38,648

Production and process engineers (2127)

(5%)

£36,916

Figures in brackets

£32,530

denote percentage

Electrical and electronics technicians (3112)

(8%)

change between 2014

£30,203

and 2016

£35,039

Engineering technicians (3113)

(4%)

£33,652

£29,570

(-0.3%)

Planning, process and production technicians (3116)

£29,672

2016

£26,276

(-1%)

Science, engineering and production technicians n.e.c. (3119)

2014

£26,526

£31,440

Energy plant operatives (8124)

(8%)

£29,109

37

Energy Sector Skills Supply

and Demand

38

Qualifications

Production (Agriculture, Energy and Water) Workplace

Qualifications across Comparator Areas, 2011

New Anglia

19%

17%

17%

14%

19%

14%

Cumbria LEP

20%

19%

18%

13%

19%

11%

Greater Lincolnshire LEP

20%

18%

17%

13%

17%

15%

Heart of the South West LEP

18%

18%

19%

14%

20%

10%

Humber LEP

18%

17%

18%

15%

20%

13%

South East LEP

17%

17%

17%

13%

21%

14%

Tees Valley LEP

14%

15%

16%

17%

25%

14%

Source: 2011 Census, Office for National Statistics

East of England Region

18%

17%

17%

13%

21%

13%

England

16%

17%

17%

14%

25%

12%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

39

FE Learning

Aims

All data (unless stated otherwise) is sourced from the Department for Education’s Further Education data library

In order to present information that is relevant to New Anglia LEPs high performing and underpinning sectors then we have

identified FE and skills provision data split by Sector Lead Body and aligned a best-fit with each sector.

The Sector Lead Bodies identified as being the most relevant to the Energy sector are: Chemicals, Life sciences, Pharmaceuticals, Nuclear,

Oil, Gas, Petroleum, Polymer; Energy & Utility; and Engineering Construction Industry.

However, not all FE and Skills learning aims align with a sector lead body. In fact, on average around two thirds are classed as unknown. This

means that we are basing results here on roughly a third of the data.

Please note that all data is rounded to the nearest 10 and that therefore some figures presented may not add to the sum totals presented.

40

Energy sector learning aims delivered to New Anglia

learners by Sector Lead Body, 2012/13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

New Anglia

230

170

100

National

13,100

11,400

2,500

Chemicals, Life sciences, Pharmaceuticals, Nuclear, Oil, Gas, Petroleum, Polymer

Energy & Utility

Engineering Construction Industry

Source: FE Data Library, Department for Education

41

Energy sector learning aims delivered to New Anglia learners

by Sector Lead Body, 2010/11 and 2012/13

580

270

230

170

100

70

2010/ 11

2012/13

Chemicals, Life sciences, Pharmaceuticals, Nuclear, Oil, Gas, Petroleum, Polymer

Energy & Utility

Engineering Construction Industry

Source: FE Data Library, Department for Education

42

Change in Energy sector learning aims delivered to New Anglia

learners by Sector Lead Body, 2010/11 - 2012/13

11%

Total inc. Unknown

9%

4%

Total not inc. Unknown

7%

-46%

Energy

-12%

-15%

Chemicals, Life sciences, Pharmaceuticals, Nuclear, Oil,

Gas, Petroleum, Polymer

7%

-71%

Energy & Utility

-29%

43%

Engineering Construction Industry

0%

Source: FE Data Library, Department for Education

New Anglia

National

43

Energy sector learning aims delivered to New Anglia

residents by New Anglia based and external providers by

Sector Lead Body, 2012/13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Energy

170

330

Chemicals, Life sciences, Pharmaceuticals, Nuclear, Oil, Gas,

40

190

Petroleum, Polymer

Energy & Utility

30

140

Engineering Construction Industry

100

-

Total inc. unknown

158,480

52,170

Total with unknown removed

55,340

24,770

New Anglia Provider

External Provider

Source: FE Data Library, Department for Education

44

Energy learning aims delivered to New Anglia learners by domiciled

providers by Sector Lead Body, 2010/11 and 2012/13

210

100

70

60

40

30

2010/ 11

2012/ 13

Chemicals, Life sciences, Pharmaceuticals, Nuclear, Oil, Gas, Petroleum, Polymer

Energy & Utility

Engineering Construction Industry

Source: FE Data Library, Department for Education

45

Change in Energy sector learning aims delivered to New Anglia learners

by domiciled providers by Sector Lead Body, 2010/11 - 2012/13

5%

Total inc. Unknown

9%

-38%

Total not inc. Unknown

7%

-50%

Energy

-13%

-43%

Chemicals, Life sciences, Pharmaceuticals, Nuclear,

Oil, Gas, Petroleum, Polymer

7%

-86%

Energy & Utility

-29%

67%

Engineering Const ruction Industry

0%

New Anglia National

Source: FE Data Library, Department for Education

46

Apprenticeships

Energy sector apprenticeship starts by year

5

8

5

6

15

5

5

5

5

5

5

5

5

5

15

10

5

5

2011/ 12

2012/13

2013/14

2014/ 15

Engineering Construction

Sustainable Resource Management

The Gas Industry

The Power Industry

The Water Industry

Source: Skills Funding Agency Data Cube

47

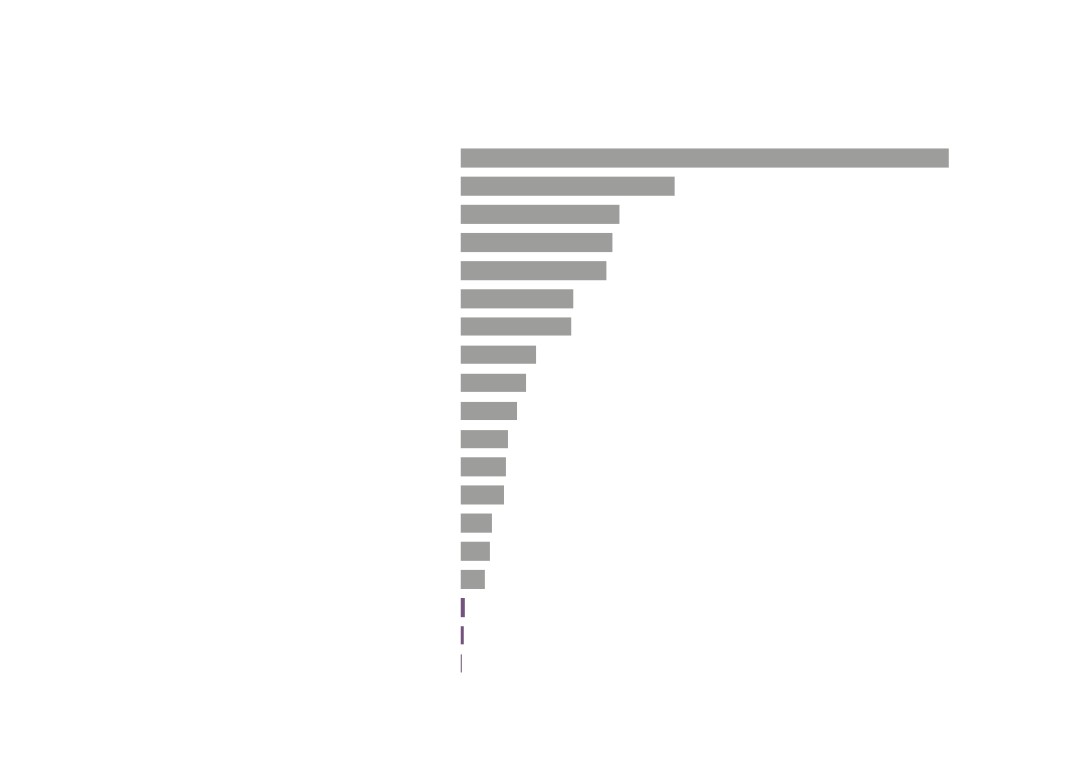

Apprenticeship participation by sector, 2014/15

Human health and social work activities

5,840

Wholesale and retail trade

2,560

Accomodation and food service activities

1,900

Manufacturing

1,820

Construction

1,740

Administrative and support service activities

1,350

Education

1,330

Professional, scientific and technical activities

900

Other service activities

780

Arts, entertainment and recreation

680

Public administration and defence

570

Transportation and storage

540

Financial and insurance activities

520

Information and communication

370

Agriculture, Forestry and Fishing

350

Real estat e activities

290

Mining and Quarrying

50

Water supply, sewerage, waste management and remediation acitivities

40

Electricity, gas, steam and air conditioning supply

10

Source: FE Data Library, Department for Education

48

Apprenticeship participation in the Energy sector

2014/15 as a proportion of total participation

0.2%

New Anglia

0.05%

0.2%

0.1%

East of England

0.04%

0.4%

0.04%

UK

0.4%

0.5%

Mining and Quarrying

Electricity, gas, steam and air conditioning supply

Water supply, sewerage, waste management and remediation acitivities

Source: FE Data Library, Department for Education

49

Labour Insight

Jobs

The following section presents data from Labour Insight, a Burning Glass analytical tool. This tool collects details of online job

postings from multiple sources and enables the analysis of these postings based on specific skills, educational requirements,

and job titles, for example.

Please note that whilst Labour Insight will capture more information on the jobs market than more traditional Department for

Work and Pensions vacancy data, the fact that not all job vacancies are advertised means that there will still be gaps in the

findings.

According to the Labour Insight Jobs tool, then there were 1,654 postings for the sector in New Anglia between Jan. 1, 2012

and Dec. 31, 2016.

The definition for the Energy sector in this exercise is wider than that we have defined using SIC codes (and is in fact in line

with that used to approximate GVA for the sector) but it still provides us with some useful information on vacancy numbers and

types.

The definition used in this exercise captures the following industry and sectors: ‘Mining and Quarrying’, and ‘Electricity, Gas,

Steam, and Air Conditioning supply’.

50

Location

0

50

100

150

200

250

300

350

400

450

500

Great Yarmouth

Norwich

Ipswich

Waveney

St Edmundsbury

Breckland

Broadland

Suf folk Coastal

South Norfolk

Forest Heath

Energy sector vacancies

Mid Suffolk

across New Anglia, Jan

King's Lynn and West Norfolk

2012 - Dec 2016

North Norfolk

228 unspecified or unclassified postings

Babergh

Source: Labour Insight Jobs, Burning Glass

Technologies

51

Recruiters

Beacon Hill Resources

E.ON UK

Industry Resource Services Ltd

Top Energy

Twinserve Ltd

Dereham Water Supplies International Ltd

Sector Employers

BFEU Global

across New

The Great Yarmouth Advertiser

BP

Anglia, Jan 2012

Utilita

- Dec 2016

Haven Power

968 unspecified or unclassified postings

Arc Norwich Ltd

Source: Labour Insight Jobs,

Royal Dutch Shell

Burning Glass Technologies

Drax Group

Forum Energy

Baker Hughes Incorporated

Southern Electric

China Africa Resources

National Grid

Expro International Group

Condor Resources

SSE PLC

Big Green Company

Edf Energy

Fugro

Centrica

0

10

20

30

40

50

60

70

52

Occupation

Health & safety officers (3567)

Plant and machine operatives n.e.c. (8129)

Sales related occupations n.e.c. (7129)

Estimators, valuers and assessors (3531)

Energy sector

Quality assurance and regulatory professionals (2462)

Science, engineering and production technicians n.e.c. (3119)

vacancies by

Production and process engineers (2127)

occupation, Jan

Design and development engineers (2126)

Sales supervisors (7130)

2012 - Dec 2016

Other skilled trades n.e.c. (5449)

15 unspecified or unclassified postings

Metal working machine operatives (8125)

Source: Labour Insight Jobs, Burning

Production managers and directors in manufacturing (1121)

Glass Technologies

Sales and retail assistants (7111)

Other administrative occupations n.e.c. (4159)

Sales accounts and business development managers (3545)

Quarry workers and related operatives (8123)

Managers and proprietors in other services n.e.c. (1259)

Engineering technicians (3113)

Mechanical engineers (2122)

Programmers and software development professionals (2136)

Plumbers and heating and ventilating engineers (5314)

Engineering professionals n.e.c. (2129)

Electrical and electronic trades n.e.c. (5249)

Business sales executives (3542)

Civil engineers (2121)

0

20

40

60

80

100

120

140

160

53

Job Title

Receptionist

Drilling Engineer

Shot Blaster

Petroleum Engineer

Operations Technician

Energy sector

Commercial Gas and Oil Fired Service Breakdown Engineer

vacancies by job title,

Instrumentation Technician

Electrical Technician

Jan 2012 - Dec 2016

Control and Automation Engineer

0 unspecified or unclassified postings

Business Development Executive

Source: Labour Insight Jobs, Burning Glass

Technologies

Meter Reader

Safety Engineer

Supervisor

Systems Engineer

Merchandiser

Sales Consultant

Engineering Manager

Diamond Driller

Project Engineer - Oil & Gas

Sales Engineer

Process Engineer

Structural Engineer

Sales Manager

Sales Executive

0

10

20

30

40

50

60

70

80

90

54

Qualification

Requirements

13

25

63

143

Energy sector vacancies by

qualification level required,

Jan 2012 - Dec 2016

1,252 unspecified or unclassified postings

Source: Labour Insight Jobs, Burning Glass Technologies

73

85

Bachelor's degrees, graduate certificates and diplomas

Level 4 diplomas and certificates, HNCs, Level S/NVQs

GCSEs, Standard Grades, and Level 2 S/NVQs

A-Levels, Highers, and Level 3 S/NVQs

Foundation degrees and HNDs

Post graduate degrees, Level 5 S/NVQs, certificates and

diplomas

55

Skills

Requirements

Operations Management

Technical Support

Energy sector

Procurement

Sales Management

vacancies by skills

Comput er Aided Draughting / Design (CAD)

Supervisory Skills

required, Jan 2012

Business Development

Sales Engineering

- Dec 2016

536 unspecified or unclassified postings

Engineering Industry Background

Customer Contact

Source: Labour Insight Jobs, Burning

Glass Technologies

Budgeting

Workplace Health and Safety

Microsoft Office

Mechanical Engineering

Contract Management

Business Management

Repair

Microsoft Excel

Renewable Energy

Inspection

Customer Service

Sales

Civil Engineering

Wind Power

Project Management

0

20

40

60

80

100

120

140

160

56

Where the

Work is

The following analysis makes use of data and findings available via the online toolkit http://wheretheworkis.org/ . The findings presented

are a result of combining data from the UKCES ‘Working Futures’ programme and job vacancy data from the Labour Market Insight tool

developed by Burning Glass.

Limitations

Though the ‘Where the work is’ tool provides the a comprehensive and detailed free-to-use dashboard of supply and demand in the UK, the

following limitations should be taken into account when interpreting the data:

- Senior Management and Elementary roles

Occupations not open to recent HR graduates or FE finishers are not considered. Similarly, occupations that do not require an y formal

qualifications or training are also excluded from this tool, since the number of job-seekers cannot be meaningfully quantified.

- Matching supply and demand

Some occupations do not have specific qualifications or subject-specific requirements (such as sales, marketing and related associate

professionals). As a result of this, and despite the fact that many people with a broad range of qualifications can apply for these occupations,

they frequently appear ‘undersupplied’ in the tool, i.e. when the “job opportunity” is low. Occupations with very small sample sizes (either of

finishers or job postings) are excluded from the dataset.

- Internal and international migration

Some occupations do not rely solely on FE finishers or HE graduates from their immediate location. Many people travel to find work, often

moving across the country. Other occupations, such as those on the Migration Advisory Committee’s shortage occupation list, m ay rely more

heavily on jobseekers arriving from outside the UK.

- Online and offline postings

Burning Glass Technologies (BGT) acknowledge that not all jobs are posted online, although a comparison of the Annual Survey of Hours and

Earnings (ASHE) employment data and BGT postings data for UK in 2014 showed a 94 per cent correlation between ASHE and BGT

occupational distributions. The BGT posting data slightly overestimate the proportion of professional and associate professional occup ations,

while slightly underestimating the proportion of elementary occupations.

57

Location Quotient - Measure of Job Posting

Engineering Techs

0.85

Density relative to employment indexed to the

national density relative to employment

Number of Job Postings asking for entry-level

(2 years of experience or fewer) and school

Engineering Techs

173

331

226

leaver education levels, further education

levels, and higher education levels

School leaver

FE

HE

£30,500

Engineering Techs

£32,100

Advertised Salaries for Job Postings in 2015

£39,900

New Anglia

East of England

England

45

Opportunity Score - Score based on the

Engineering Techs

58

Demand Supply Ratio of FE postings

50

within a geography, from Very Low (0) to

Very High (100)

New Anglia

East of England

England

58

A Future View of the

Energy Sector

59

The following analysis uses data from the East of England Forecasting Model (EEFM) and the UKCES Working Futures data

(WF). In each case an Energy sector has been approximated from the sector splits available in each model. In the case of the

East of England Forecasting Model then ‘Mining & Quarrying’, ‘Utilities’, and ‘Waste & Remediation’ have been summed to

produce a definition of the Energy sector. For the Working Futures data, ‘Mining & Quarrying’, ‘Electricity & Gas’, and ‘Water &

Sewerage’ have been summed.

Please note that neither model, or the forecasts they produce, take into account the New Anglia LEPs ambitions for growth in

Gross Value Added (GVA) and employment.

60

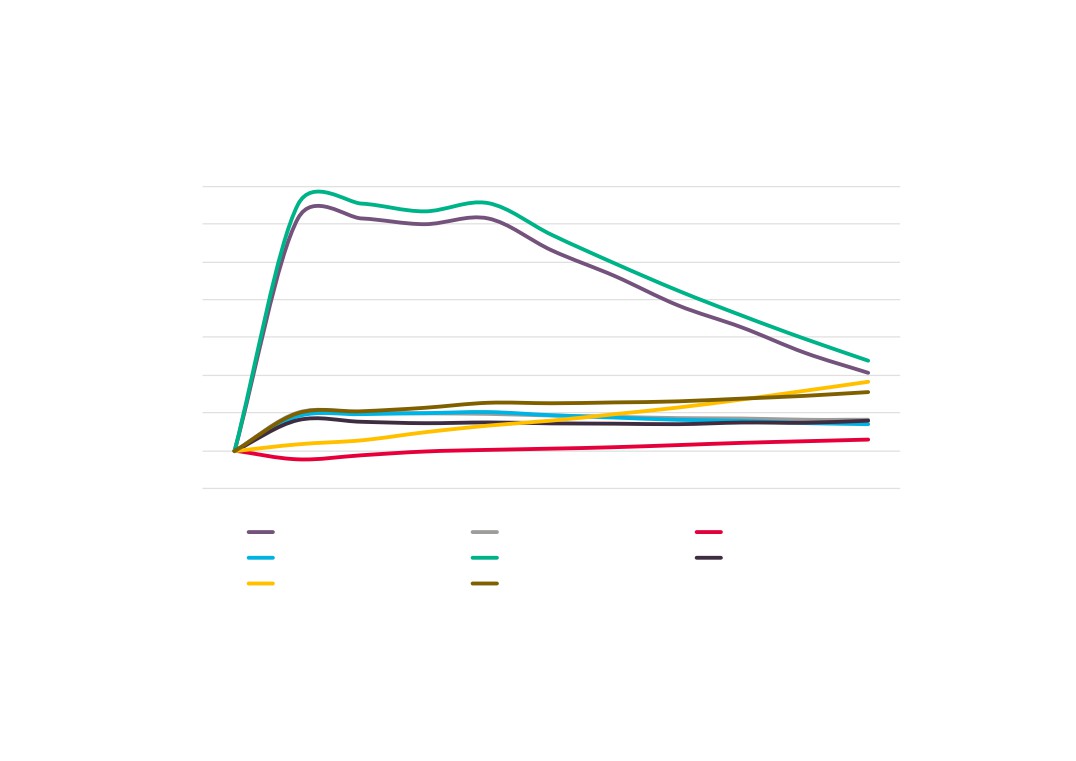

Forecasts for change in Energy sector employment

in New Anglia (2010 = 100)

170

160

150

140

130

120

110

100

90

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

Mining & Quarrying (EEFM)

Utilities (EEFM)

Waste & Remediation (EEFM)

Energy (EEFM)

Mining & quarrying (WF)

Electricity & Gas (WF)

Water & Sewerage (WF)

Energy (WF)

Sources: East of England Forecasting Model, Cambridge Econometrics; UKCES Working Futures 2014 - 2024

61

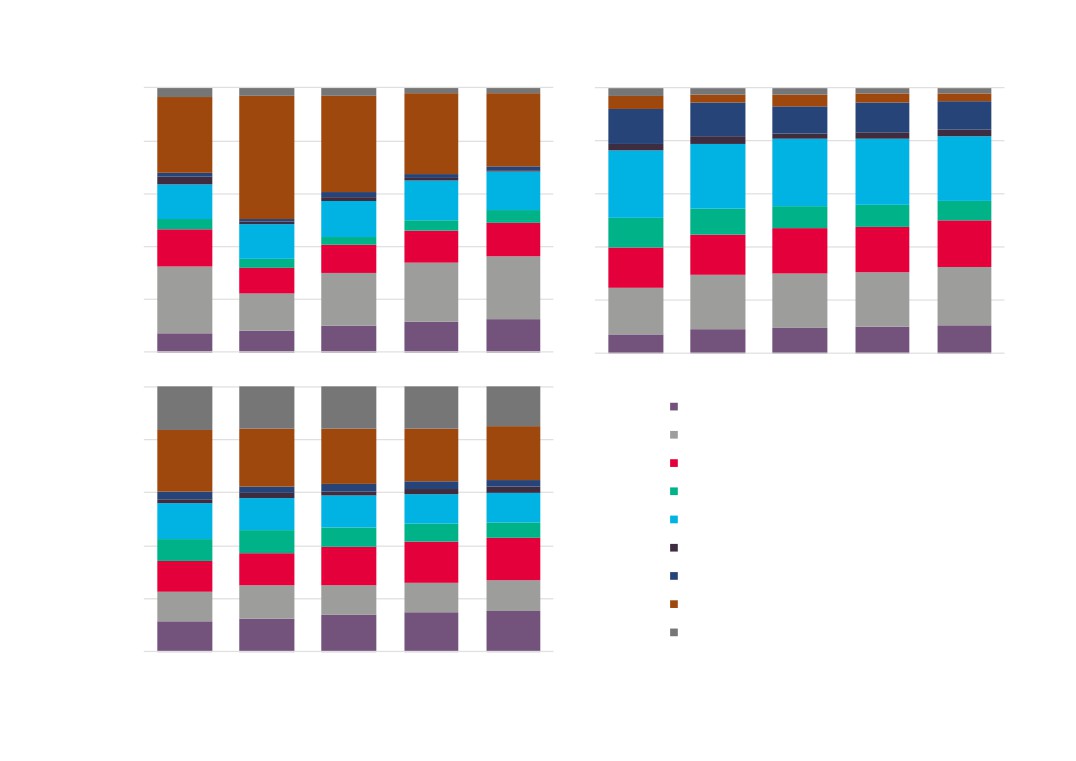

Occupational composition of employment in New

Anglia’s Energy sector over time

100%

8%

10%

10%

10%

10%

19%

17%

16%

80%

20%

17%

5%

5%

6%

5%

5%

60%

15%

17%

16%

16%

16%

7%

6%

7%

8%

8%

40%

15%

16%

14%

15%

13%

16%

16%

20%

15%

18%

15%

12%

13%

14%

9%

11%

0%

2004

2009

2014

2019

2024

Elementary occupations

Process, plant and machine operatives

Sales and customer service

Caring, leisure and other service

Skilled trades occupations

Administrative and secretarial

Associate professional and technical

Professional occupations

Managers, directors and senior officials

Source: UKCES Working Futures 2014 - 2024

62

Electricity and Gas

Mining & Quarrying

Electricity & Gas

100%

00%

11%

11%

13%

10%

13%

28%

29%

31%

80%

37%

80%

47%

25%

25%

24%

24%

25%

60%

15%

60%

13%

15%

7%

5%

8%

8%

14%

10%

4%

4%

11%

13%

3%

12%

40%

14%

12%

40%

17%

18%

17%

15%

11%

3%

15%

10%

24%

23%

20%

25%

20%

20%

20%

20%

21%

22%

14%

17%

10%

11%

12%

11%

7%

8%

0%

nced Manufacturing & Engineering

2004

2009

2014

2019

2024

100%

0%

10%

12%

12%

13%

14%

Managers, directors and senior officials

17%

11%

12%

14%

Professional occupations

80%

20%

14%

15%

13%

23%

14%

Associate professional and technical

14%

15%

16%

40%

8%

60%

8%

Administrative and secretarial

7%

7%

7%

13%

Skilled trades occupations

24%

23%

22%

60%

21%

40%

20%

8%

Caring, leisure and other service

3%

2%

3%

12%

3%

3%

Sales and customer service

80%

20%

22%

19%

19%

17%

16%

11%

Process, plant and machine operatives

7%

8%

8%

8%

8%

Elementary occupations

12%

100%

0%

Source: UKCES Working Futures 2014 - 2024

2004

Water & Sewerage

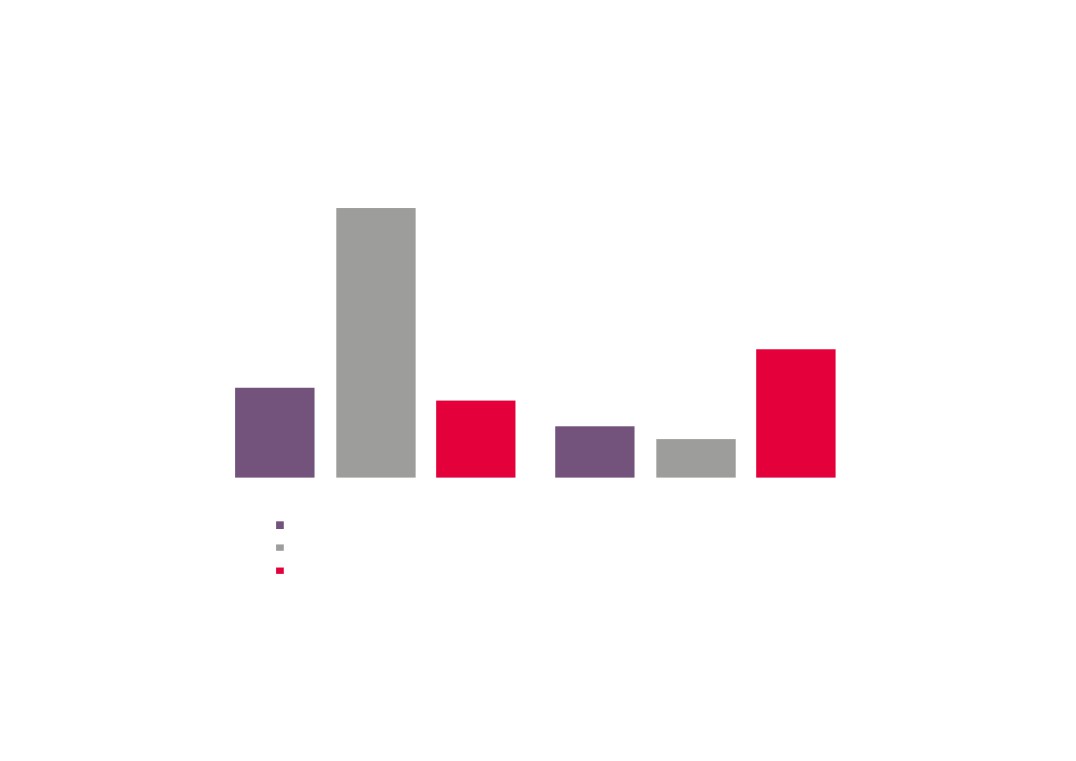

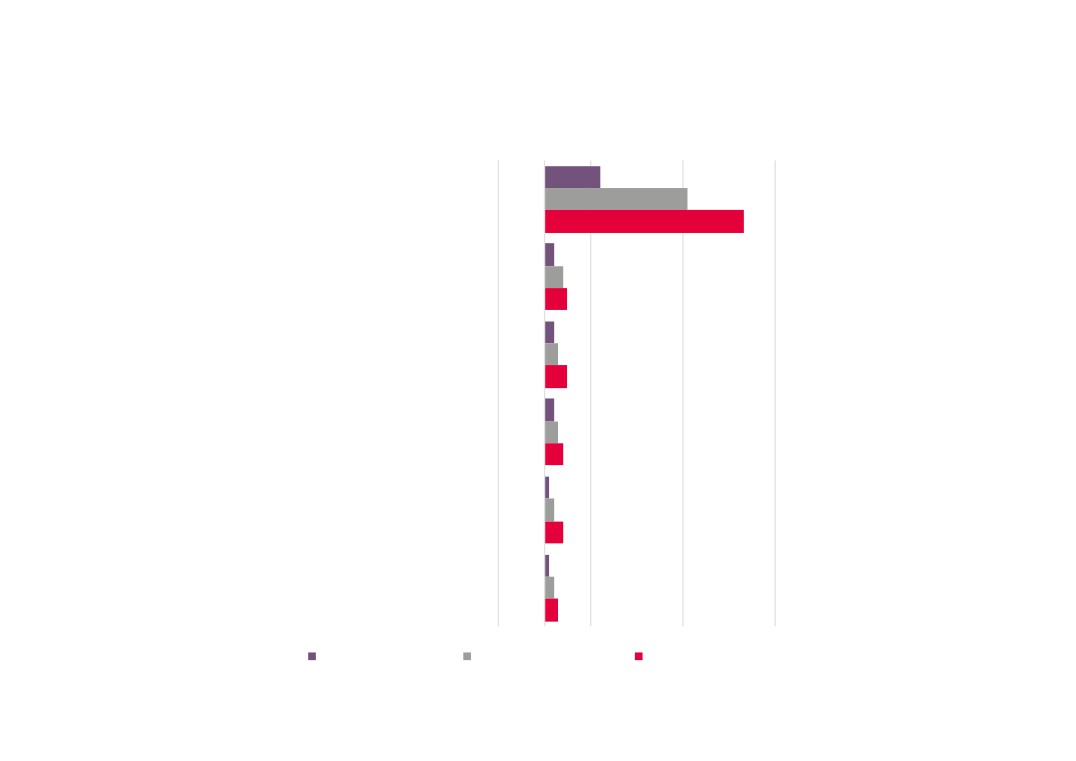

Energy sector replacement and expansion demand by

occupation (top 5 in terms of net requirement), 2014 - 2024

-1,000

1,000

3,000

5,000

All occupations

Transport and mobile machine drivers

and operatives

Science, research, engineering and

technology professionals

Corporate managers and directors

Business and public service associate

professionals

Skilled metal, electrical and electronic

trades

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

64

Energy sector replacement and expansion demand as a

proportion of employment by occupation, 2014 - 2024

80%

70%

60%

50%

40%

30%

20%

10%

0%

All

Transport

Science,

Corporate

Business

Skilled metal,

occupations and mobile

research,

managers

and public

electrical and

machine

engineering

and directors service

electronic

drivers and

and

associate

trades

operatives technology

professionals

professionals

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

65

Energy sector replacement and expansion demand by

qualification, 2014 - 2024

-500

0

500

1,000

1,500

2,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

66

Energy sector qualifications, 2014 - 2024

2024

10%

35%

18%

23%

11%

3%

Source: UKCES Working Futures 2014 - 2024

2014

7%

27%

21%

23%

15%

7%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

67

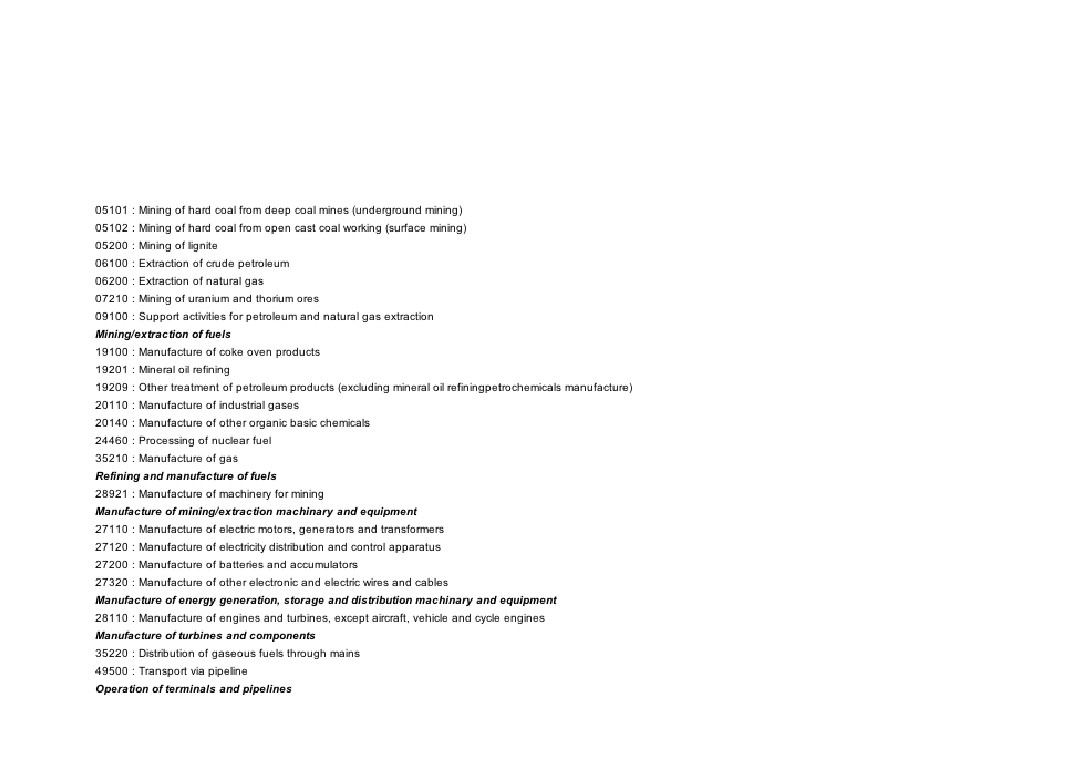

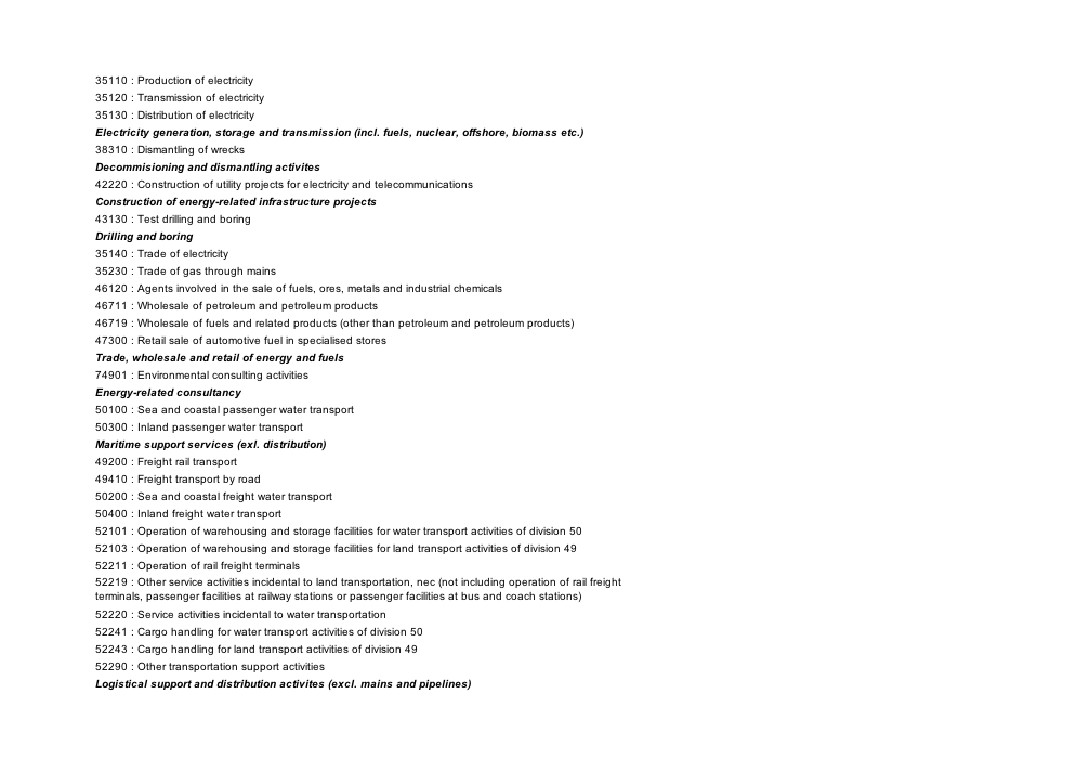

Appendix 1 - Energy sector definition

The following five digit SIC codes are being used to measure levels of, and change in, both employment and business numbers in the sector.

Please note that multipliers have been applied to those SIC codes under ‘Maritime support services (excl. distribution) and ‘Logistical support

and distribution activities (excl. mains and pipelines) in order to only capture the elements of these activities that directly relate to the energy

sector. This is in line with the methodology used to define the sector in the New Anglia Local Economic Strategy evidence base work.

69